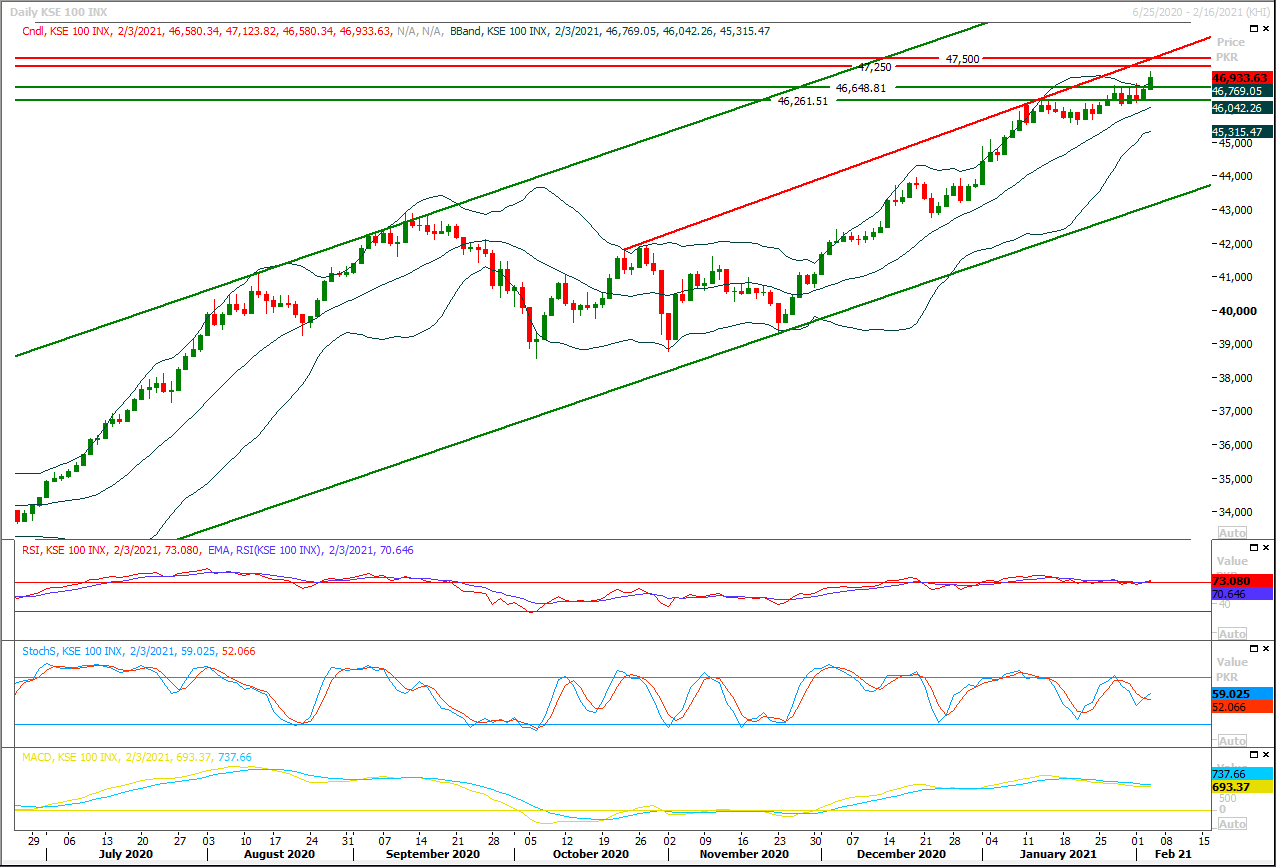

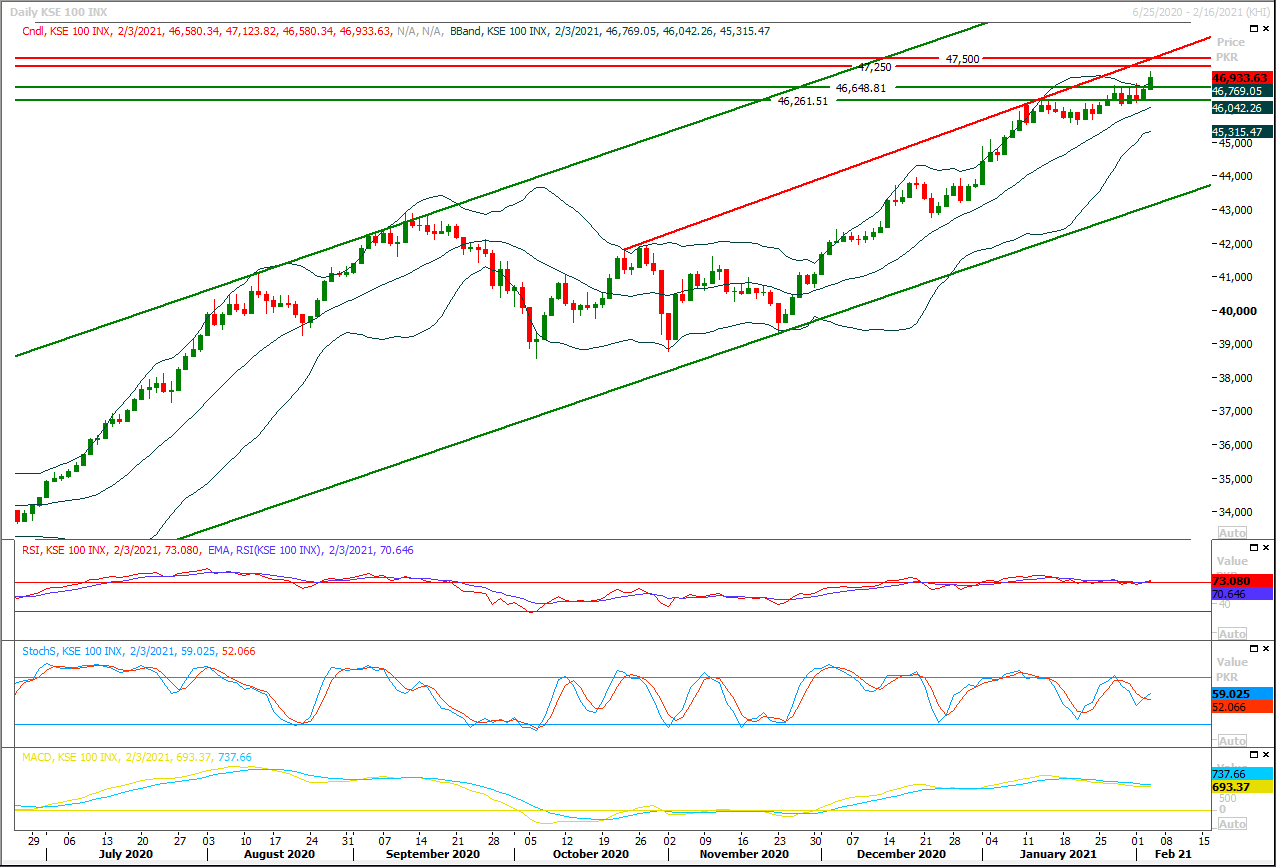

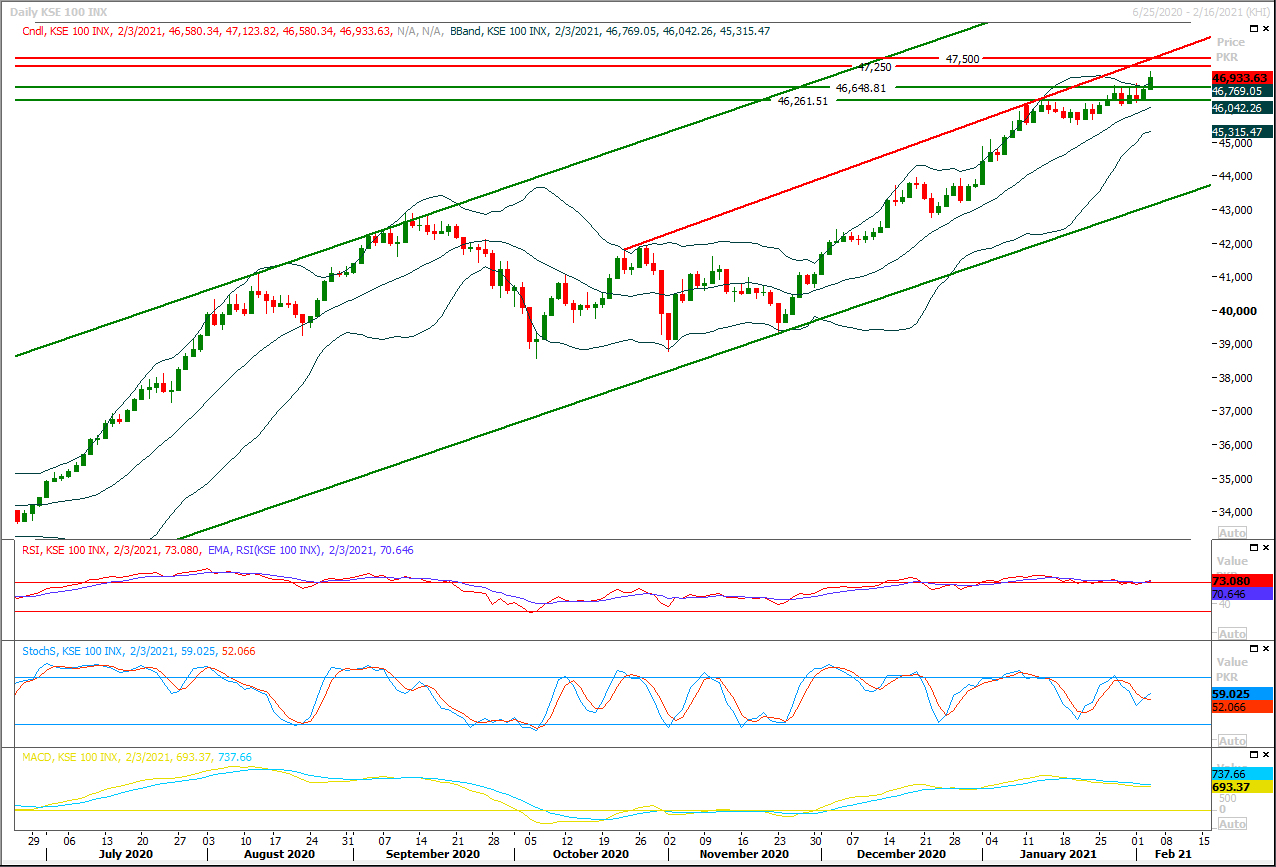

Technical Overview

The Benchmark KSE100 have reached 76.4% correction of its whole bearish rally which was start four years ago from 53,127pts and ended at 27,046pts in shape of a bearish Elliot wave. If index would not succeed in closing above 46,972pts on weekly or monthly chart then it would be considered that an ABC formation have been completed during last bullish rally. Meanwhile index is being capped by a strong horizontal resistant region between 47,250pts-47,500pts on weekly and monthly charts therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. It's expected that index would try to target its resistant regions at 47,140pts and 47,250pts during current trading session but hourly momentum indicators have changed their direction towards bearish side therefore an intraday dip could be witnessed during the day. In case of breakout above 47,500pts index would try to target 48,400pts to complete 100% expansion of its previous 38% correction. While on flip side in case of rejection from its resistant regions index would try to establish ground between 46,660pts-46,500pts while daily closing below these regions would push index further downward for a deeper correction.

Regional Markets

Asian stocks ease as caution persists despite calmer markets

Asian stocks came under pressure on Thursday as a mixed Wall Street session gave investors few immediate reasons to increase their risk positions following the recent social media-driven trading chaos. Markets have calmed significantly in the past few days with the Cboe Volatility index down on Wednesday as wild swings in stock prices of GameStop and other social media favorites subsided and the retail trading frenzy faded. However, caution continues to dominate sentiment despite