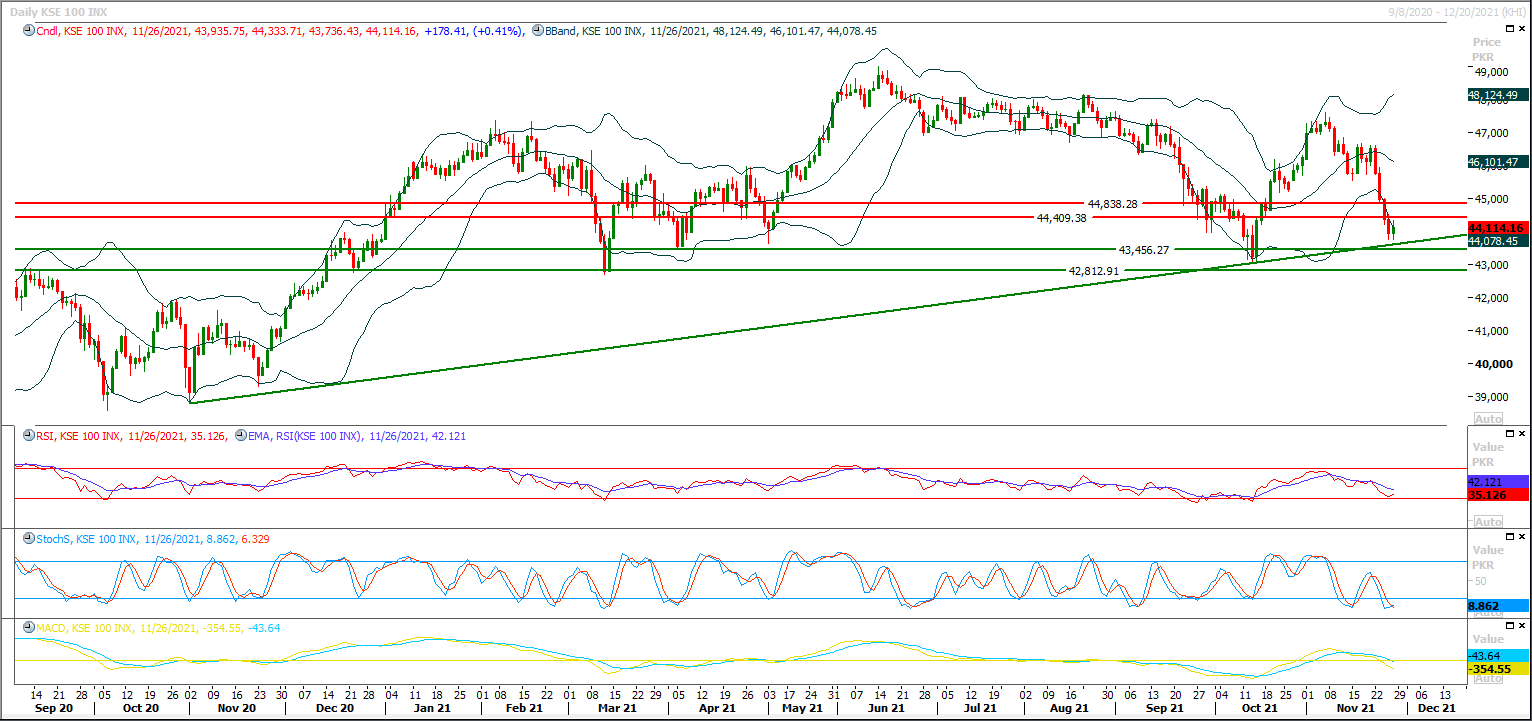

The Benchmark KSE100 index is being supported by a rising trend line on daily chart since last two trading session and have tried to establish a double bottom during last trading session. As of now it's expected that it may face a strong resistance between 44,400pts-44,500pts therefore it's recommended to stay cautious and post trailing stop loss on existing long positions, because if index would not succeed in recovering above this region then it would face some serious pressure which may push it towards 43,900pts and 43,500pts. Currently hourly and daily momentum indicators are trying to change their direction towards bullish side but it's recommended to wait for a confirmation before initiating new long positions. Overall daily closing below 43,700pts would change market sentiment which may push index towards 43,200pts and 42,900pts in coming days.

Asian markets regained a little composure on Monday as investors settled in for a few weeks of uncertainty on whether the Omicron variant would really derail economic recoveries and the tightening plans of some central banks. Oil prices also bounced $3 a barrel to recoup some of Friday's shellacking, while the safe haven yen took a breather after its run higher.

Read More...The Federal Board of Revenue (FBR) on Sunday has seized 172 sugar bags, which were found without affixation of tax stamps in one warehouse. Inland Revenue Enforcement Network (IREN) Squad of Directorate of Intelligence and Investigation (I&I)-IR, Hyderabad, in a major counter-tax evasion operation, has seized 172 sugar bags, which were found without affixation of tax stamps in one warehouse, said a press release issued by FBR here. In compliance of STGO 05 of 2021 dated 11th November, 2021 issued by Project Director, (Track and Trace System) and specific directions of Member-IR (Operations), FBR Islamabad, and Dr Amir Talpur, Director General I&I (IR) Islamabad, the team of Directorate of I&I (IR) Hyderabad (IREN) visited area of Tower Market Hyderabad on 27th November, 2021 to check sugar dealers.

Read More...

US dollar falls amid rising risk aversion

The US dollar recorded a deep decrease in late trading on Saturday as demand for safe haven shot up. The dollar index, which measures the greenback against six major peers, decreased 0.75 percent at 96.0468 in late trading. The discovery of a new COVID-19 variant in South Africa sent jitters across global markets on Friday. Surging demand for safe haven drove 10-year Treasury bond yield to 1.479 percent on Friday, down 16.2 basis points from the previous trading session. Commodity-based currencies were in a free fall on Friday morning as the price of commodities plunged with global equities, said a note by foreign exchange and international payment solutions provider Tempus, Inc. In late New York trading, the euro was up to 1.1313 dollars from 1.1209 dollars in the previous session, and the British pound was up to 1.3335 dollars from 1.3321 U.S. dollars in the previous session. The Australian dollar decreased to 0.7118 dollar from 0.7185 dollar.

Read More...

Railways revenue registers increase in 2020-21

The revenue of Pakistan Railway has increased from Rs47,587.9 million in 2019-20 to Rs48,651.7 million in 2020-21, registering an increase of around Rs1,063.8 million. “Pakistan Railways has earned Rs48,651.7 million during 2020-21 as compared to Rs47,587.9 million during 2019-20,” an official in the Ministry of Railways told media. The official said the working expenses of Pakistan Railways has also decreased to Rs95,883.8 million in 2020-21 as compared to Rs97,740.4 million in 2019-20. He said that accounts of Pakistan Railways for the financial year 2018-19 and 2019-20 had been audited by the Auditor General of Pakistan (AGP). Similarly, accounts of the financial year 2020-21 would also be audited by the same authority, he added.

Read More...

Dhabeji Industrial Zone project hits snags

The recently awarded contract for the Dhabeji Industrial Zone (DIZ) project that falls under the China-Pakistan Economic Corridor (CPEC) is in the doldrums after being challenged before a court of law. The Sindh High Court will take up on Monday (today) a petition submitted to it challenging that the rules of Special Economic Zones (SEZ) had not been followed in the award of the contract. The provincial government claims that since DIZ has not been given the status of SEZ so far, the rules of special economic zones do not apply to it. The CPEC Authority also had submitted an official statement to the high court, expressing satisfaction over the bidding process and claiming that no irregularity had been committed in the award of the contract.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.