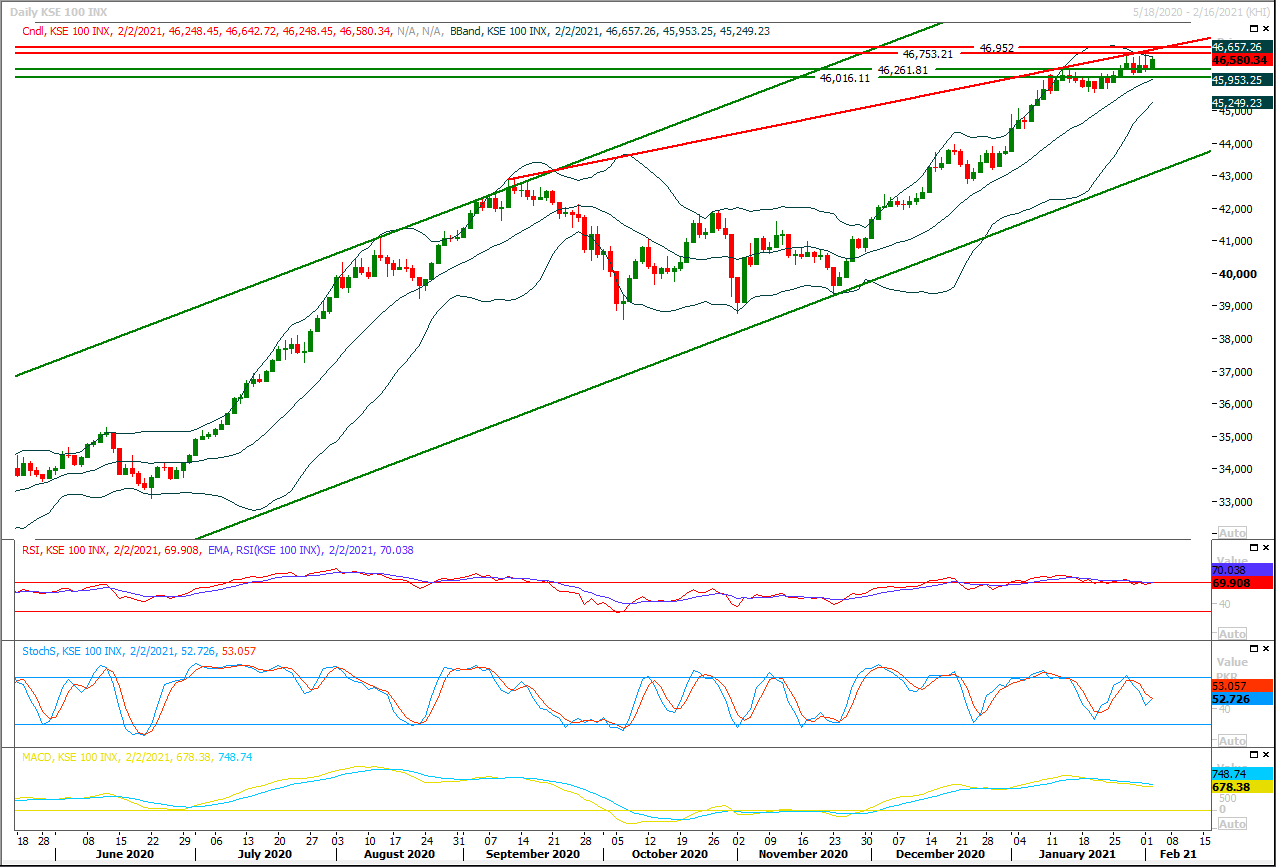

Technical Overview

The Benchmark KSE100 index is facing resistance from an ascending trend line on daily chart since last week and today that line falls at 46,922pts therefore it's expected that index would face major resistance in this region but before that region index have initial resistance at 46,760pts where a daily double top would take place. As of now it's expected that index would initially take a spike towards its resistant regions and would face initial resistance at 46,760pts where a daily double top would take place but breakout above this region would call for 46,900-46,950pts where index would face strong resistance from resistant trend line of its ascending wedge. Meanwhile daily momentum indicators are still on bearish side and those are not supporting current bullish sentiment therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. On flip side in case of bearish reversal index would try to establish ground initially above 46,300pts-46,250pts where a strong horizontal supportive region would try to pump fresh volumes along with a supportive trend line, but breakout below this region would push index towards 46,000pts and 45,800pts. It's recommended to adopt swing trading if index would not succeed in amending previous high because in this case a head & shoulder formation would take place on hourly chart.

