Technical Overview

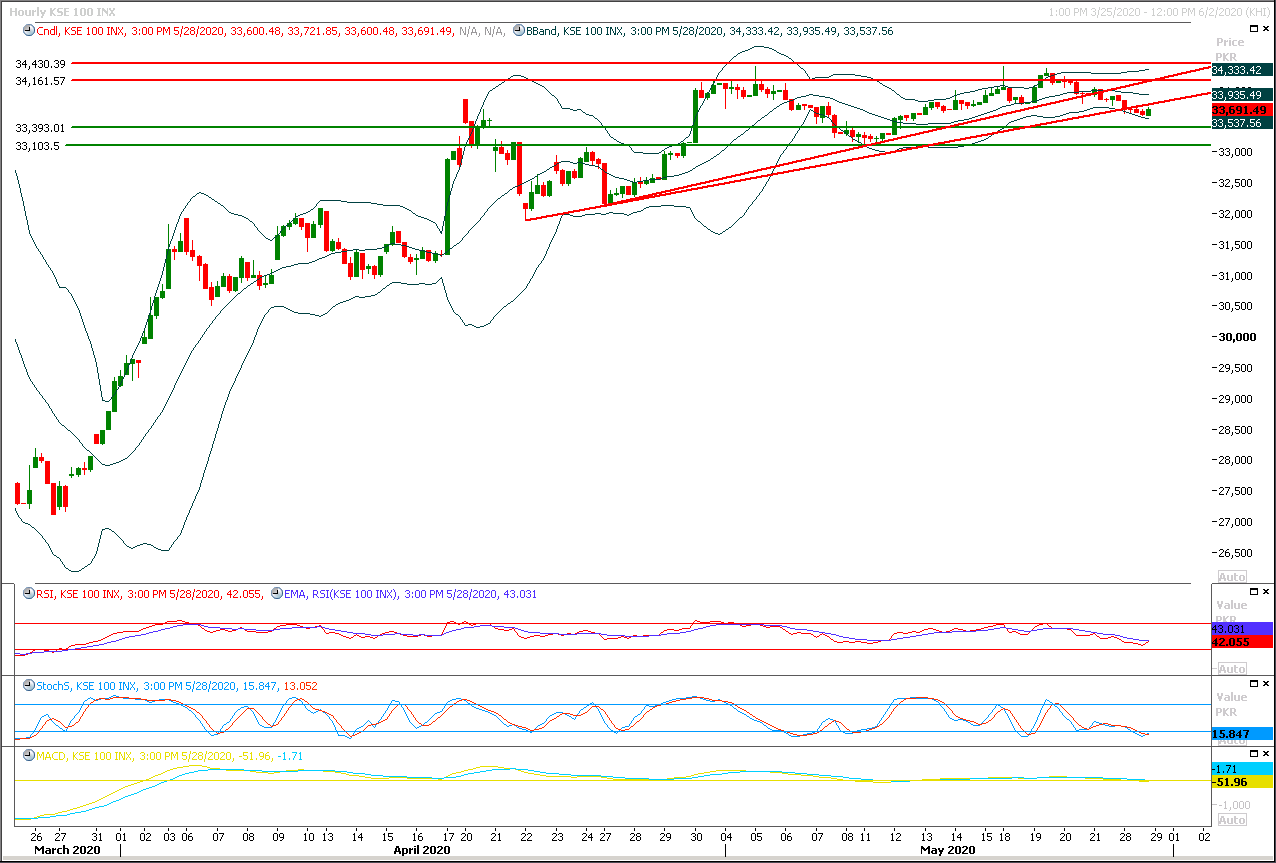

The Benchmark KSE100 index have succeed in sliding blow its initial supportive region of 33,760pts during last trading session but its major supportive region of 33,500pts is still intact, this region would try to react against current bearish pressure during current trading session but if index would succeed in breakout of this region than its next targets would be 33,100pts and 33,000pts. Index would enter bearish zone once it would succeed in closing below 33,000pts on daily chart. Mean while breakout below 33,000pts would call for 32,500pts and 32,100pts. While on flipside in case of reversal index would face initial resistance between 34,000-34,160pts and penetration above this band would call for 34,500pts and then 35,200pts. It's recommended to stay cautious and adopt swing trading until index gave a clear breakout of either side.

