Technical Overview

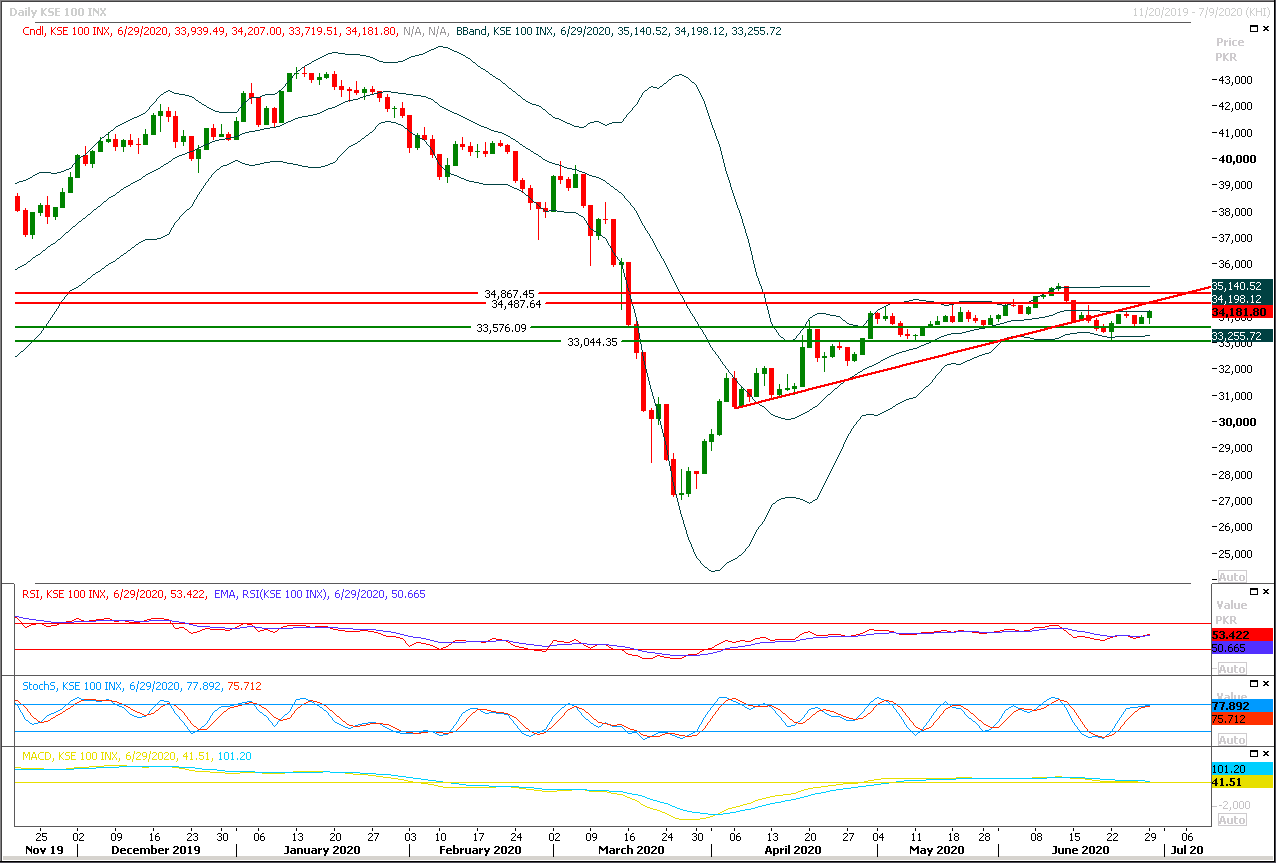

The Benchmark KSE100 index was trying to establish some ground above its major supportive region of 33,500pts since last week but selling pressure was still intact at 34,000pts region but as per expectation index again tried to close above its initial resistant region of 34,000pts and succeeded in doing so, mean while it would try to target 34,340pts and 34,500pts during current trading session but its recommended to stay cautious until index succeeds in closing above 34,500pts. Currently index is being capped by a rising trend line along with several horizontal resistant regions and it would remain under pressure until it would not succeed in closing above this trend line. While daily momentum indicators are changing their direction towards bearish side and if these would succeed to generate a bearish crossover on same time then index would start sliding downward, closing below 33,500pts would push index towards 33,000pts.

