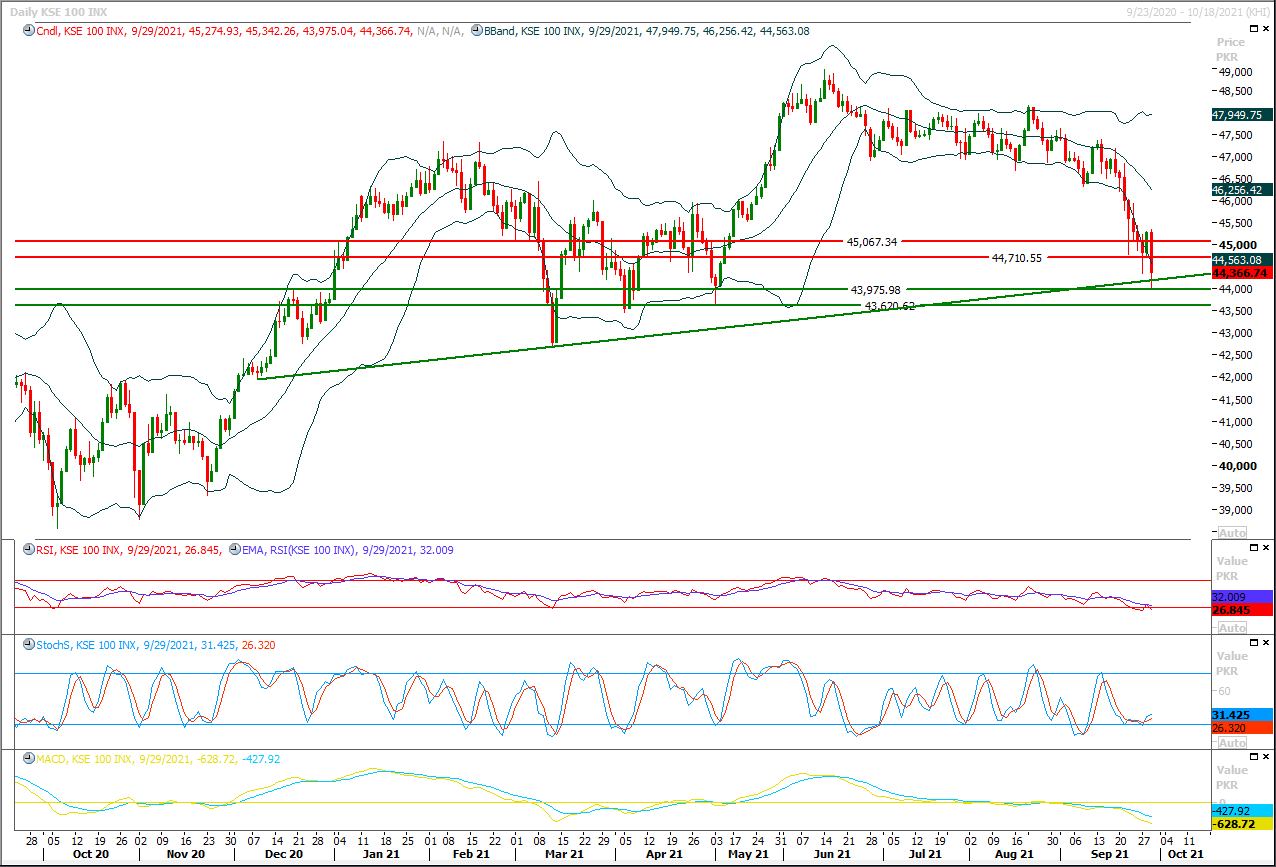

The Benchmark KSE100 index had continued its bearish journey after facing rejection from a horizontal resistant region during last trading session and slide below its major supportive region of 44,500pts at day end. As of now a volatile session would be witnessed during current trading session because index is being caged in a descending wedge on hourly chart and it would try to bounce back after getting support from its supportive trend line but it's recommended to stay cautious because a bearish engulfing pattern have taken place on daily chart during last trading session and being last trading day of the month index may show some volatile moves before day end. Today's closing below 44,155pts would not only provide confirmation for daily bearish engulfing but also create an evening shooting star on monthly chart. On resistant side index is being capped at 44,710pts where a strong horizontal resistant region would try to push index back into bearish zone while on flip side it may try to establish ground above 44,155pts but breakout below this region would call for 43,975pts and 43,620pts. Today's closing below 44,155pts would open doors for 43,500pts and later on it may slide towards 41,900pts. Momentum indicators on hourly, daily and weekly time frames are in bearish mode and these would also create panic among investors in coming days.

Regional Markets

Debt ceiling worries start to rattle Wall Street

The slim-but-growing possibility of a fiscal crisis if Congress doesn’t act on the debt ceiling is getting increasing attention from U.S. investors and is filtering into certain asset prices, though few believe the nation will ultimately default. Warnings have been rung from policymakers to Wall Street bankers of the risk that talks go down to the wire. Jamie Dimon, chief executive of JPMorgan Chase & Co, said the bank is preparing for what could be a "potentially catastrophic event," while New York Federal Reserve Bank President John Williams warned of potential negative market reaction if no solution is found to the debt-ceiling issue.

Read More...

Business News

Rupee hits new low as importers rush for dollars

The US dollar continued its upward spiral against the rupee, hitting a new peak of Rs170.48 after posting a gain of 52 paisa in the interbank market on Wednesday amid a strong demand as growing imports exerted pressure on the already fragile local currency. The dollar has surged by 11.5 per cent against the rupee since May 7. However, in September it appreciated by 2.4pc as it gained on a daily basis except a few days when the State Bank of Pakistan (SBP) intervened to support the rupee.

