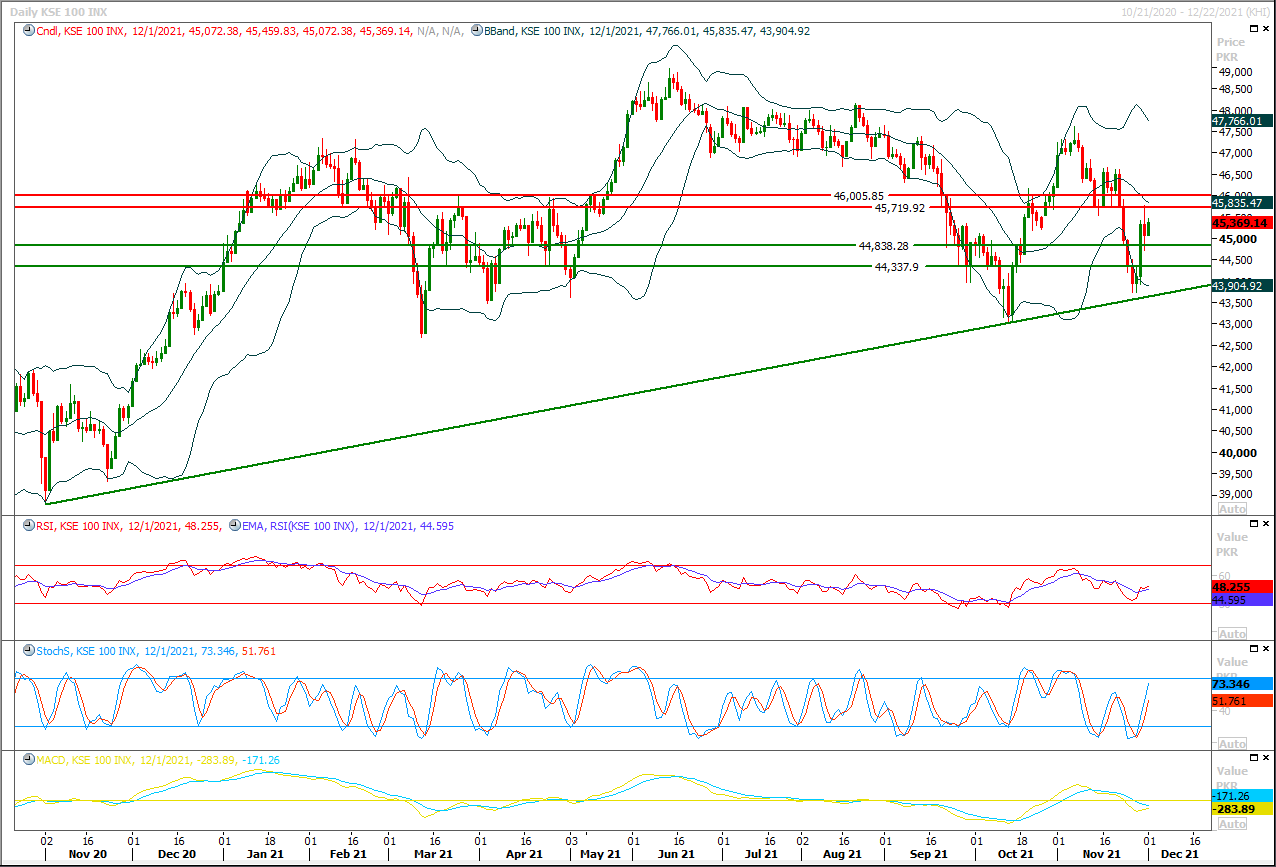

The Benchmark KSE100 index had tried to neutralize impact of its rejection from resistant regions during last trading session but it's still trading below its major resistant region of 45,500pts. Meanwhile hourly momentum indicators are exhausting therefore it's recommended to stay cautious and post trailing stop losses on existing long positions until index succeeds in closing above 45,700pts, because if index would not succeed in closing above this region then there are chances of a daily double top at correction level of its previous bearish correction which would increase uncertainty among investors. Currently index seems to start a bearish rally which may target 45,200pts and 45,000pts initially but hourly closing below 45,000pts would call for 44,700pts where a strong supportive region would try to pump some fresh volumes but daily breakout below this region would call for 44,500pts and further downward in coming days. It's recommended to adopt selling on strength strategy with strict stop loss of 45,700pts.

