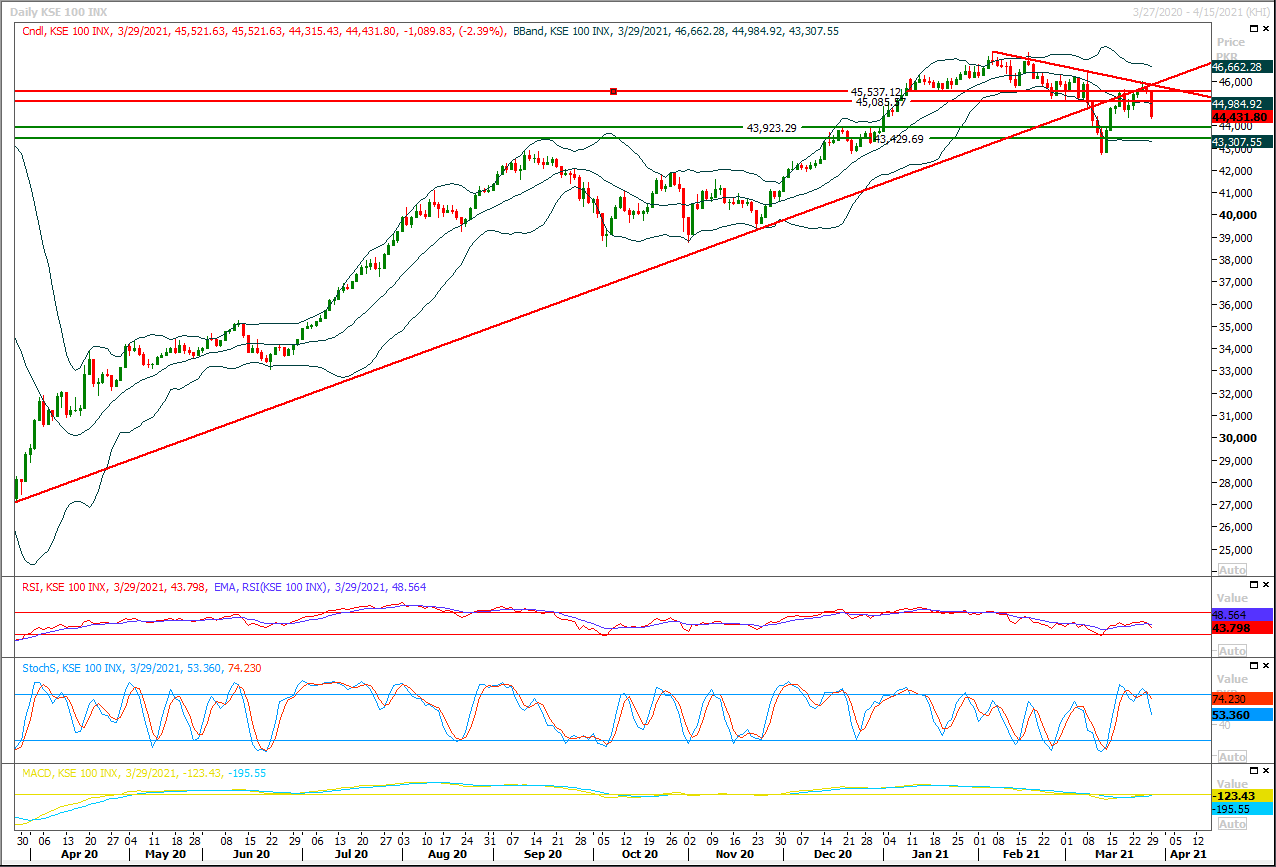

Technical Overview

The Benchmark KSE100 index have dropped towards 50% correction of its recent bullish pull back in last two trading sessions after facing rejection from its major resistant regions. As of now it's expected that index would try to establish ground initially above 43,900pts where its being supported by a strong horizontal supportive region and 61.8% correction of recent pull back, but breakout below this region would push index for expansion of its previous bearish correction. As index is moving downward after facing rejection from its 74.6% correction so it can expand this correction initially towards 43,150pts initially which can be extended towards 41,400pts once it would succeed in closing below 43,100pts on daily chart. But its recommended to stay cautious around 43,900pts because this region falls at 61.8% correction level of recent pull back. Daily momentum indicators have entered strongly bearish zone and if index would not succeed in recovering above 45,000pts then weekly momentum would start losing strength. Meanwhile in case index would not succeed in maintaining above 44,500pts in next two trading sessions then a monthly evening shooting star would take place which would create panic among short to mid-term investors. For current trading session it's recommended to stay cautious and selling on strength with strict stop loss is recommended while later on if index would succeed in maintaining above 43,900pts then a slight recovery could be witnessed before day end from where swing trading could be initiated. In case of bullish pull back index would face initial resistance at 44,630pts which would be followed by 44,880pts and 45,000pts.