positive corporate earnings and firm signs of economic recovery. The Australian S&P/ASX 200 index lost 0.34% during early trade and Japan’s Nikkei 225 fell 0.35%. The lackluster start to Asian trade followed a mixed Wall Street session with the Dow Jones Industrial Average up 0.12%, the S&P 500 gaining 0.10%, but the Nasdaq Composite losing 0.02%.

Read More...

Business News

Germany’s IT, telecom companies invited to invest in Pakistan

Federal Minister for IT and Telecommunication Syed Amin-Ul-Haque Wednesday invited Germany IT and telecom companies to invest in Pakistan. “IT and telecom companies of Germany must invest in Pakistan as environment for investment in Pakistan is conducive,” the minister expressed these views during a meeting with German Ambassador to Pakistan Bernhard Schlagheck, said a news release. Federal Secretary Ministry of IT and Telecommunication Shoaib Ahmad Siddiqui was also present in the meeting. The two sides agreed to enhance cooperation in IT and telecommunication sector. The minister said Pakistan greatly values its relations with Germany and wanted to enhance cooperation between the two countries in the field of IT and telecom. He said that steps are underway for fulfilling Digital Pakistan Vision.

Read More...

Agha Steel signs contract with Renewable Power for installing 2.25MW solar project

Agha Steel Industries, a leading steel rebar manufacturing company, has signed a contract with Renewable Power Pvt. Ltd. for installing a 2.25 megawatts solar power project at its production facility located at Port Qasim Karachi. Meezan Bank Ltd is the banking partner for this transaction. This would be among one of the largest solar power projects installed by a steel manufacturer in Pakistan. According to a statement, this project will initiate a Green Steel Revolution at Agha Steel Industries by helping in sustainability of its energy mix and at the same time reducing the burden on national grid. The 2.25 megawatts solar power project would also reduce the carbon emission by 46,000 tons in a lifespan of 20 years.

