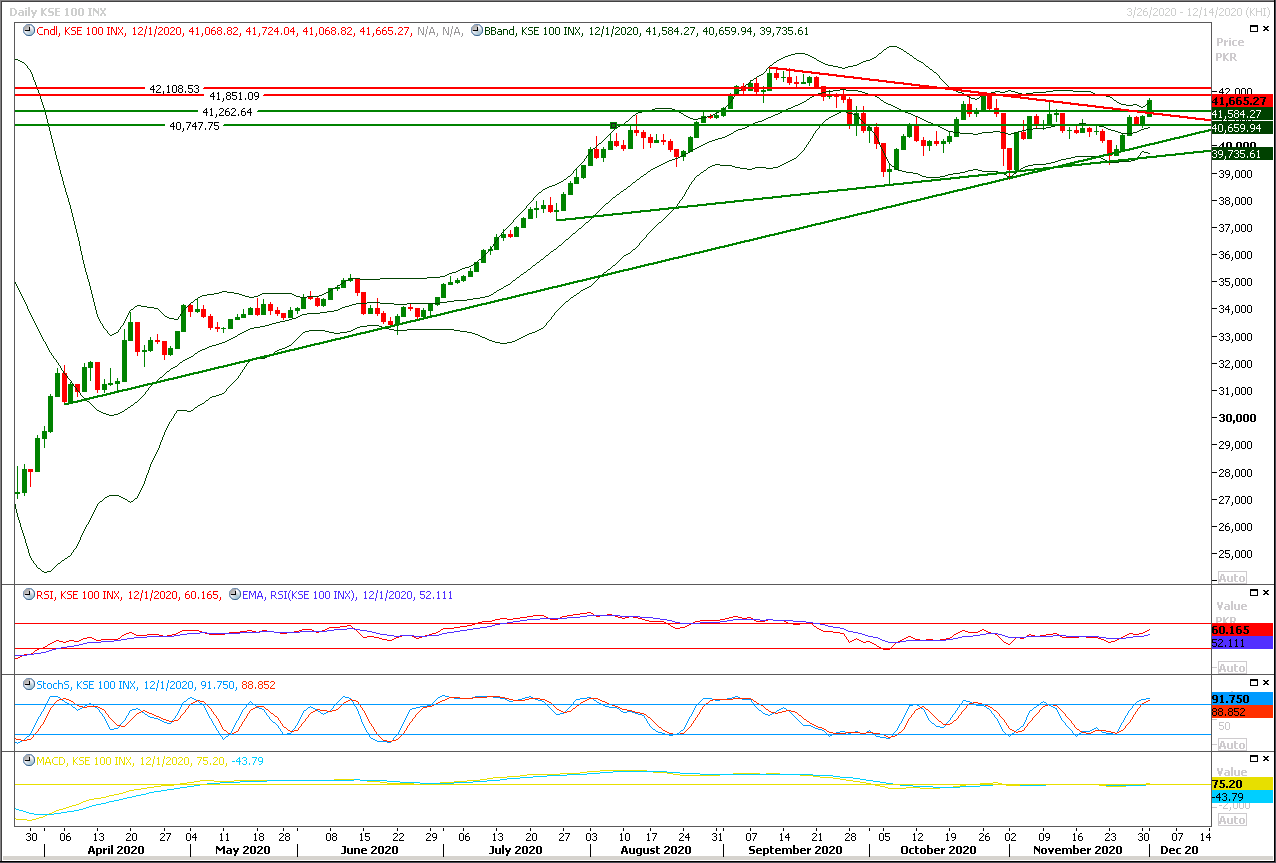

Technical Overview

The Benchmark KSE100 index have succeeded in penetration above its major resistant region of 41,500pts during last trading session and have given bullish breakout of its daily triangle in upward direction as well. But it's still being capped by a major resistant region at 41,860pts where a weekly double top would try to cap current bullish sentiment in case of breakout above this region index would face its next resistance from resistant trend line of its bullish price channel which fall on 42,100pts, meanwhile if index have to move forward in bullish direction then it needs to take a dip to retest resistant trend line of its previous triangle as supportive one, meanwhile daily stochastic is ready for a bearish pull back and it would also try to add pressure on index. Therefore it's recommended to post trailing stop loss on existing long positions because it's expected that index would try to start the day with a positive spike but later on it would start sliding downward and maybe it would return toward neutral zone till day end. Hourly momentum indicator have generated bearish crossovers and if index would not succeed in penetration above 41,860pts then these would start add pressure on index. On flip side in case of reversal index would initially find support between 41,300pts-41,200pts while breakout below this region would call for 41,000pts and 40,700pts. Overall sentiment would remain bullish until index would not slide below 40,500pts on daily chart but rejection from its double top would convert current bullish breakout into a cheat pattern.

Regional Markets

Asian shares edge lower but stimulus, vaccine hopes provide support

Asian shares shed early gains from a strong Wall Street lead on Wednesday, as some investors booked profits on a stellar run to record highs, but hope for additional U.S. economic stimulus and a coronavirus vaccine kept market sentiment well supported.MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.06%, pulling back from last week’s all-time high. Australian stocks erased early gains and fell 0.38%. Shares in China fell 0.22%. Tokyo stocks fell 0.17% after setting a new 29-year high. South Korean shares bucked the trend and rose 1.11% due to signs of an increase in semiconductor demand. U.S. stock futures declined 0.4% following a record closing high for Wall Street shares.

Read More...

Business News

Country needs to grow unconventional sectors of economy: LCCI

