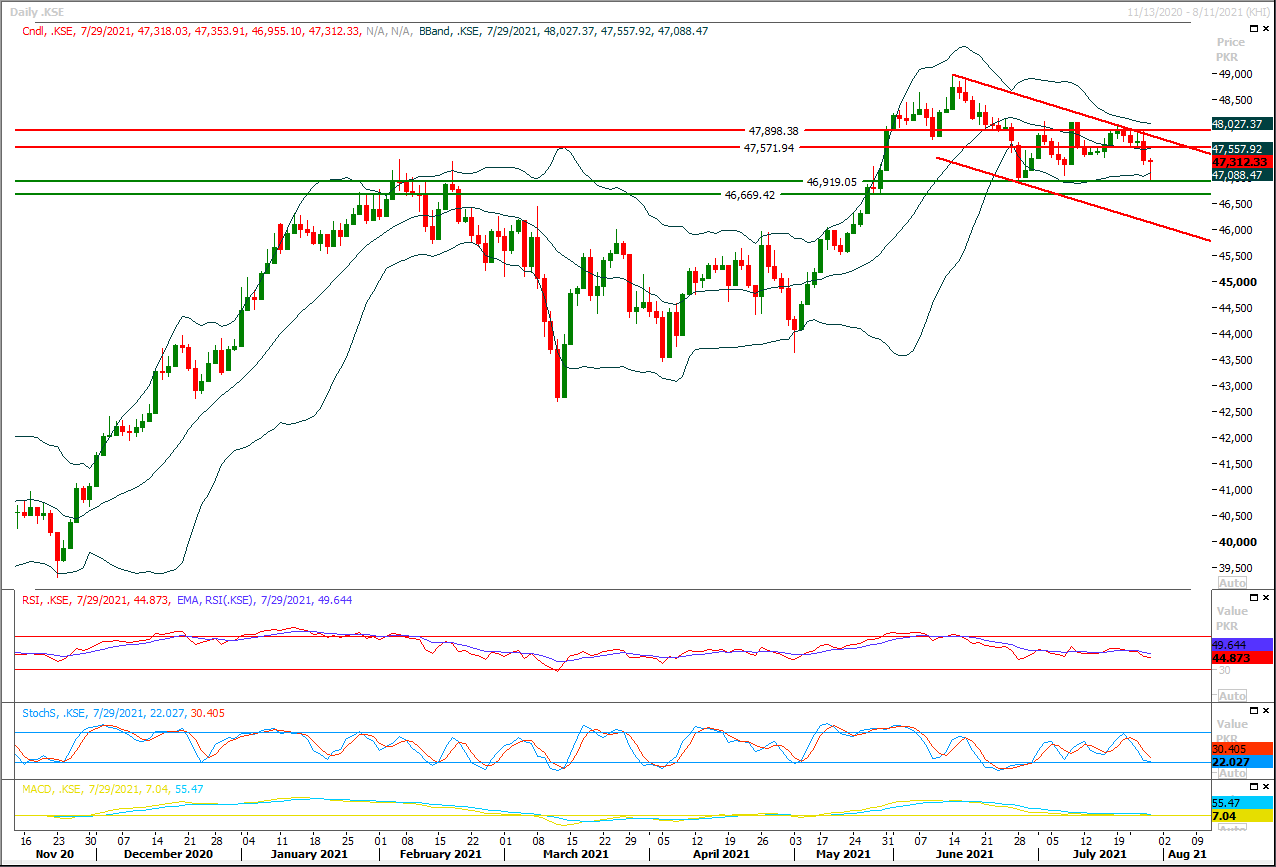

The Benchmark KSE100 index have started recovery after getting support from supportive trend line of its bearish price channel on hourly chart and a strong horizontal supportive region during last trading session and a hammer formation was created on daily chart. As of now it's expected that index would try to continue its pull back initially towards 47,450pts where it may face resistance from a horizontal resistant region. Being last trading day of the week and month also today's closing matters a lot therefore it's recommended to stay cautious because index is trading in a caution zone therefore a fight between bulls and bears could be witnessed during current trading session. Overall a volatile session would be witnessed and index may start sliding downward again if it would succeed in penetration above 47,500pts and current pull back would be considered as a correction of last bearish rally. Meanwhile if index would succeed in penetration above its resistant regions then there are chances of formation of a morning shooting star on daily chart which would occur if index would succeed in closing above 47,550pts at day end. While on flip side in case of rejection from its resistant regions index would slide towards 47,165pts and 47,000pts. Daily closing below 46,900pts would push index towards a deeper correction in coming days.

Regional Markets

Asian shares down, set for worst month since March 2020

Asian shares slipped on Friday, with a gauge of regional equities set for its biggest monthly drop since the height of global pandemic lockdowns last March, while the dollar lagged near one-month lows on expectations of continued Fed stimulus. But the stock market losses were moderate compared with sharp falls earlier in the week that had been sparked by investor fears over the impact of regulatory actions in China against the education, property and tech sectors. On Friday, MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.84%, taking its losses for the week to more than 6.5%. Japan's Nikkei dipped 1.71%, set for an 11th straight month of falls on the last trading day in the month. Nasdaq e-mini futures slid 1.35% and S&P 500 e-minis were down 0.82%.

Read More...

Business News

SBP’s reserves decrease by $221m

The total liquid foreign reserves held by the country stood at $24,875.5 million as on July 23, State Bank of Pakistan (SBP) Thursday reported. According to the break-up figures, the foreign reserves held by the SBP stood at $17,829.8 million whereas the net foreign reserves held by commercial banks stood at $7,045.7 million. During the week ending July 23, the SBP’s reserves decreased by US$221 million to $17,829.8 million.

Read More...

OGDCL discovers gas/condensate reservoirs in KP

Oil and Gas Development Company Limited (OGDCL), being operator of Wali Exploration Licence with 100 per cent working interest has made a gas and condensate discovery over Kawagarh Formation from its exploratory efforts at Well Wali No 01 which is located in FR Lakki, Khyber Pakhtunkhwa province. The said discovery is unique as it is the first ever discovery made in Kawagarh Formation in Pakistan and will open new avenues for exploration and this will give boost to exploration activities in Pakistan. The structure of Well Wali No 01 was drilled and tested using OGDCL’s in house expertise.

Read More...

Pakistan’s regional exports rise 9pc in FY21

Pakistan’s exports to nine regional countries posted growth of 9.14 per cent while imports grew by nearly 36pc in FY21 from a year ago, latest data released by the State Bank of Pakistan showed. The country’s exports to Afghanistan, China, Bangladesh, Sri Lanka, India, Iran, Nepal, Bhutan and the Maldives account for a small amount of $3.925 billion — just 14.21pc of Pakistan’s total global exports of $25.304bn in FY21. China tops the list of countries in terms of Pakistan’s exports to its neighbours, leaving other populous countries India and Bangladesh behind. Pakistan carried out its border trade with the farther neighbour Nepal, Sri Lanka, Bhutan, Bangladesh and Maldives via sea only.

Read More...

Expansion of existing LNG terminals opposed

Amid rising number of unaffordable bids, the Petroleum Division has opposed capacity enhancement of existing terminals of liquefied natural gas saying it would lead to competition barrier and create private monopoly. “Allowing Terminal-1 (of Engro Elengy) to expand existing terminal capacity may create the competition barrier and discourage the market for investing in new LNG terminals and infrastructure as there is limited pipeline capacity available for Gas Transport Agreement,” warned Directorate General of Liquid Gases (DGLGs) — a dedicated expert arm of the Petroleum Division.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.