Read More...

Medicinal products import up 4.56pc in 1st half of FY2020-21

The import of medicinal products into the country witnessed an increase of 4.56 percent during the first half of the current financial year (2020-21) as compared to the corresponding period of last year. Pakistan imported medicinal products worth $538.941 million during July-December 2020-21 as compared to the imports of $515.429 million during July-December 2019-20, according to data released by the Pakistan Bureau of Statistics (PBS). In terms of quantity, however, medicinal imports witnessed a decrease of 3.37 percent, as the country imported 10,903 metric tonnes of medicinal products during the period under review as compared to the imports of 11,283 metric tonnes last year.

Read More...

China remains top importer among other countries

China topped the list of countries from where Pakistan imported different products during the first half of the current financial year (2020-21), followed by United Arab Emirates (UAE) and Singapore. The total imports from China during July-December (2020-21) were recorded at $5730.084 million against the $4878.751 million during July-December (2019-20), showing an increase of 17.44 percent during the period, State Bank of Pakistan (SBP) said. This was followed by UAE, where Pakistan imported goods worth $3300.862 million against the imports of $3643.200 million last year, showing negative growth of 9.39 percent. Singapore was the third top country from where Pakistan imported products worth $1341.440 million against the imports of $1081.356 million last year, showing growth of 24.05 percent, SBP data revealed.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.