Technical Overview

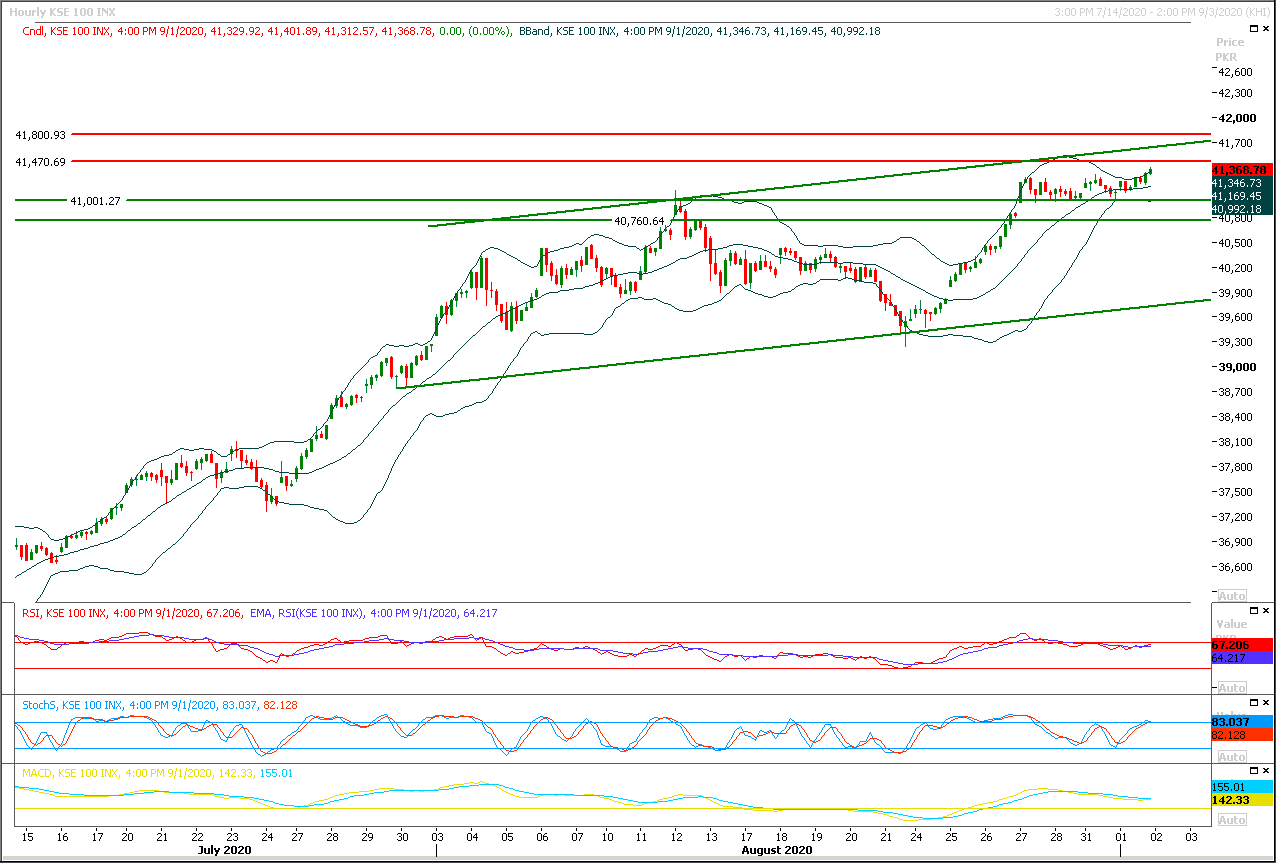

The Benchmark KSE100 index is moving in an upward price channel on hourly chart and have succeeded in closing above its initial resistant region of 40,200pts during last trading session but sentiment is still bullish as index have rejected effects of previous weekly evening shooting star by creating a bullish engulfing pattern. As of now it's expected that index would try to continue its bullish journey towards 41,500pts and breakout of this region would call for41,760pts, meanwhile it would face major resistance between 42,000pts-42,200pts. While on flip side in case of bearish pressure index would try to find ground at 41,000pts where a strong horizontal supportive region would try to push index in upward direction followed by a strong supportive region at 40,780pts.

