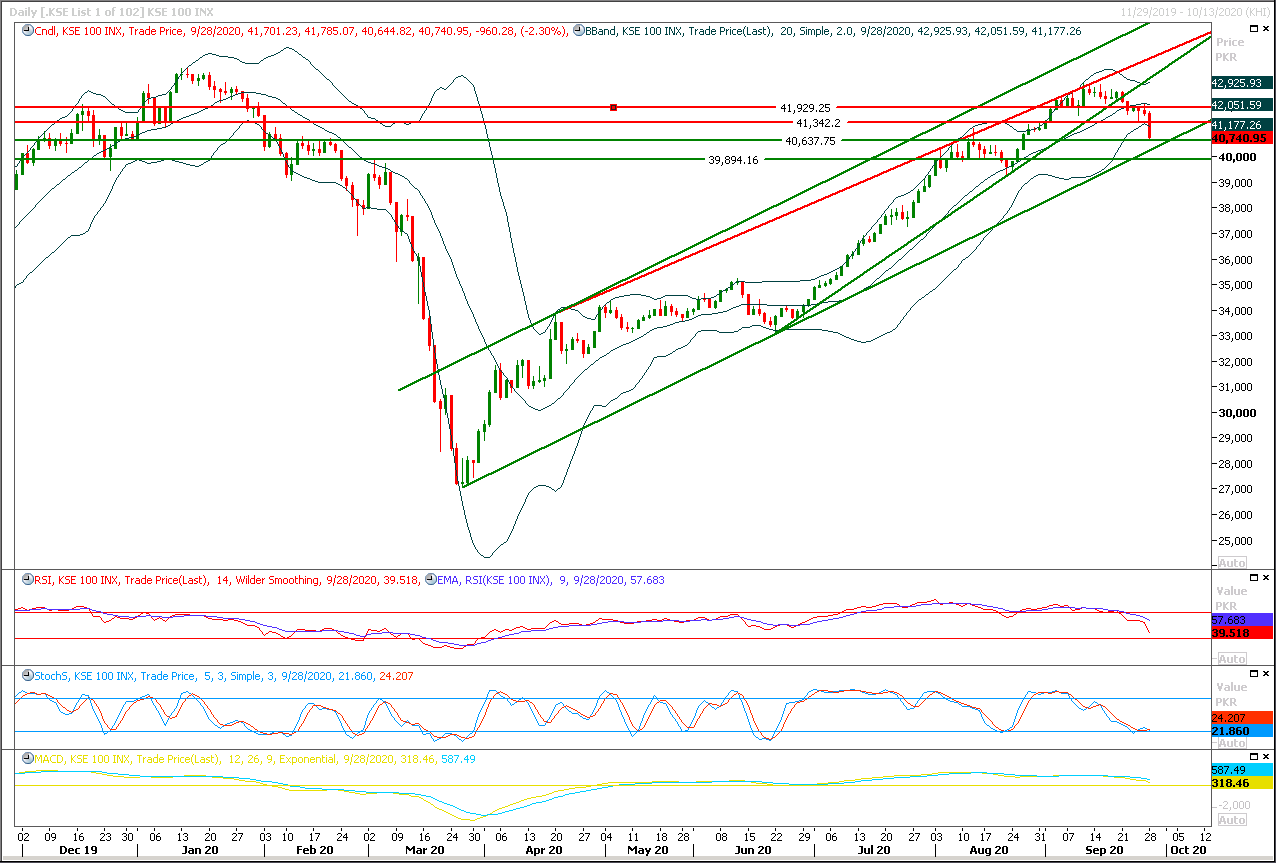

Technical Overview

The Benchmark KSE100 index is trying to expand its Bollinger Band in downward direction after facing rejection from its previously supportive regions. As of now it's expected that index would try to find some ground between 40,500pts-40,300pts where a strong horizontal supportive region is being followed by supportive trend line of its rising trend channel. If index would succeed in finding ground above these regions then a bounce back would be witnessed towards 41,100pts and 41,300pts. But it's recommended to stay cautious because political instability could cause the index to slide below its major supportive region of 40,500pts. Daily and hourly momentum indicators are still in bearish mode and these would try to drag index downward in coming days to complete impact of weekly evening shooting star pattern. For existing long positions it's recommended to post strict stop loss at 40,300pts.

Regional Markets

Asian markets push higher after U.S. bounce

Asian markets largely opened higher on Tuesday, building on newfound momentum after bargain hunters helped a recovery in U.S. markets in the wake of last week’s selloff.MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.39% to 555.01. Japan’s benchmark Nikkei average, however, dropped 0.61% as telecom stocks fell after Nippon Telegraph and Telephone Corp announced a $38 billion take-private of its wireless carrier business, paving the way for price cuts in the sector. Shares going ex-dividend was also expected to dampen market sentiment. Australia’s S&P/ASX 200 index rose 0.22%, while New Zealand’s S&P/NZX 50 index edged down 0.27% after rising in early trade. Asian markets have been buoyed by positive signs around China’s economic recovery, although the coronavirus pandemic continues to wreak economic havoc globally and raise concern about high valuations.

Read More...

Business News

Wheat price in market higher than imported rate, note MPs

National Assembly Standing Committee on Commerce on Monday demanded government to fix support price of wheat and to announce maximum incentives for local growers to get rid of wheat crisis. The meeting of the Standing Committee on Commerce under the Chairmanship of Syed Naveed Qamar was held yesterday in the Parliament House. The Ministry of Commerce and Ministry of Food Security & Research briefed the Committee on import/exports of wheat and informed that the cabinet has approved import of 1.5 million MT (Metric Tonne) of wheat by Trading Corporation of Pakistan (TCP) on the recommendation of the Ministry of Food Security & Research to meet the demand in the country, which will be provided to Punjab, PASSCO and Khyber Pakhtunkhwa.

Read More...

Govt to construct gas storages to avoid supply disruption

The government is considering various options for building Strategic Underground Gas Storages (SUGS) which will help avoiding gas supply disruption in peak demand season. The feasibility study for the Strategic Underground Gas Storage (SUGS), funded by the Asian Development Bank, will be completed by May 2021. Asian Development Bank (ADB) is funding the feasibility of the project and is providing $575,000 for the purpose, official source told The Nation. The source said that the feasibility is being undertaken to establish Strategic Underground Gas Storage (SUGS) in Sindh, Balochistan and Khyber Pakhtunkhwa.

Read More...

Tea imports increase by 34.77pc in 2 months

The tea imports witnessed an increase of 34.77 per cent during the first two months of the current fiscal year as compared to the same period of last year, Pakistan Bureau of Statistics (PBS) reported. The tea imports were recorded at $87.964 million during July-August (2020-21) as against imports of $65.258 million in July-August (2019-20), according to latest PBS data. In terms of quantity, the tea imports increased by 48.88 per cent during the period under review by going down from the imports of 26,694 metric tonnes last year to 39,742 metric tonnes during current year.

Read More...

Finance ministry projects inflation at around 9pc

Projecting mixed prospects for crops and inflation at around 9 per cent, the government on Monday said the overall macroeconomic indicators were moving in a positive direction to put the economy on a long-term sustainable growth path. The Ministry of Finance in its Monthly Economic Update and Outlook for September revealed that revenue collection by the Federal Board of Revenue (FBR) stood at only Rs586.6 billion in the first two months (July-August) of the current fiscal — about Rs6.5bn lower than Rs593bn reported by the FBR. The collection posted 1.8pc growth when compared to Rs576bn during the same period last year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.