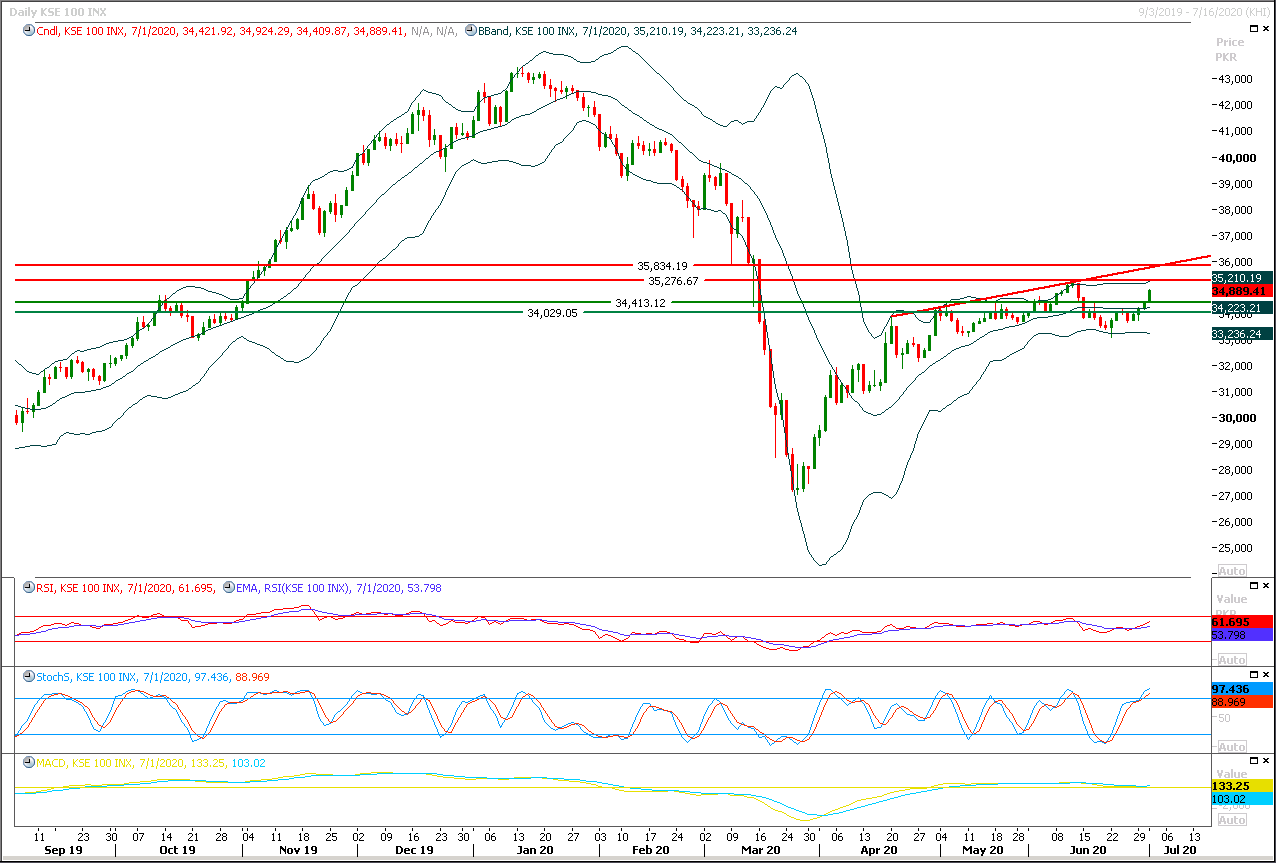

Technical Overview

The Benchmark KSE100 index have succeed in closing above its second mile stone towards bullish direction by closing above 34,500pts and now it's going to target 35,000pts and 35,200pts in coming days but its recommended to stay cautious because index would face major resistances at 35,000-35,200pts where a monthly double top is taking place therefore it's recommended to post trailing stop loss on existing long positions because if index would not succeed in closing above 35,200pts then it would face some serious bearish pressure. While in case it would succeed in closing above 35,200pts then doors towards 36,500pts 37,000pts would start widening and a short term rally would be witnessed with some fresh volumes.

