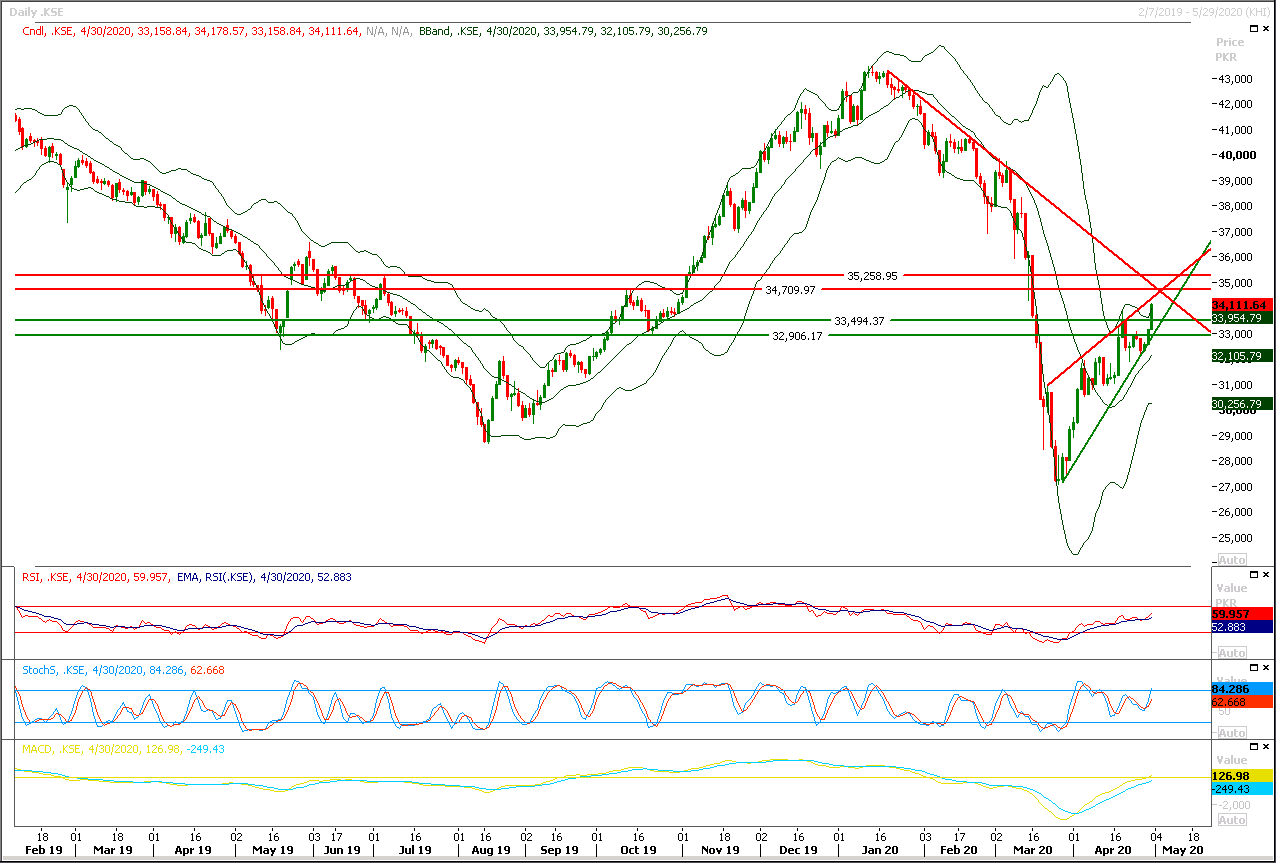

Technical Overview

The Benchmark KSE100 index is moving upward in a rising wedge on daily chart. As of now index have resistant regions ahead between 34,500pts-34,700pts and if it would succeed in breakout above this region then it would find its next resistant region at 35,200pts where 50% correction of its last bearish rally would complete. It's recommended to stay cautious and post trailing stop loss on existing long positions. Because in case of rejection from its resistant regions index would slide downward and would try to find some ground at supportive trend line of its rising wedge but daily c losing below said trend line would star adding pressure on index. Daily momentum indicators are still in bullish mode but hourly momentum indicators have lost their strength and these could start sliding downward any time.