Regional Markets

Asia stocks up as China PMI, U.S. data cheer markets worried over coronavirus surge

Asian shares rose on Tuesday after data showed China’s manufacturing sector grew more than expected in June, a hopeful sign for a global economy still struggling to recover from the sweeping impact of the coronavirus crisis. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.9%, while U.S. stock futures, the S&P 500 e-minis, advanced 0.23%. Sentiment in the region, which got a boost from overnight gains on Wall Street thanks to strong housing data, got a further lift from a survey in China showing a quickening in activity in its vast factory sector. The stock market in Australia, which has crucial economic links with China, rose 1.59%, while shares in China gained 0.72%. Hong Kong stocks jumped 1.18%, undeterred by the Chinese parliament’s passage of a security law that will increase Beijing’s control over the former British colony. The Nikkei rose 2%, shrugging off a larger-than-expected decline in Japanese industrial production.

Read More...

Business News

NA passes budget as govt humbles opposition

Amidst reports of cracks within the ranks of the ruling alliance, the Pakistan Tehreek-i-Insaf (PTI) government on Monday managed to get the federal budget for the financial year 2020-21 passed from the National Assembly, comfortably outnumbering the opposition whose members delivered fiery speeches, but failed to make any difference. At the time of final vote on the finance bill, generally known as the federal budget, a triumphant Prime Minister Imran Khan was seen raising his hand in the air like he used to during his cricketing days and then receiving felicitations from the treasury members over his latest political victory.

Read More...

Finance bill sees 30 amendments

The government has introduced 30 amendments to the Finance Bill 2020, most of them related to income tax measures. Of all the recommendations, 16 are related to income tax, 10 to sales tax, and four to federal excise duty (FED). These amendments will come into effect from July 1. However, the revised rate of excise duty on cement and cigarettes will come into effect on the next day of assent given by President Dr Arif Alvi. Through the Act, the government has included three institutions in the list of tax exemptions. No one will ask questions about the income of these institutions in the case of government. Through the Act, the government extended this status to the Shaukat Khanum Memorial Trust, Sindh Institute of Urology & Transplantation (SIUT) Trust and Society for the Welfare of SIUT and National Endowment Scholarship for Talent.

Read More...

IPPs reluctant to produce power on expensive diesel

Amid tight demand and supply situation, the fuel related problems continue to jolt the entire energy sector chain, compelling the authorities to shift some of the power plants on high-speed diesel (HSD) — the most expensive fuel. Informed sources told Dawn that with upsurge in power demand following increase in summer temperatures, the authorities were literally utilising all fuels to run maximum power plants in the public and private sector to minimise electricity loadshedding. These sources said some private parties were requesting the government to allow them LNG imports for direct sales to private power plants, textile and CNG sector at almost half the price at public sector entities — PSO and Pakistan LNG Ltd (PLL) — were importing LNG but were facing institutional resistance.

Read More...

OGRA imposes Rs15 million fine on 3 more OMCs for not maintaining fuel stocks

Oil and Gas Regulatory Authority (OGRA) on Monday imposed fine amounting to Rs15 million on three more Oil Marketing Companies (OMCs) for not maintaining the required fuel stocks as per terms and conditions of the licences awarded to them. “OGRA imposed penalty of [Rs] five million each to BYCO, ASKAR and BE ENERGY on show cause notices issued during oil shortage crises earlier this month,” authority’s spokesman Imran Ghaznavi said in a tweet. On June 11, OGRA had imposed plenty of Rs5 million each on Attock Petroleum Limited, Puma, Gas & Oil Pakistan Limited and Hascol, and Rs10 million each on Shell Pakistan and Total Parco Pakistan Limited

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.