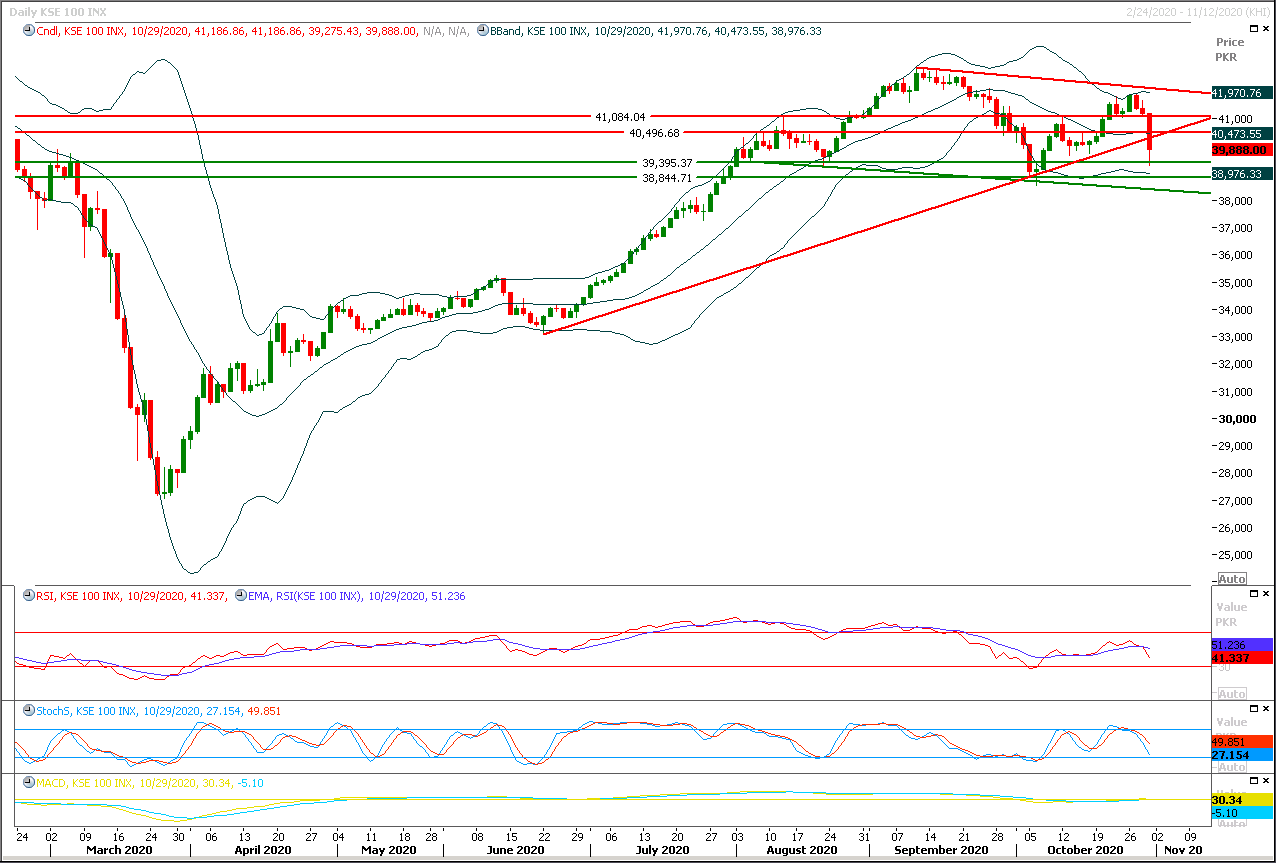

Technical Overview

The Benchmark KSE100 index have created a bearish engulfing pattern on weekly chart while completing its correction of last bullish rally which have increased uncertainty for coming days. As of now it's expected that index would try to recover slightly after a dip on intraday basis to retest its previous supportive regions as resistant ones therefore buying on dip with strict stop loss could be beneficial for day trading. It's expected that index would try to find initial support at 39,500pts which would be followed by 39,200pts therefore buying in this region with strict stop loss of 38,800pts could be beneficial. While on course of recovery index would face initial resistance at 40,200pts and breakout above that region would call for 40,500pts where index would face major resistance from supportive trend line of its previous bullish price channel along with a strong horizontal resistant region. Sentiment would remain negative until index would not succeed in recovering above 41,000pts on daily closing basis and it would be considered in correction mode of its current bearish rally. Daily momentum indicators have entered into bearish zone therefore it's expected that index would take a dip in coming days again after retesting its previous supportive regions and entertaining them as strong resistances.

Regional Markets

Asian shares rebound on strong China data, oil on slippery slope

Asian shares bounced off one-month lows on Monday on solid data from China showing factory activity expanded at its fastest pace in a decade while oil prices skidded as many Western countries slid back into coronavirus-driven lockdowns. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS climbed 0.5% to 573.04, as China's Caixin/Markit Manufacturing Purchasing Managers' Index offered hope the region's success in containing the coronavirus could spare it the economic pain being inflicted on Europe and the United States. All major indexes except New Zealand were up on Monday. Australian shares .AXJO rose 0.4%. Japan's Nikkei .N225 jumped 1.5%. E-Mini futures for the S&P 500 ESc1 added 0.1%, with investor focus turning to the U.S. Presidential elections on Tuesday.

Read More...

Business News

Remittance inflows to increase by 9pc, says WB

A new World Bank report projected that remittances in Pakistan will grow at about 9 per cent in 2020, totalling about $24 billion. The ‘Migration and Development Brief’ released on Friday says that the negative impact of the Covid-19-induced global economic slowdown has been somewhat countered by the diversion of remittances from informal to formal channels due to the difficulty of carrying money by hand under travel restrictions as well as the incentives to transfer remittances.

Read More...

Pakistan’s exports to Afghanistan decrease by 13.98pc in Q1

Pakistan’s exports of goods and services to Afghanistan witnessed a decrease of 13.98 per cent during the first quarter (Q1) of current fiscal year (2020-21) as compared to the exports of corresponding period of last year, State Bank of Pakistan (SBP) reported. The overall exports to Afghanistan were recorded at $209.868 million during July-September (2020-21) against exports of $243.980 million during July-September (2019-20), showing negative growth of 13.98 per cent, SBP data revealed.

Read More...

Exports of sports goods fall 11.84pc in Q1

The exports of sports goods from the country witnessed decrease of 11.84 per cent during the first quarter (Q1) of the ongoing financial year (2020-21) against the exports of corresponding period of last year. The country exported sports goods worth $66.681 million during July-September (2020-21) against the exports of $75.633 million during July-September (2019-20), showing negative growth of 11.84 per cent, Pakistan Bureau of Statistics (PBS) reported. During the months under review, the export of footballs decreased by 22.87 per cent from $42.040 million last year to $32.426 million during current year while the exports of gloves also declined by 16.02 per cent from $ 21.954 million to $17.681 million.

Read More...

Businessmen reject slight cut in POL prices

The Friends of Business and Economic Reforms (FEBR) on Sunday rejected the slight reduction in the rates of petroleum products, saying the government is not passing on the full impact of international oil prices’ reduction to the public, as the authorities have increased the overall GST and petroleum levy on petroleum products to the highest level. FEBR President Kashif Anwar said that the benchmark Brent crude prices have plunged to almost $40 per barrel but the government reduced price of petrol by just Rs1.57/litre and High Speed Diesel by mere 84 paisa per litre, which is not more than a joke, as several other fuels rates were kept unchanged.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.