While on flip side index would try to find some ground at 33,500pts in case of any bearish pressure where a strong horizontal supportive region would try to push index upward. While breakout below that region would call for dip towards 32,900pts. Mean while bulls would start losing control on market once index would succeed in sliding below 33,000pts.

Regional Markets

Dollar edges up, Asian stocks slip as U.S.-China tensions flare

The dollar inched higher, stock markets struggled for traction and oil fell on Monday as a U.S.-China spat over the origin of the coronavirus put the brakes on optimism about an economic re-start as countries around the world ease restrictions. In reduced trade, with China and Japan on holiday, U.S. stock futures fell 1.7% and U.S. crude tumbled 7%. The safe-haven U.S. dollar rallied to one-week highs against the risk sensitive Australian and New Zealand dollars. South Korea’s KOSPI fell, Hong Kong’s Hang Seng returned from a two-session holiday with a 3.5% drop, while Australia’s ASX 200 eked out a 0.5% gain. China has reported its first quarterly GDP contraction since such records began a generation ago, and posted a slump in April export orders last week. U.S. manufacturing plunged to an 11-year low last month, consumer spending has collapsed and some 30.3 million Americans have filed claims for unemployment in the last six weeks.

Read More...

Business News

PM’s think tank asks govt to cut tax rates

The prime minister’s think tank at a meeting on Sunday advised the government to consider reducing tax rates and shifting focus of federal and provincial development programmes to high-impact areas while keeping a close eye on an effective rescue and relief campaign to protect vulnerable segments of society from the serious fallout triggered by Covid-19 in the country. The focus of the meeting appeared to be more on relief operations as some participants also insisted that policymakers should not lose sight of the medium- and long-term direction of the economy and some steps should also be in place for restructuring and redefining government role and rightsizing the path. The meeting also discussed easing of regulatory requirements for the financial sector.

Read More...

Rs3.67bn irregularities found in Zakat, Baitul Mal funds

he Auditor General of Pakistan (AGP) on Saturday disclosed to the Supreme Court that they had unearthed staggering irregularities of Rs3.67 billion out of a total fund of Rs5.96bn audited jointly for the Zakat Department and Pakistan Baitul Mal for the current year. The AGP report was furnished before the Supreme Court in line with its earlier direction to furnish a detailed report when lack of transparency in Zakat and Baitul Mal funds distribution came under scrutiny of the court. While hearing a suo motu case on the measures being taken by the federal and provincial governments in combating the deadly coronavirus pandemic on April 20, a five-judge Supreme Court bench had regretted that the court had not been provided information about deduction of Zakat and Baitul Mal funds and their distribution among needy persons.

Read More...

Punjab to restructure wheat market with World Bank assistance

Punjab government has decided to restructure its wheat market reform process under the World Bank’s Punjab Agriculture and Rural Transformation Programme. The provincial government has decided to begin discussions with the World Bank on restructuring the project during the upcoming mid-term review. The implementation of $300 million ‘Strengthening Markets for Agriculture and Rural Transformation’ (SMART) began in February 2018 and overall progress of the programme has been on track. However, the wheat market reforms were not implemented as envisaged under the original plan.

Read More...

CDNS achieves net target of Rs172b in last 10 months

The Central Directorate of National Savings (CDNS) has achieved collection net target of Rs172 billion in last 10 months of current fiscal year by April 30, 2019-20. The CDNS has set Rs352 billion annual collection target for the year 2019-20 as compared to Rs 324 billion for the previous year’s 2018-19 to enhance savings and promoting saving culture in the country, senior official of CDNS told APP here. The directorate has also revised and increased the gross target of Rs1570 billion for fiscal year 2019-20, he said. Replying to a question, he said CDNS had collected Rs 410 billion by June 30, exceeding the target of Rs 324 billion set for the year while during the preceding year of 2017-18, CDNS collected Rs155 billion. The total savings held by the CDNS stood at Rs 1,150 billion by June 30 while the directorate had Rs 774 billion savings by the same date, a year ago, he said.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.