Regional Markets

U.S. stimulus, vaccine progress encourage equity bulls

Asian shares and U.S. stock futures rose on Wednesday as governments around the world looked poised to boost spending to help economies recover from the coronavirus and vaccine roll-out programmes accelerated. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.51%. Australian stocks jumped by 1.12%. Shares in China fell 0.06%. Japan’s Nikkei added 0.66%. Shares in Seoul rose by 0.44%. E-mini futures for the S&P 500 rose 0.36%. Wall Street rallied on Tuesday on renewed hopes for U.S. President Joe Biden’ proposed $1.9 trillion COVID-19 aid bill as the Senate took steps to allow Democrats to pass Biden’s package without Republican support. The U.S. Treasury yield curve continued to steepen in Asian trading, reflecting expectations for more fiscal spending and growing economic optimism.

Read More...

Business News

Pakistan’s exports to Afghanistan decrease 17.1 per cent in 1st half

Pakistan’s exports of goods and services to Afghanistan witnessed a decrease of 17.10 percent during the first half of current financial year (2020-21) compared to the corresponding period of last year, State Bank of Pakistan (SBP) reported. The overall exports to Afghanistan were recorded at $450.243 million during July-December (2020-21) against exports of $543.159 million during July-December (2019-20), showing negative growth of 17.10 percent, SBP data revealed. On year-to-year basis, the exports to Afghanistan during December 2020 also decreased by 25.74 percent, from $110.598 million last year to $82.129 million. On month-on-month basis, the exports to Afghanistan also witnessed declined of 14.70 percent during December 2020 when compared to the exports of $71.651 million in November 2020. Overall, Pakistan’s exports to other countries witnessed decline of 4.75 percent in first half, from $12.392 billion to $11.803 billion, the SBP data revealed.

Read More...

Total cement despatches surge to 4.73 million tonnes in Jan

Cement sector posted growth of 16.28 per cent in January 2021 as compared to January 2020. Total cement despatches during January 2021 were 4.73 million tonnes against 4.07 million tonnes despatched during the same month of last fiscal year. According to the data released by All Pakistan Cement Manufacturers Association (APCMA), local cement despatches in the month of January 2021 increased to 4.03 million tonnes compared to 3.26 million tonnes in January 2020, depicting a growth of 23.67 percent. However, the exports dropped by 14.09 percent from 808,874 tonnes in January 2020 to 694,934 tonnes in January 2021.

Read More...

Govt plans to privatise three PSEs during ongoing fiscal year

The government has plan to privatise three public sector entities (PSEs) including SME Bank Limited during ongoing fiscal year. The Privatisation Commission has decided to complete the privatisation process of three PSEs including divestment of up to 20% shares of Pakistan Reinsurance Co. Ltd, SME Bank Limited and Services International Hotel, Lahore by June 30 this year, according to the official documents. For the three PSEs mentioned above, expected proceeds would be determined at the time of approval of valuation/ bidding processes by the CCoP and the cabinet. However, the process of completing privatisation depends on various factors including Covid-19 effects on market conditions and timely approval of requisite milestones by the CCoP and the cabinet.

Read More...

Finance ministry to clear IPPs dues in two tranches

The deal between the government and Independent Power Producers (IPPs) has entered the implementation phase after the finance ministry agreed to clear about Rs400 billion dues in two instalments of 40 per cent and 60pc within six months. At the time of filing of this report, the power division of energy ministry was finalising a summary that could be placed before the Economic Coordination Committee (ECC) of the cabinet for formal approval on Wednesday, as otherwise a special ECC meeting would have to be convened within a couple of days, a senior government official told Dawn on Tuesday.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.