Technical Overview

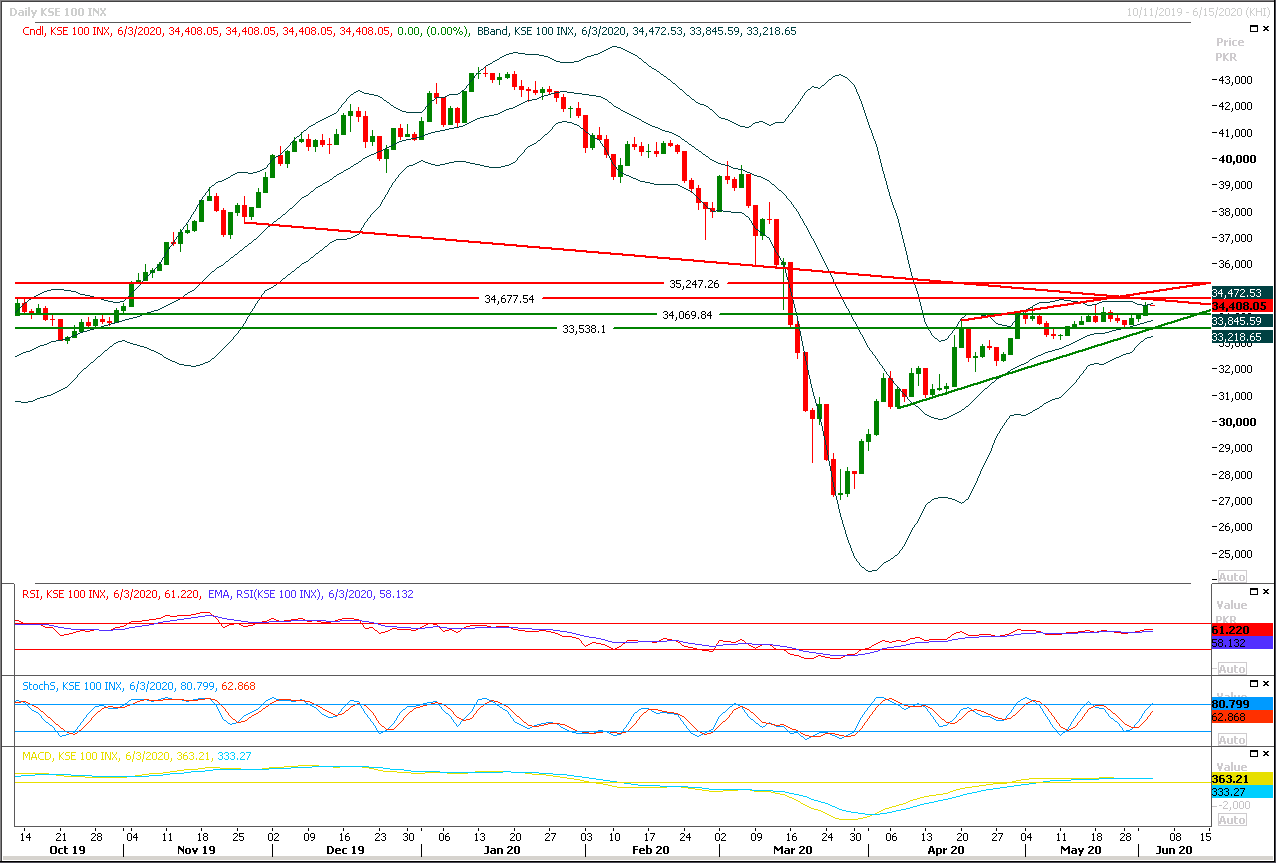

The Benchmark KSE100 index have crossed its first milestone towards bullish sentiment by closing above 34,200pts during last trading session but it's still caged in an ascending wedge and resistant trend line of this wedge would try to resist against current bullish sentiment at 34,900pts, mean while index have a major resistant region ahead at 34,650pts for current trading session where a descending trend line along with a horizontal resistant region would try to push index downward again. As of now index have entered into caution zone because if it would succeed in closing above 34,500-34,650pts region then its next targets would be 35,200pts while in case of rejection from its resistant regions index would slide downward again and 34,000pts would try to support against any bearish pressure. It's recommended to stay cautious and post trailing stop loss on existing long positions because index needs fresh volumes to close above its major resistant regions and if it would succeed in penetration above its resistant regions with thick volumes then it would be a caution call for bulls because this penetration could convert into false breakout in coming days in this scenario.