It's recommended to stay cautious and trade with trailing stop loss because daily and hourly momentum indicators are slightly under pressure as MACD have turned its direction towards bearish side on both time frames and if it would not start recovery then index start sliding any time. Meanwhile stochastic is trying to generate a bullish crossover on hourly chart which would try to pump some fresh volumes but daily stochastic seems turning down which could be dangerous if MACD would not start a pull back.

Regional Markets

Stocks gain on brisk U.S. manufacturing survey, stimulus hopes

Asian shares inched up on Wednesday following buoyant U.S. manufacturing indicators and a rally in U.S. tech shares, with investors also expecting more policy support from Washington. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.25% while Japan’s Nikkei advanced 0.35%. Mainland Chinese shares slipped a tad, with bellwether CSI300 index giving up 0.3% on investor caution after having hit a five-year high earlier this week. On Wall Street, both the S&P 500 and Nasdaq boasted record closing highs, with gains of 0.75% and 1.39% respectively, with the technology sector leading the charge.

Read More...

Business News

Govt approves special power, gas rates for erstwhile 5 zero-rated industries

The government has approved special electricity and gas rates for erstwhile 5 zero-rated industries to increase the country’s exports. “In a meeting held yesterday between the Ministries of Commerce, Finance and Energy, it was agreed that erstwhile 5 zero-rated industries will be given a rate of 7.5 cents (¢) per kWh for July & August and 9 ¢/kWh thereafter. For gas, the rate will be $6.5/MMBtu throughout,” said Adviser to the Prime Minister on Commerce and Investment Abdul Razak Dawood on Twitter. In wake of the situation created by COVID pandemic, he felt that ministry of commerce has obtained a very good rate. He asked the exporters to concentrate on growth of the country’s exports.

Read More...

Nepra reserves judgment on CPPA petition for hike in power tariff

National Electric Power Regulatory Authority (NEPRA) has reserved its judgment on the Central Power Purchasing Agency (CPPA) petition for increase of Rs0.86 per unit in power tariff, under fuel price adjustment, for the month of July. In a public hearing conducted by Nepra, the regulator has indicated allowing CPPA to increase the power tariff by around Rs0.84 per unit, however later the regulator has issued a statement saying that it has reserved its judgment in the matter. According the Nepra’s spokesman, the Authority conducted a public hearing on Fuel Price Adjustment for the month of July 2020 in the matter of X-Wapda DISCOs on 1“ September, 2020.

Read More...

Inflation eased down to 8.2pc in Aug

Inflation eased down to 8.2 percent in the month of August despite increase in the prices of petroleum products in the last month. Inflation measured through the Consumer Price Index (CPI) was recorded at 8.2 percent in August this year over the same period of last year, according to the latest data of Pakistan Bureau of Statistics (PBS). The inflation remained lower against the projection of Ministry of Finance, as it had estimated inflation would remain within a range of 8.4 to 9.7 percent in August 2020. The ministry said that international food prices continued to remain fairly stable. On the other hand, in recent months, international price of oil tends to recover from recent lows and the USD/PKR exchange rate has been rising gradually.

Read More...

PRA collected Rs8.6b in August

Punjab Revenue Authority has registered a growth of 39% in August in comparison to the same period last year. A provisional revenue collection of Rs.8.6 billion has been registered in August.It is worth mentioning here that due to the impact of COVID-19, the rate of taxes of over 20 services were reduced from 16% to 5% yet this record collection is encouraging. This also happens to be the highest recorded revenue collection for the month of August in the history of PRA. Chairperson PRA praised the efforts of the officers and appreciated their revenue planning and collection efforts. He also instructed the officers to keep up the hard work as they are on the right track of accomplishing this year’s revenue target.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.