Technical Overview

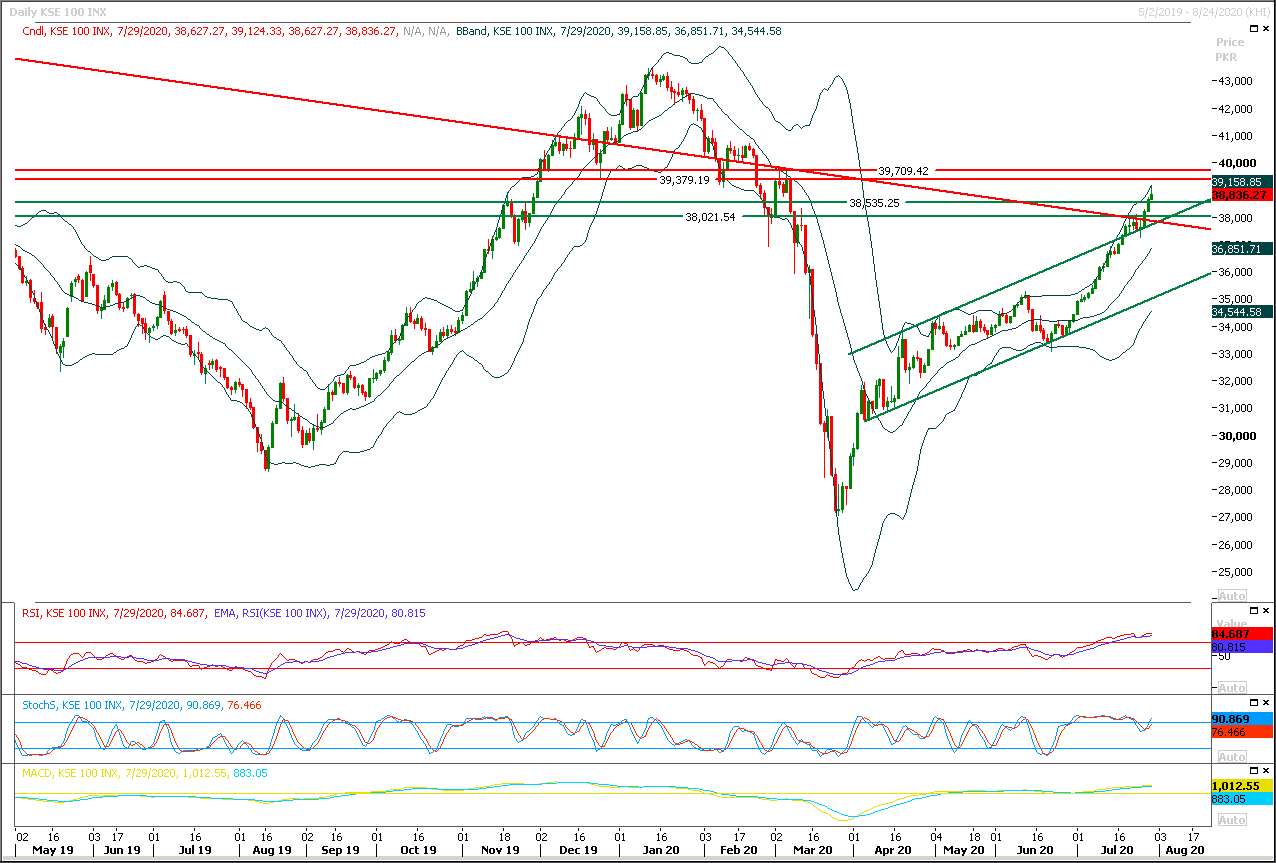

The Benchmark KSE100 have turned down after getting resistance from its resistant regions at day end yesterday and now it's expected that it would remain volatile during current trading session therefore it's recommended to stay cautious because if index would not succeed in maintaining above 38,700pts then some kind of serious pressure would be witnessed because an evening shooting star have been formatted on hourly chart and mean while momentum indicators on hourly chart have changed their direction towards bearish side. First hourly closing would matter a lot because if bulls would not succeed in providing some fresh volumes then pressure would start piling up. Initially index would face resistances below 39,200pts and in case of bullish breakout above this region it can spike towards 39,500pts. While on flip side index would try to find some ground at 38,500pts and 38,350pts in case of bearish pressure.