Regional Markets

Asia shares mixed as broader worries about U.S. hedge fund default ease

Asian shares were mixed early Tuesday as global investors shook off worries about a hedge fund default that roiled global banking stocks overnight, while rekindled concerns about inflation pushed bond yields higher.Wall Street pared earlier losses driven by the banking sector on fears that issues with a defaulting hedge fund could spread throughout the banking sector. In Asia, the MSCI’s broadest index of Asia-Pacific shares outside Japan was marginally higher by 0.08% in early in the session Tuesday. Hong Kong’s Hang Seng Index was up 0.36% to 28,440 but in Australia a weaker tone emerged when the S&P/ASX200 slid 0.4% to its lowest point for a week. Mainland China’s CSI300 index is 0.18% higher in early trade while Japan’s Nikkei is off 0.1%.

Read More...

Business News

Opposition terms tax laws ordinance unconstitutional

The National Assembly on the opening day of its new session on Monday witnessed a legal and technical debate on the issue of government’s powers to bypass parliament and make changes in the country’s tax laws through a presidential ordinance after the opposition protested over the recently promulgated Tax Laws (Second Amendment) Ordinance 2021, terming it unconstitutional and a breach of the parliament’s privilege. While the opposition lawmakers asked the government to immediately withdraw the ordinance, a number of cabinet members defended the law, saying it has done nothing unconstitutional and that the opposition members are wrongly interpreting Article 73 of the Constitution which states that “a money bill shall only be originated in the National Assembly”.

Read More...

Pak-India trade relations’ resumption to greatly improve stability in South Asia

Pakistan Businesses Forum (PBF) on Monday said the recent trajectory of Indo-Pak relations could be a welcome development not only for both countries but also for the region. Vice President PBF, Ahmad Jawad said that we can change friends but not neighbours. Amid signs of bonhomie, India signaled few days back that it is ready to resume trade with Pakistan, which the latter had unilaterally stopped almost two years ago. India has Also, placed the onus of restoring trade ties on Pakistan. In the year 2020, India’s exports to Pakistan dipped 76.3 per cent to $283 million while imports plummeted 96.2 per cent to just $2.5 million. According to 2013, study titled ‘Normalizing India-Pakistan Trade’ by Indian Council for Research on International Economic Relations estimated the trade potential between India and Pakistan in the range of $11 billion to $20 billion.

Read More...

Amendments in Nepra Act through ordinance to hit economy hard: ICCI

The Islamabad Chamber of Commerce and Industry (ICCI) has expressed serious concerns over the amendments made in the NEPRA Act through an ordinance to put in place a mechanism for automatic hike in electricity tariff of about Rs.5.36 per unit (34 per cent) over the next 27 months. The ICCI has termed it a dangerous move as it would give a serious blow to the business and investment activities in the country and plunge the economy in deep troubles. In a press statement, Sardar Yasir Ilyas Khan, president ICC,I said that power tariffs in Pakistan were already considered highest in the region, which have caused huge increase in the cost of doing business and rendered our products uncompetitive in world markets. He said that under the Circular Debt Management Plan (CDMP) of the government envisaged in the ordinance, the average uniform power rate would gradually go up to over Rs.21 per unit, excluding taxes, duties, surcharges and other add-owns in the bills from its current level of over Rs.15 per unit.

Read More...

ADB to assist Pak in introducing structural reforms

Pakistan and Asian Development Bank (ADB) on Monday reiterated to expand the economic portfolio. Federal Minister for Economic Affairs, Makhdum Khusro Bakhtyar held a virtual meeting with Yevgeniy Zhukov, new Director General of the Central and West Asia Department, Asian Development Bank. The Secretary Economic Affairs and Country Director ADB Division, Xiaohong Yang also joined the meeting. The Minister appreciated ADB’s role as a trusted development partner of Pakistan, especially in terms of the quality of the portfolio and support, keeping in view the emerging needs of the country that includes ADB’s timely support to fight the COVID-19 pandemic. The Minister highlighted that despite challenges posed by COVID19 and worldwide contraction, the key economic indicators are showing encouraging results owing to the government’s strong commitment for structural reforms in the country.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.