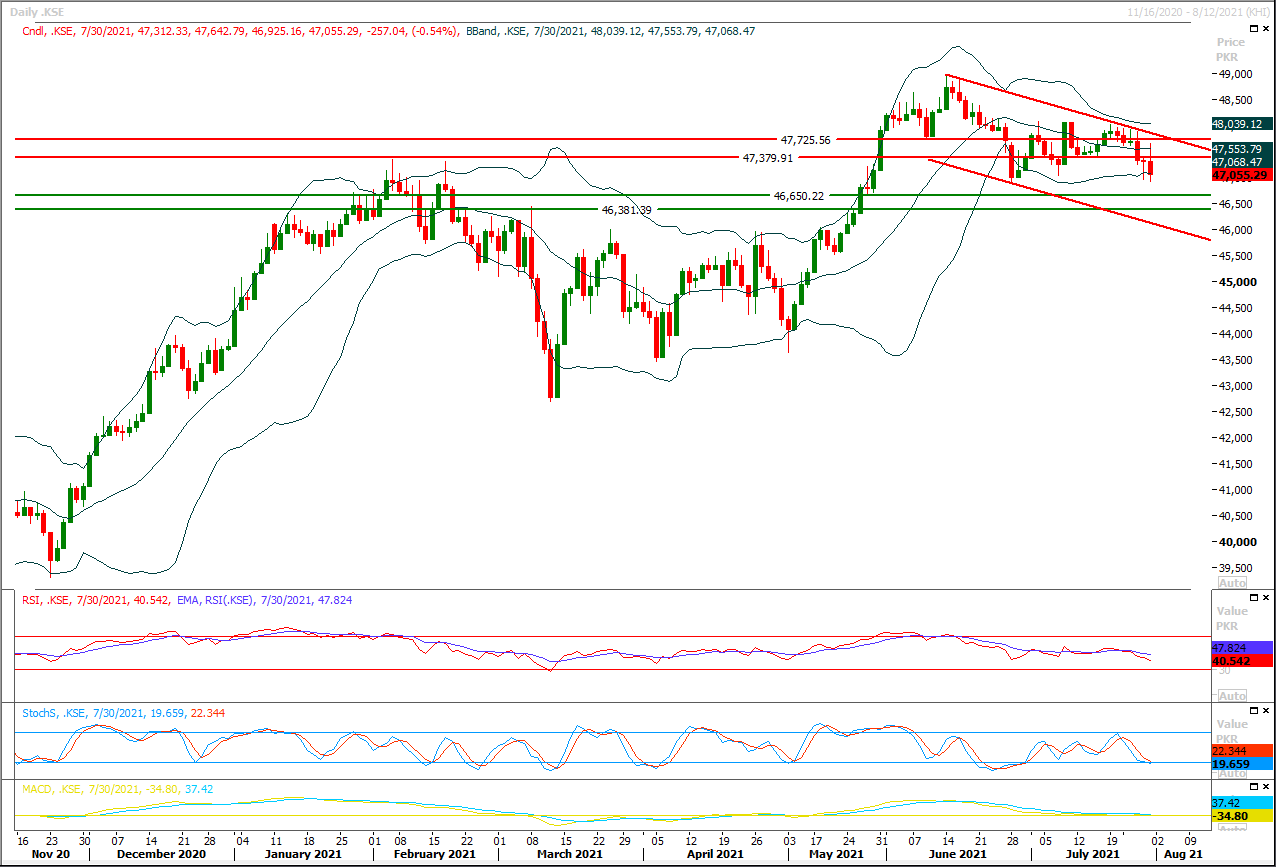

The Benchmark KSE100 is in expansion mode of its previous bearish correction on hourly chart and have succeeded in penetration below its previous low. As of now it's expected that index would initially try to establish ground above 46,900pts where a horizontal supportive region would try to pump some fresh volume in market but penetration below this region would call for 46,660pts and 46,500pts for completion of 100% expansion of its last bearish correction. Meanwhile it's being traded inside a bearish price channel therefore it's recommended to stay cautious with existing long positions, daily closing below 46,900pts would push index into bearish zone. While on flip side index would face initial resistance at 47,360pts where a horizontal resistant region would try to cap index in case of bullish pull back which would be followed by 47,700pts. Currently daily and hourly momentum indicators have turned their direction towards bearish side therefore it's expected that index may remain bearish during current trading session.

Regional Markets

Renault locks in lithium supply from Vulcan Energy in five-year deal

German-Australian start-up Vulcan Energy Resources Ltd said on Monday it has signed a deal to supply lithium to Renault SA, the latest move by an electric vehicle maker to lock down supply of the battery metal ahead of a projected surge in demand.Vulcan will supply 6,000 to 17,000 tonnes of lithium annually to the French automaker from its geothermal brine deposits in Germany starting in 2026, the companies said. The five-year deal is renewable if both parties agree.Renault, with brands including Alpine and Dacia, has said it would like 90% of Renault models to be fully electric by 2030.

Read More...

Business News

Food commodities worth $4.393b exported in FY2020-21

Food group exports of the country during last fiscal year 2020-21 crossed $4.393 billion mark and witnessed about 0.73 per cent growth as compared to exports of the corresponding period of last year. During the period from July-June, 2020-21, the exports of fruits grew by 11.16 per cent, vegetables 7.14 per cent, spices 5.34 per cent, fish and fish preparations increased by 1.85 per cents. Besides, the exports of oil seeds, nuts grew by 212.64 per cent, meat and meat products increased by 9.62 per cent respectively, according the data of Pakistan Bureau of Statistics. During the period under review, country earned $2.041 billion by exporting about 3.691 million tons of rice and $1.465 billion by exporting rice other then Basmati rice, it added.

Read More...

Punjab Mines & Minerals Dept revenues up by 17pc

Despite various constraints due to Covid-19 pandemic, the Punjab Mines & Minerals Department showed excellent performance by recording 17 per cent increase in its revenues in fiscal year 2020-21 compared with the FY 2019-2020.Punjab Mines & Minerals Department’s sources disclosed this to APP here Sunday. They said the department managed to collect a record non-tax revenue of Rs 10.19 billion in the FY 2020-21, compared to Rs 8.74 billion in FY 2019-20. The revenue included bid money, royalty, rent and fees, collected from the lease/ license holders.Over the last three years, they added, the Punjab Mines & Minerals Department contributed a total of Rs 27 billion to the public exchequer in respect of non-tax revenues.

Read More...

Pakistan’s first indigenous electric vehicle, battery to be rolled out in 2023

Pakistan plans to indigenously manufacture its first electric vehicle and battery in 2023, said the top planner and manager of the project, adding that the economic benefit of the endeavor would exceed $1 billion.Funded and designed by expatriate Pakistani experts, the country’s EV and battery manufacturing project is spearheaded by DICE Foundation, a US-based non-profit and tax-exempt entity that is registered in Michigan.“Pakistan is close to launching its own world class electric vehicle,” Dr. Khurshid Qureshi, the foundation’s chairman, said in an interview with Arab News. “The commercial rollout of the vehicle will take place in the third quarter of 2023.”

Read More...

Ogra faces pressure to allow new gas connections

Ahead of its determination of gas prices, the Oil and Gas Regulatory Authority (Ogra) is coming under increasing pressure to allow millions of new connections despite unavailability of additional gas, rising price and circular debt.Ogra completed the process of public hearing more than a month ago on up to 220 per cent increase in prescribed prices to meet estimated revenue requirements (ERR) of the two gas companies for fiscal year 2021-22 and is expected to come up with its determination in a couple of weeks.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.