While on flip side if index would not succeed in closing above 35,200pts on daily or weekly closing basis then bearish pressure would start piling up which would try to push index below 34,500pts again.

Regional Markets

Asian stocks rise on vaccine hopes, eyes on U.S. payrolls

Asian stocks tracked Wall Street higher on Thursday although sentiment was cautious ahead of U.S. employment data while copper prices jumped to more than six-month highs on a better global outlook and supply fears in top producer Chile. MSCI’s broadest index of Asia Pacific shares outside of Japan rose 0.9% with all major indexes trading higher on hopes of a vaccine for COVID-19, which has killed more than half a million people globally and shut down the world economy. Japan’s Nikkei rose 0.4%, China’s blue-chip index added 0.6% while Hong Kong’s Hang Seng index climbed 1.7%. E-mini futures for the S&P 500 were flat. U.S. employment figures due later in the day are expected to show if the world’s largest economy can sustain its fragile recovery as new COVID-19 cases accelerate in several southern states.

Read More...

Business News

Fresh projects put on hold till finalisation of power capacity expansion plan

Rebuffing the power regulator’s advice, the Power Division on Wednesday put on hold making fresh commitments for new power projects until a consensus is reached on the country’s first Integrated Generation Capacity Expansion Plan (2020-2047) awaiting approval of the National Electric Power Regulatory Authority (Nepra). “It would not be proper or in the national interest to go back to the old system of process of projects, and adding to the capacity and cost of electricity through a non-transparent mechanism”, the Power Division wrote to Nepra and concerned entities including the National Transmission and Despatch Company (NTDC), Private Power & Infrastructure Board, Central Power Purchasing Agency and Alternative Energy Development Board.

Read More...

Inflation rises to 8.6pc in June

Inflation based on the Consumer Price Index (CPI) inched up to 8.6 per cent in June from 8.2pc in May on the back of a jump in prices of essential food items, showed data released by the Pakistan Bureau of Statistics (PBS) on Wednesday. Substantial reduction in prices of petroleum products and improvement in the supply of essential food items has dragged the overall inflation down to single digit in the past few months. However, the prices of a few food items witnessed a slight increase in June. Inflation during the month under review fell to ten-month low since the calculation methodology was changed last year. In July 2019, the price levels rose by 8.4pc. The average CPI inflation between July-June FY20 rose to 10.74pc, from 6.8pc — highest since 2011-12 when it stood at 11.01pc.

Read More...

IDFC to involve Pakistan in regional fund

The United States International Development Finance Corporation (IDFC) has shown interest to involve Pakistan in a regional fund to be set up for programmes in the Central Asian Republics (CARs). It came from the IDFC CEO Adam Boehler during a meeting with Commerce Adviser Abdul Razak Dawood. Board of Investment (BOI) Chairman Atif Riaz Bokhari and Secretary Commerce Muhammad Sualeh Ahmad Faruqi were also in attendance. An official statement issued after the meeting said Boehler informed the adviser that they intend to start a regional fund for development in CARs, who have shown keen interest for involving Pakistan. He added that IDFC has a $3 billion fund for immediate liquidity requirements of financial institutions in the aftermath of Covid-19 pandemic.

Read More...

Rs900b tax exemptions given to powerful lobbies through SROs

Pakistan Businesses Forum (PBF) has Wednesday alleged that powerful lobbies have been given huge tax exemptions through SROs saying that around 40 different SRO’s have been issued during last one year. “Powerful lobbies have been given huge tax exemptions through SROs and that the whole tax system is now like an NRO for the elite class,” President Pakistan Businesses Forum (PBF), Sahibzada Mian Usman Zulfiqar. He said that SRO culture had strengthened the cartelisation process in the country. President PBF said that the concessions and zero rating through SROs must be routed through parliament and it may be the discretion of the latter to maintain or drop these concessions. “Though SRO culture was introduced in the era of 90’s for political engineering through individual businesses”.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.