Regional Markets

Asian stocks jump to 3-month high as recovery hopes outweigh looming risks

Asian shares vaulted to a near three-month high on Wednesday as hopes of more stimulus and further easing in social restrictions around the world outweighed caution over a host of worries from the coronavirus to growing U.S. civil unrest. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 1.3%, extending its rally into a fifth straight day to reach a level last seen on March 9. Japan’s Nikkei rose 1.2% to its highest level since late February, while mainland China’s CSI300 rose 0.4% to break above its May peak to a 12-week high. E-mini futures for the U.S. S&P 500 were up 0.2% in early Wednesday trade, extending the gains so far this week to 1.4%.

Read More...

Business News

Nepra asked to transfer burden of Rs162.36b to power consumers

EX-Wapda Discos have filed a petition with NEPRA asking to transfer the burden of Rs162.363 billion to the power consumers on account for the 2nd and 3rd quarters 2019-20 adjustments. Ex-Wapda Discos have filed their requests with NEPRA for adjustment on account of variation in Power Purchase Price (PPP) for the 2nd and 3rd quarters (October 2019 to March 2020) of fiscal year 2019-20. For the 2nd quarter (October to December 2019) adjustments Discos have demanded Rs 72.770 billion which includes Rs60.884 billion capacity purchase price, impact of Transmission & Distribution losses on Monthly FCA Rs 7.778 billion, Variable O &M Rs 2.351 billion, UOC & MoF Rs 1.662 billion and impact of extra/less purchases Rs95 million. For the 2nd quarter IESCO has demanded Rs 5.198 billion, LESCO Rs 11.655 billion, GEPCO Rs 5.611 billion, FESCO Rs 10.419 billion, MEPCO Rs 10.807 billion, PESCO Rs 13.475 billion, HESCO Rs 5.705 billion, QESCO Rs 6.919 billion, SEPCO Rs3.371 billion.

Read More...

ECC to decide on Rs20bn plan for hedging of oil imports

The government has called a meeting of the Economic Coordination Committee (ECC) of the Cabinet on Wednesday to consider hedging of oil prices and about Rs120 billion worth of funds to finance improvement of western border management and low bill recoveries in the power sector. To be presided over by Finance Adviser Dr Abdul Hafeez Shaikh, the ECC may also approve payment of over Rs4.4bn to Broadsheet LLC after the National Accountability Bureau (NAB) lost an arbitration case in London courts.

Read More...

Duty drawback raised for finished leather, plastic

The Federal Board of Revenue has raised duty drawback rates on exports of finished leather and plastic goods including packing material. The revised rates, worked out by Input-Output Coefficient Organisation (IOCO) of the Customs, were issued through two different notifications SRO460 and SRO461 and the new one will be available to exporters from May 20. On the plastic goods including packing material, the duty drawback rate was raised to Rs5.42 per kg, from Rs3.14 per kg. Similarly, the rates of duty drawback were raised for finished leather of different animals. The rate was revised upward to 1.78pc of the Free on Board (FoB) value from 0.80pc on export of finished leather of goat, sheep or kangaroo skin. For cow, buffalo or camel’s hide, it was increased to 3.73pc of the FoB value, from 1.17pc.

Read More...

Supply of petrol affected across country

The supply of petroleum products has been seriously affected in many parts of the country as oil marketing companies and the authorities concerned failed to ensure mandatory stocks at designated depots. The major shortage was witnessed in the supply of motor gasoline, commonly known as petrol, in many cities and towns as smaller stocks were quickly exhausted on the first two days of the month after price revision. The oil companies were then asked by the authorities in the petroleum division and the Oil and Gas Regulatory Authority (Ogra) to adopt rationing practices to avoid a total dry-out. The retail outlets were then instructed to restrict their sales to Rs500-Rs1,000 per vehicle and still the outlets went dry on Tuesday.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.