Read More...

Most loans under CPEC at commercial rates

A substantial chunk of Chinese development financing under the China-Pakistan Economic Corridor (CPEC) consists of loans that are at or near commercial rates as opposed to grants, according to a report released on Wednesday by AidData, a US-based international development research lab. Shedding light on Beijing’s global development programme, the report said Chinese loans under CPEC constitute 95.2 per cent and 73pc of total commitments in energy and transport sectors, respectively.

Read More...

Nepra asks KE to resolve issue of gas supply agreement with SSGC

NEPRA has asked K-Electric to resolve the issue of gas supply agreement with SSGC and warned that in case of failure the regulator will impose fine on the power company. In a public hearing on a petition filed by K-Electric, for the increase of Re 0.97 per unit in power tariff under month Fuel Charges Adjustment, the regulator noted that expensive electricity was generated through expensive fuel during the month of August and efficient plants were not fully utilised. The hearing was presided over by presided Chairman NEPRA and he was accompanied by member Sindh Rafiq Ahmad Shaikh and member KP Maqsood Anwar Khan. In its petition filed by K-Electric for an increase of Rs 0.97 per unit in power tariff under monthly FCA, the company has informed that the cost of electricity has increased due to shortage of gas and running power plants against the merit order, on imported furnace oil (RFO).

Read More...

Board of Investment secy presents three game changing projects to UNDP

As a part of realisation of Pakistan’s SDG vision, Secretary Board of Investment, Fareena Mazhar presented three game changing projects to UNDP that will pave the way for Pakistan to become a success story in terms of progress on SDGs, here on Wednesday. SDG Investment Fair is held twice a year under United Nations Department of Economic and Social Affairs (UNDESA). The first Investment Fair was held earlier in April 2021 and the Second Investment Fair was held yesterday. Projects from NHA, NUST and Ministry of Science and Technology were presented by the Secretary, BOI Fareena Mazhar. She had presented 09 projects from all sectors in the April 2021 Investment Fair while this time the shovel ready 03 projects were offered to the international investors as per UN International standards. The three projects include the Sialkot-Kharian-Rawalpindi Motorway project (phase I and II) and manufacturing of medical equipment.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.