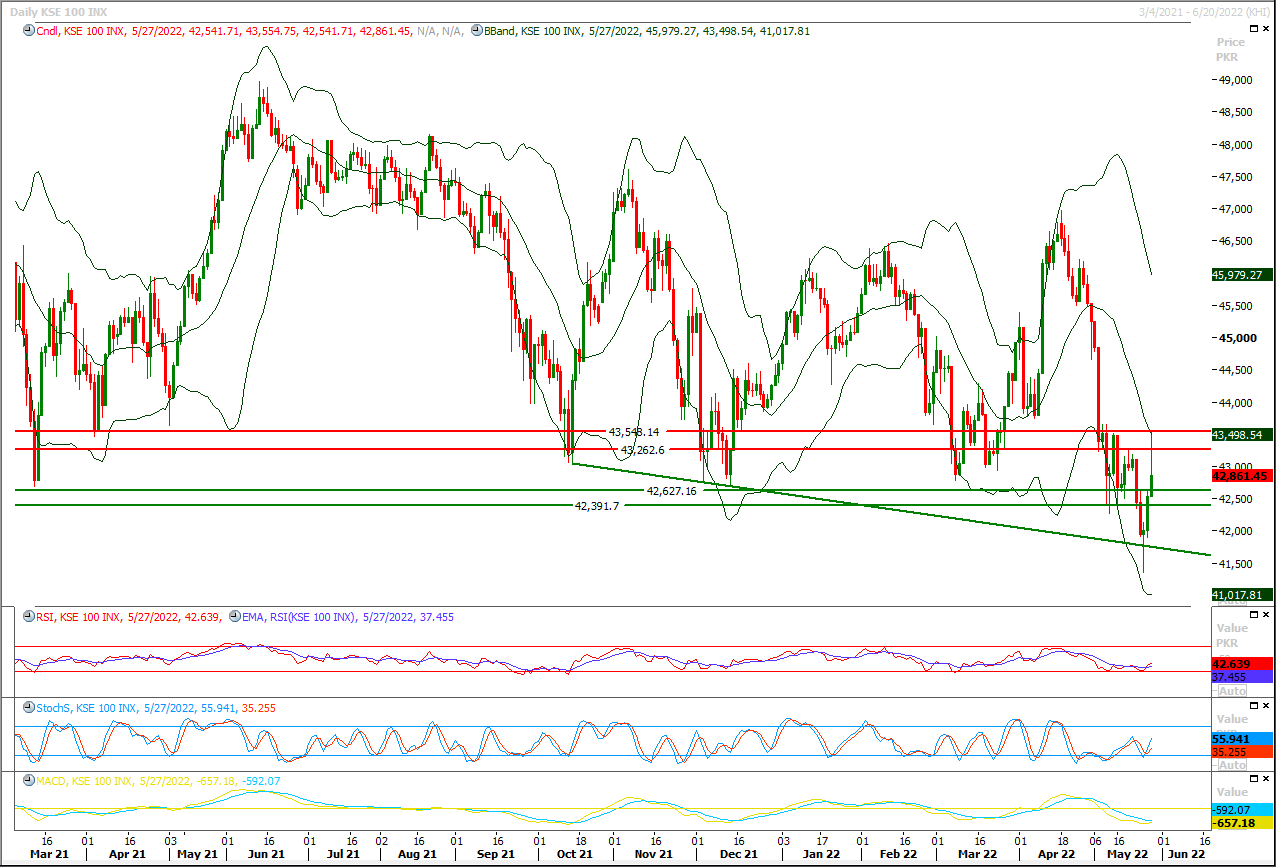

The Benchmark KSE100 index had continued its bullish journey during last trading session and faced rejection from its major resistant region of 43,550pts where it was being capped by a horizontal resistant region. Meanwhile confirmation of daily morning shooting star have taken place and now it's expected that index would show some volatility during current trading session as it slide below 43,200pts before day end but it's recommended to stay on long side as index seems to continue its recover after an intraday dip. For current trading session initially index would try to establish ground above 42,600pts which would be followed by 42,390pts in case of bearish breakout. While on flip side index would face initial resistance at 43,030pts which would be followed by 43,260pts and 43,500pts. Daily and intraday momentum indicators are in bullish mode and it's expected that index would try to target resistant trend line of its current descending wedge in coming days and it would be considered bullish as long as its trading above 41,860pts.

Asian stocks tracked Wall Street higher on Monday while the dollar was pinned near five-week lows as investors wagered on an eventual slowdown in U.S. monetary tightening, albeit after sharp hikes in June and July.Helping to mellow the mood was news that Shanghai authorities will cancel many conditions for businesses to resume work from Wednesday, easing a city-wide lockdown that began two months ago.The Memorial Day holiday in the United States could make for a thin session ahead of the end of the month, but MSCI's broadest index of Asia-Pacific shares outside Japan still climbed 1.2% to a three-week high.

Read More...The free fall of the rupee against the US Dollar and other major currencies has sent alarm bells ringing among the stakeholders of the agriculture sector, who rely on imported inputs like seeds, fertiliser, pesticides and machinery. They fear that an over 14 per cent drop in the value of the local currency since March 1 this year is set to further increase the cost of production for farmers, disturbing rural livelihoods as well as jeopardising national food security.The American currency was being sold for Rs202.34 this weekend against the rate of Rs177.41 on March 1, 2022, a fall of around Rs25 or 14.05pc in less than three months, whereas this decline is Rs79.34 or more than 60pc since August 2018, when the dollar-rupee parity stood at 1:123.

Read More...

Past energy decisions haunting the future

The coalition government led by the PML-N is in the process of finalising an agreement with the International Monetary Fund (IMF) for a fiscal adjustment of well over Rs 1.4 trillion in the upcoming budget. It would be looking at additional tax measures of no less than Rs300 billion besides expenditure cuts, primarily the development programme — the traditional victim. This is set to compromise the country’s growth prospects to yet another stabilisation-cum-inflationary cycle — and prolonged stagflation.

Read More...

Escalating cost-of-living crisis

Unaddressed for long, numerous imbalances in many market economies, emerging or developed — aggravated by global geopolitics and the war in Ukraine — have turned into grave crises. But a high rate of current, unsubdued, persisting inflation has triggered politically the most sensitive ‘cost-of-living-crisis’ worldwide.In Pakistan, inflation has become a crucial political issue because of its possible fallout on the coming provincial and national elections preceded by local body polls. And yet there is no clear indication of how the cost-of-living-crisis will be resolved.

Read More...

Govt Likely To Enhance Sanction Powers Of PDWP To Rs20 Billion

The government is likely to enhance the sanction powers of Provincial Development Working Party (PDWP) to Rs20 billion, while the powers of Gilgit Baltistan (GB) and Azad Jammu and Kashmir (AJK) development forums are being increased to Rs2 billion.The government will seek the nod of the National Economic Council (NEC) for enhancing the sanction powers of the Provincial Development Working Party (PDWP), GB and Azad Jammu and Kashmir development forums, official source told The Nation. The sanction powers of the PDWP is recommended to be increased to Rs20 billion from the existing Rs10 billion, the source said. The sanction powers of the development forums of AJK and GB are also being revised upward to Rs2 billion from the existing limit of Rs1 billion, the source said. However, the sanction powers of Departmental Development Working Party (DDWP) are being downward revised to Rs500 million from the existing Rs2 billion.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.