Pakistan needs to adopt models of developed countries that grew their unconventional economic sectors along with the conventional ones and got positive results. This was stated by the LCCI Vice President Tahir Manzoor Chaudhry while talking to a delegation of hair care, skin care and cosmetics industry, led by Convener LCCI Standing Committee on Hair Care and Skin Ayesha Farooqui, at the Lahore Chamber of Commerce & Industry. Tahir Manzoor Chaudhry said that Pakistan has a number of sectors which can be economic booster but have been on a tear for the years.

Read More...

SBP governor promotes Roshan Pakistan Digital Accounts initiative in Dubai at JS Bank’s event

A dinner hosted by JS Bank marked the end of Governor State Bank’s successful trip to promote Roshan Pakistan Digital Accounts initiative. Roshan Digital Account is a major initiative of State Bank of Pakistan, in collaboration with commercial banks operating in Pakistan. These accounts provide innovative banking solutions for millions of Non-Resident Pakistanis (NRPs) seeking to undertake banking, payment, and investment activities in Pakistan. Commenting on the success of the product at the dinner attended by Pakistani diaspora in Dubai, Dr Reza Baqir, Governor State Bank, said, “Pakistan has been receiving close to $2 million daily through these digital accounts with approximately $100 million inflow since launch.

Read More...

CCP lauds federal cabinet for resolving funding issues

The Federal Cabinet has recently demonstrated its unequivocal support to the Competition Commission of Pakistan (CCP) by approving the issuance of a statutory regulatory order (SRO), prescribing 3 per cent of fee and charges levied by SECP, OGRA, PTA, NEPRA and PEMRA from the financial year 2009-10 and onwards to meet charges in connection with the functioning of the CCP. Accordingly, the Ministry of Finance has issued the SRO on 27 November 2020 for gazette notification.

Read More...

FBR exceeds five-month tax collection target by Rs19 billion

The Federal Board of Revenue (FBR) has exceeded the five months tax collection target by Rs19 billion. The FBR has collected Rs 1688 billion net revenue in the current fiscal year from July to November against target of Rs. 1669 billion whereas revenue collected was Rs 1623 billion in the previous year. Income Tax collection for July to November stood at Rs. 577 billion. Similarly, collection of Sales Tax, Federal Excise Duty, Customs Duty remained at Rs. 743 billion, Rs. 104 billion and Rs. 264.4 billion respectively. FBR has collected gross revenue of Rs. 1773 billion in the first five months from July to November which was Rs. 1664 billion in the previous year thus showing an increase of Rs. 109 billion in the current year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.