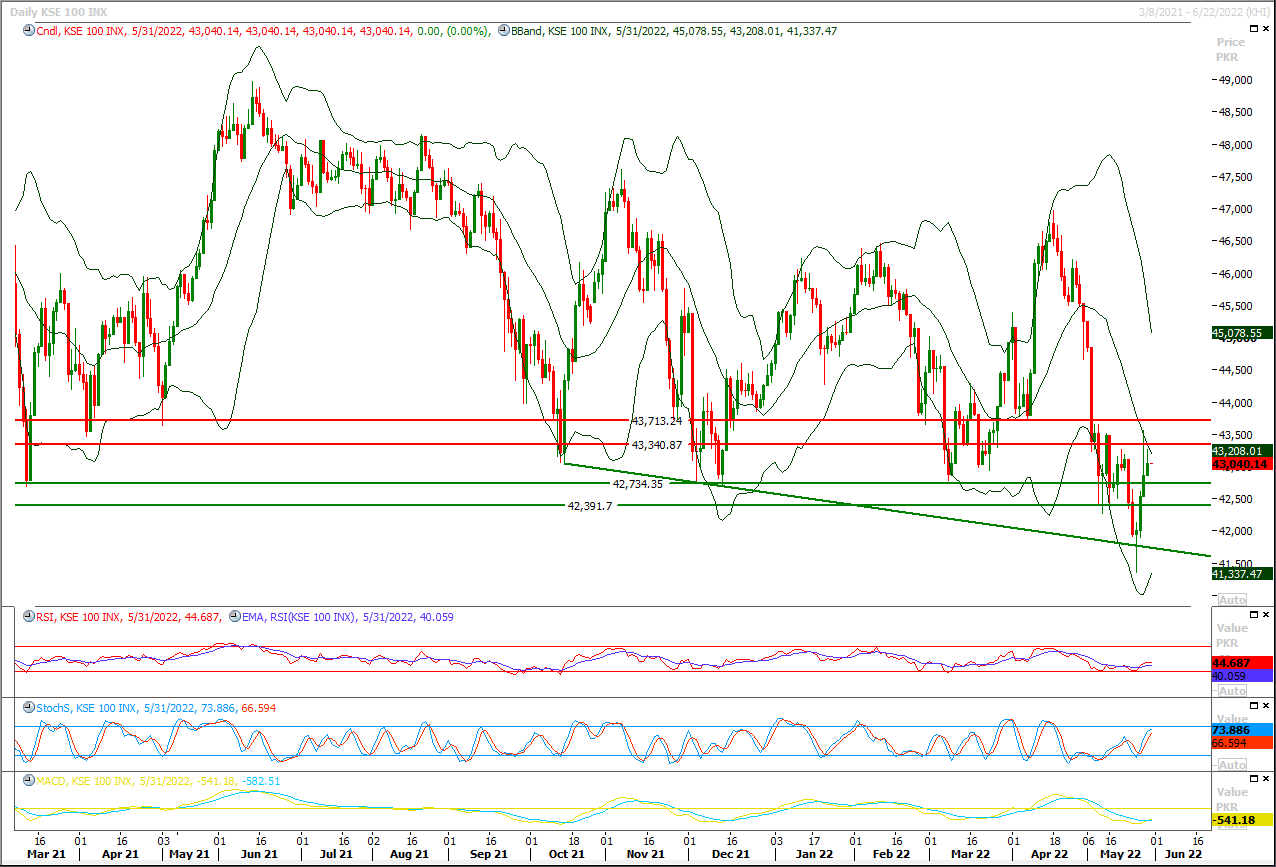

The Benchmark KSE100 index had continued its bullish journey during last trading session and faced rejection from its initial resistant region of 43,550pts where it was being capped by a horizontal resistant region. Meanwhile confirmation of daily morning shooting star have taken place and now it's expected that index would show some volatility during current trading session as it still have not succeeded in closing above 43,200pts before day end but it's recommended to stay on long side as index seems to continue its recover after an intraday dip. For current trading session initially index would try to establish ground above 42,730pts which would be followed by 42,390pts in case of bearish breakout. While on flip side index would face initial resistance at 43,170pts which would be followed by 43,340pts and 43,500pts. Daily and intraday momentum indicators are in bullish mode and it's expected that index would try to target resistant trend line of its current descending wedge in coming days and it would be considered bullish as long as its trading above 41,860pts.

Taiwan's Foxconn, the world's largest contract electronics maker, said on Tuesday that the second half of the year is heading "in a better direction" as Shanghai's COVID-19 lockdown appears to be easing."We are quite confident in the stability of our supply chain for the second half of this year," Foxconn chairman Liu Young-way told the company's annual shareholder meeting.The Shanghai government will allow all residents in 'low-risk' areas to return to work from Tuesday.

Read More...With the gas sector’s circular debt at Rs1.5 trillion, the Petroleum Division on Monday said the gas companies would go bankrupt without a hike in gas tariff that was now inevitable in view of the amended Oil and Gas Regulatory Act.Minister of State for Petroleum Musadik Malik and Secretary Ali Reza Bhutta while testifying before the Senate Standing Committee on Petroleum said the government did not have money for bailouts and gas tariff increase could not be avoided under the revised Ogra Act passed by the previous government under the IMF programme.

Read More...

Oil imports facing foreign exchange constraints

Amid rising subsidy allocations, the oil industry is now facing challenges in arranging international finances for import of crude and oil products.Informed sources told Dawn that the Petroleum Division had informed the prime minister and finance minister that arrangements of oil imports were getting tough by the day as foreign banks were not providing financing against letters of credit (LCs) opened by oil marketing companies (OMCs) and refineries with the local banks.

Read More...

Govt Likely To Take More Tough Economic Decisions To Revive IMF Programme

The federal government is likely to take more tough economic decisions in next few weeks to revive stalled International Monetary Fund (IMF) programme including enhancing oil, electricity and gas prices besides introducing massive revenue generation measures in next budget.Finance Minister Miftah Ismail had announced that staff level agreement with the IMF is expected in next month (June). However, officials in ministry of finance believed that government would have to take tough economic decisions to secure next tranche from the IMF. They said that government would gradually take the decision as it does not want to put sudden burden on the people, who are already facing double digit inflation. The government might have to further increase the petroleum products prices to reduce the volume of subsidies, enhancing electricity and gas tariffs and introducing massive revenue generation measures in next budget, which would be announced on June 10 this year.

Read More...

SECP Chief Suggests Steering Committee For Islamic Finance Promotion

Chairman of SECP Aamir Khan suggested establishment of a high-level Steering Committee tasked with charting an impactful roadmap for the future, encompassing all touch points of Islamic finance ecosystem, to promote Islamic finance in the country. He made this suggestion in his keynote address at World Islamic Finance Forum’s “Development of Islamic Finance Ecosystem for Global Prosperity” conference, organized by Center of Excellence in Islamic Finance (CEIF) on Monday. It is notable here that a similar committee was formulated in 2013 for promotion of Islamic banking in Pakistan. Aamir Khan also recommended a tax incentive for companies whose financing needs are principally met through capital market Islamic instruments. “This would be a preferred approach than to revive the erstwhile 2% flat incentive,” he said. He noted that ‘protection, justice, fairness and societal well-being’ are the key goals of Islamic finance, and SECP has been focused on promotion of Islamic financing with all these goals in sight, said Chairman Securities and Exchange Commission of Pakistan (SECP) in his keynote address at World Islamic Finance Forum’s “Development of Islamic Finance Ecosystem for Global Prosperity” conference, organized by Center of Excellence in Islamic Finance (CEIF).

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.