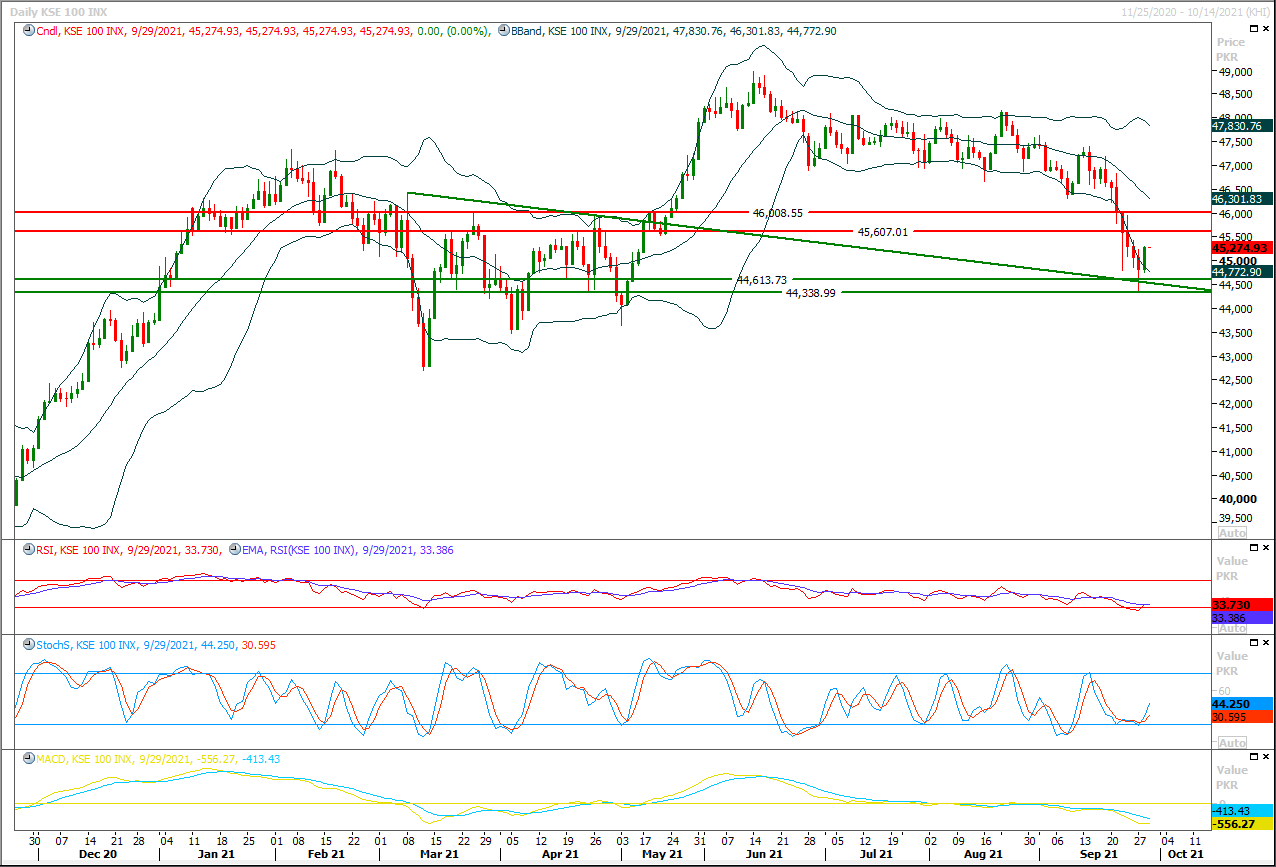

The Benchmark KSE100 index have created a bullish engulfing pattern on daily chart during last trading session but it's recommended to stay cautious as long as index is trading below 45,460pts and 45,760pts because below these regions current pull back would be considered as correction of last bearish rally. For current trading session index seems to target 45,460pts initially where it would face resistance from a horizontal resistant region along with its 61.8% correction of last bearish rally. If it would not succeed in penetration above this region then some serious selling pressure would be witnessed therefore it's recommended to post trailing stop loss on existing long positions. While on flip side in case of rejection from its resistant regions index would find initial support at 45,000pts but breakout below this region would call for 44,800pts and then 44,600pts. Daily closing below 44,500pts would change sentiment again towards bearish side.

Regional Markets

Asian shares stumble as U.S. yields, dollar hold firm

Asian shares lost ground on Wednesday, tracking declines on Wall Street as investors fretted over economic uncertainties that caused a spike in U.S. benchmark bond yields and pushed the dollar to a more than 10-month high. Doubts are re-emerging over the global recovery at a time when the U.S. Federal Reserve is set to taper stimulus and the Biden Administration is stuck in contentious debt ceiling negotiations that could lead to a government shutdown. Benchmark 10-year rates have gained 25 basis points in five sessions and were last at 1.5513%, having hit their highest since mid-June the day before, while the dollar index was at 93.752.

Read More...

Business News

Economy set to achieve higher, inclusive, sustainable economic growth in FY2022

The Ministry of Finance on Tuesday noted that there are some downside risks to the outlook of Pakistan’s economy associated with rising international commodity prices, new variants of virus and geopolitical dynamics especially post August 15 scenario, emerging in Afghanistan. “Due to the government’s growth oriented policies, Pakistan’s economy is set to achieve higher, inclusive and sustainable economic growth in FY2022. However, there are some downside risks to the outlook of Pakistan’s economy associated with rising international commodity prices, new variants of virus and geopolitical dynamics especially post August 15 scenario, emerged in Afghanistan,” the Ministry of Finance stated in its Monthly Economic Update & Outlook September 2021.

Read More...

Govt urged to extend last date for filing of income tax returns

The Islamabad Chamber of Commerce and Industry (ICCI) has called upon the government to extend the last date for filing of income tax returns by at least for six months considering the difficulties created by the Covid-19 pandemic. The ICCI has said that extension would facilitate the maximum number of eligible taxpayers to discharge this national obligation with ease and would also help in improving the tax revenue of the country. Sardar Yasir Ilyas Khan, president of Islamabad Chamber of Commerce and Industry, said that the Federal Board of Revenue has set September 30, 2021 as the last date for the filing of income tax returns 2021.

Read More...

NA body concerned over rising loans

National Assembly Standing Committee on Economic Affairs on Tuesday expressed concerns over the increasing loans of the country and sought the details of external loans and dollar exchange rate since year 1971. The meeting of the National Assembly Standing Committee on Economic Affairs Division was held in Parliament House, Islamabad, under the chairmanship of Mir Khan Muhammad Jamali, MNA. He welcomed the participants of the meeting.

Read More...

Rupee loses another 36 paisas vs dollar

The exchange rate of Pakistani rupee weakened by 36 paisas against US dollar in the interbank trading on Tuesday and closed at Rs169.96 as compared to the previous day closing of Rs169.60. According to Forex Association of Pakistan, the buying and selling rates of dollar in the open market were recorded at Rs 170.3 and Rs 172.3 respectively. Similarly, the price of euro appreciated by 27 paisas and closed at Rs198.65 against the last day’s trading of Rs198.38, the State Bank of Pakistan reported. The Japanese Yen remained unchanged to close at Rs 1.53, whereas an increase of 05 paisas was witnessed in the exchange rate of British Pound, which was traded at Rs 232.40 as compared to its last closing of Rs 232.35.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.