Index would remain range bound on short term basis until it would not succeed either in closing above 34,500pts or below 32,000pts. Breakout of either side would add 1500-2000 points in respective direction.

Regional Markets

Asian stocks slip as markets await Trump's Hong Kong response

Asia’s stock markets pulled back and major currencies were held in check on Friday, as investors await the U.S. response to China tightening control over the city of Hong Kong. U.S. President Donald Trump, who has vowed a tough response, said he will hold a news conference on China later on Friday. Trepidation about a further deterioration in Sino-U.S. relations sent stocks lower and put investors on edge. MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.3%. The Nikkei .N225 retreated from a three-month high and, though moves were slight, riskier currencies were under pressure against the U.S. dollar. Futures for the S&P 500 slipped 0.7%. “It is seen as a major threat to the rally we’ve had and the recovery,” said Shane Oliver, chief economist at Australian wealth manager AMP Capital.

Read More...

Business News

FBR directed to simplify tax laws

Ministry of Finance dropped several tax proposals recommended by the Federal Board of Revenue (FBR) while directing the apex trade body to focus on simplification of tax laws, procedures and removing anomalies in the budget for the next fiscal year, Dawn has learnt from knowledgeable sources. The FBR had proposed taxing few sectors to raise revenue in order to achieve the collection target of Rs5.1 trillion for the next year — up 30 per cent from the proposed collection target in the last fiscal year. A senior FBR tax official told Dawn on Thursday that the Finance Division has rejected the proposals to tax a few sectors on the plea that the upcoming budget will be a ‘corona-budget’. “We have identified several sectors for taxing to raise revenue for achieving the target”, the official said.

Read More...

Private sector sputters, fiscal balance improves in latest data

Latest data released in the run up to the budget shows private sector activity dropped sharply in the first ten months of the fiscal year, while the primary balance of the government improved, posting a surplus over last year’s deficit. Almost all the indicators that reflect private sector confidence showed steep declines, from demand for working capital to investment, while the government’s finances were buoyed by non-tax revenues, allowing it to keep the fiscal deficit under control. In an Economic Update, the Ministry of Finance reported the total credit to private sector at Rs298 billion as of May 8, 2020 when compared to Rs563bn of same period last year, down by 47per cent. The credit off-take for working capital by big businesses amounted to just Rs28bn, down almost 92pc from Rs345.6bn of the same period last year.

Read More...

Dollar gains Rs 1.06 in inter bank

The exchange rate of US dollar against Pakistani rupee went up by Rs 1.06 in interbank on Thursday and was traded at Rs 161.98 as compared to Rs 160.92 of last trading day, State Bank of Pakistan (SBP) reported. However, according to Forex Association of Pakistan, the buying and selling rates of dollar in open market were recorded at Rs 161.30 and Rs 161.80 respectively. The SBP further reported that in interbank the price of Euro appreciated by Rs 1.62 and was traded at Rs 178.15 against the last closing of Rs 176.53. The exchange rate of Japanese yen gained Re 0.01 and was traded at Rs 1.50 against Rs 1.49 whereas the increase of Rs 2.08 was witnessed in the exchange rate of British Pound which was traded at Rs 198.46 as compared to last closing of Rs 196.38.

Read More...

Pakistan aims to increase agri exports through rice: Razak

Prime minister’s adviser on commerce and investment Abdul Razak Dawood has said that Pakistan had attained huge space in global rice market for exporting local rice in potential markets of Middle East, North America and African regions to achieve the target of increasing the agricultural exports. He said the government intended to take the exports to the highest level ever and for that purpose it was taking different measures to reclaim traditional markets besides accessing new ones.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.