Asian shares edged higher in choppy trading on Thursday, helped by advances in Chinese real estate shares, though fears about the Omicron variant of the new coronavirus capped gains regionally.Also weighing on share markets were remarks from Fed Chair Jerome Powell reiterating that he and fellow policymakers will consider a faster wind-down to the Fed's bond-buying programme, a move widely seen as opening the door to earlier interest rates hikes.This helped support the dollar which, despite the cautious mood gained ground on the yen, typically seen as an even safer haven than the greenback.MSCI's broadest index of Asia-Pacific shares outside Japan advanced 0.2%, boosted by Chinese blue chips up 0.25% and Hong Kong up 0.2%.

Read More...Federal Board of Revenue (FBR) has advised all the Chambers of Commerce & Industries, all trade bodies and trade associations of the country to strictly comply with the legal requirements of Track & Trace System on Sugar Sector in order to avoid any legal repercussions.This was informed to all the stakeholders vide a letter issued by the Project Director, Track and Trace System, FBR.In the letter, FBR has referred to Sales Tax General Order No.05 of 2021, wherein it was notified that no sugar bags, for the current crushing season 2021-22, would be allowed to move out from a production site and the factory premises or warehouse without affixation of tax stamps and Unique Identification Marks (UIMs) with effect from 11th November, 2021.

Read More...

Transaction of HEC likely to be completed soon

The government on Wednesday noted that transaction/bidding of Heavy Electrical Complex (HEC) is likely to be completed very shortly.Federal Minister for Privatisation Mohammedmian Soomro chaired a second pre-bid meeting of Heavy Electrical Complex (HEC) in Islamabad. Federal Minister Mohammedmian Soomro said that the transaction of HEC is in its concluding stage and we are resolving the pending matters related to the transaction completion along with facilitating the potential investors. The HEC transaction/bidding is likely to be completed very shortly.A detailed presentation was made to the four pre-qualified bidders, and the queries from them were addressed, the earnest money for this transaction was approved and accepted by the bidders is PKR 50 million.

Read More...

ECC approves increase in dealers’ margins for motor spirit, high speed diesel

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday approved increase in dealers’ margins for motor spirit (MS) and high speed diesel (HSD).The ECC discussed in detail and approved the proposal submitted by Ministry of Energy for increase of OMCs and dealers’ margins for motor spirit (MS) and high speed diesel (HSD) with effect from forthcoming revision in oil prices. The ECC has approved increase in the OMCs and dealers margin by 99 paisas in the existing margin of petrol and 83 paisas in the existing margin of high speed diesel. Petrol dealers were charging Rs3.91 per litre and would now charge Rs4.90. OMCs’ and dealers’ margins for HSD has enhanced to Rs4.13 from existing Rs3.3 per litre.All Pakistan Petrol Pumps Dealers Association in last week had called off a nationwide strike after the government agreed to increase their profit margin.

Read More...

Trade deficit hits all-time high in November

The month of November of the current fiscal year (FY22) saw a steep rise of 162.4 per cent in trade deficit which was driven largely by more than triple increase in imports compared to exports from the country.The reversing trend in trade deficit was witnessed for the fifth consecutive month as merchandise trade deficit reached $5.107 billion in November against $1.946bn over the corresponding month last year, according to provisional data released on Wednesday. This is the highest trade deficit recorded in a single month in terms of value.The current year started with a rising import bill which poses a serious threat putting pressure on the external side.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.