Regional Markets

Asian stocks rise, dollar languishes near two-year lows on Fed

Asian stocks were boosted by the promise of ultra-easy monetary policy globally as the U.S. Federal Reserve left interest rates near zero to support the country’s virus-battered economy, sending the dollar to a two-year trough.All Fed members voted to leave the target range for short-term rates between 0% and 0.25%, where it has been since March 15 when the virus was beginning to hit the nation. The unchanged policy setting together with a pledge the Fed would use its "full range of tools" if needed boosted risk appetite overnight with all three Wall Street indexes finishing firmer. .IXIC .DJI .SPX The confidence extended in Asia where Japan's Nikkei .N225 and South Korea's KOSPI .KS11 were up 0.3% each, Australia's main index climbed 0.7% and Hong Kong's Hang Seng index .HSI rose 0.2%. Chinese shares were a shade firmer, leaving MSCI’s broadest index of Asia Pacific shares outside of Japan .MIAPJ0000PUS up 0.4%.

Read More...

Business News

Ogra proposes Rs7-9 per litre increase in petrol, diesel prices

The Oil and Gas Regulatory Authority (Ogra) on Wednesday proposed an increase of about Rs7-9 per litre in petrol and high speed diesel (HSD) for next month and about Rs6 per litre increase in kerosene and light diesel oil (LDO) rates. However, the government is expected to increase the price of petrol and HSD by Rs4-5 per litre by bringing down the rate of petroleum levy and allow about Rs6 per litre increase for kerosene and LDO. Informed sources said that Ogra, which was bypassed last month in petroleum price adjustments, has this time forwarded a working paper to the government to increase petroleum prices based on existing tax rates and import costs of the Pakistan State Oil (PSO).

Read More...

Increase in divestment shares of OGDCL approved

The Privatisation Board on Wednesday approved to increase the divestment of Oil and Gas Development Company Ltd (OGDCL) shares in the capital market from 7 per cent to 10 per cent on the recommendation of the ministry of energy. The final approval will now be given by the Cabinet Committee on Privatisation (CCoP) which had earlier given the approval of 7 per cent. The increase in shares would attract investment from international exploration and production companies in OGDCL, the ministry believes. The board meeting, chaired by Minister for Privatisation, Muhammad Mian Soomro, also gave due consideration to the recent stability of crude oil prices in international markets, share price trends of OGDCL and its higher dividend yield ratio.

Read More...

Pakistan’s exports to recuperate, likely to surge around $2.0 to $2.1 billion in July

The government is expecting that Pakistan’s exports would recover in July and may surge to around $ 2.0 to $ 2.1 billion. The exports of goods and services dramatically declined in April and May 2020, following the outbreak of the COVID-19 pandemic. However in June exports remained at $1.6 billion which implies that revival of economic activities in trading partners has caused 25 per cent growth in exports. “It is expected that exports will further recover in July and may find themselves within a broad margin around $ 2.0 to $ 2.1 billion,” the ministry of finance noted in Economic Outlook July 2020. For the current fiscal year (FY 2021), the target of exports is $22.7 billion which is almost $1.9 billion per month on average.

Read More...

NA committee slams ‘non-serious’ attitude to meeting FATF conditions

With deadlines looming next month, Pakistan’s compliance with 27-point action plan and 40 recommendations of the Financial Action Task Force (FATF) stands at 14 and 10 respectively. With this update, the government on Tuesday came under severe criticism from the National Assembly’s Standing Committee on Finance and Revenue led by MNA Faiz Ullah of the PTI for wasting precious time of the nation without making tangible progress. While the committee decided to refer three proposed bills — Anti Money Laundering, Limited Liability Partnership and Companies Bill — relating to the FATF to another parliamentary meeting on legislative business, Committee Chairman Faiz announced that he would resign from his position if Adviser to PM on Finance Dr Abdul Hafeez Shaikh maintained his continued abstention from the panel.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.