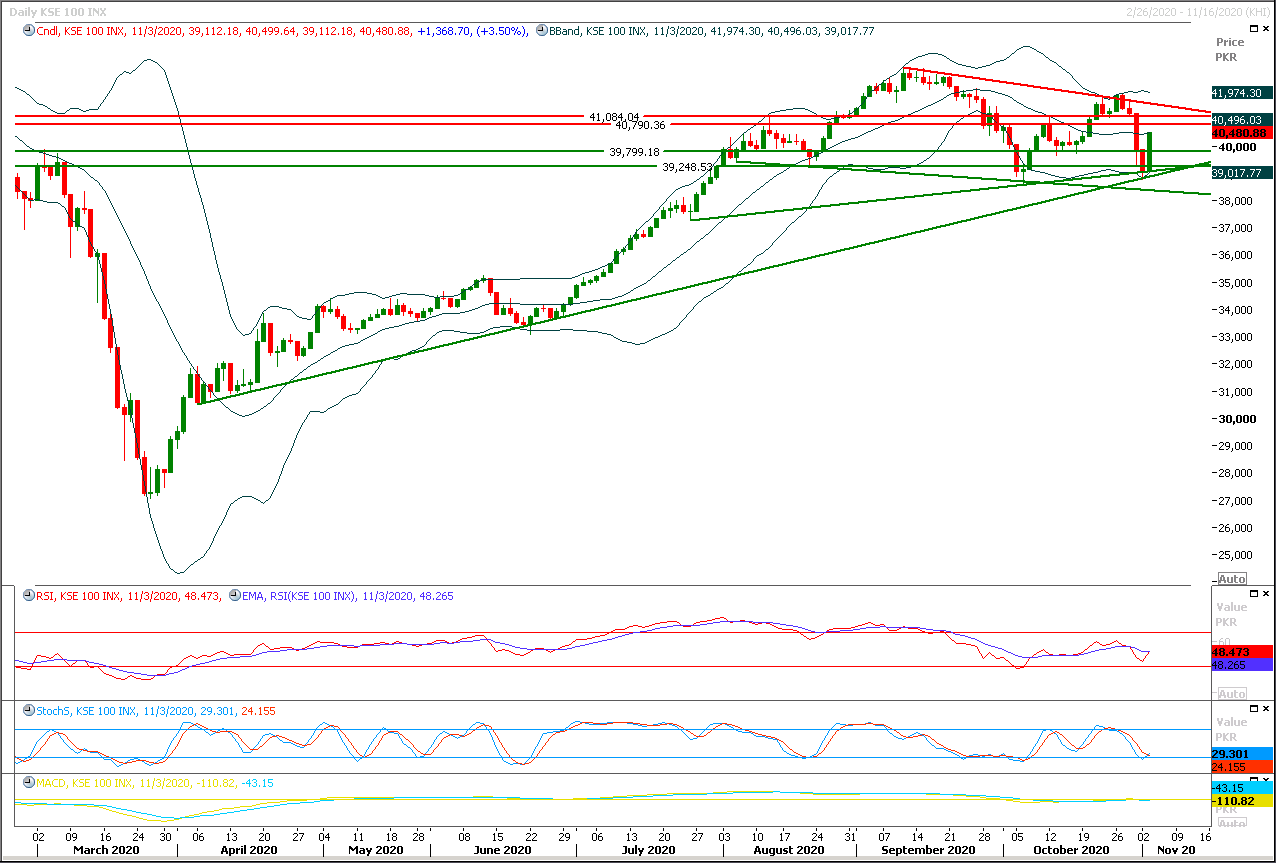

Technical Overview

The Benchmark KSE100 index have generated a bullish engulfing pattern on daily chart to decrease impact of weekly bearish engulfing during last trading session and have bounced back after getting support from two strong supportive trend lines but this formation could convert into a cheat pattern if index would not succeed in closing above 41,000pts-41,200pts region in coming days. As of now it's expected that index would face initial resistance at 39,800pts region where 61.8% correction of its last bearish rally would complete and closing above that region would call for next resistant regions at 41,000pts and 41,200pts. It's recommended to start profit taking from existing long positions on spike and wait for a clear breakout above its resistant regions to initiate new ones or post trailing stop loss on existing long positions. If index would not succeed in closing above 41,000pts-41,200pts in coming days then a major sell off could be witnessed which would push index below neck line of its daily head and shoulder. Mean while hourly momentum indicators are losing strength and that could be a negative indicator for bulls. Initially index would try to find some ground at 39,760pts in case of rejection from its resistant regions and breakout below that region would push index further downward and this bearish rally may extend towards 39,500pts and 39,200pts in case of reversal.

Regional Markets

Global stocks whipsaw, bonds rally as U.S. vote agonisingly close

Asian share markets turned skittish and S&P futures wobbled on Wednesday as results from the U.S. presidential election showed an agonisingly close race with no clear winner yet in sight. E-Mini futures for the S&P 500 veered wildly between negative and positive and were last up 0.36%. EUROSTOXX 50 futures lost 0.5% and FTSE futures 0.8%. Japan’s Nikkei was still ahead by 1.4%, but MSCI’s broadest index of Asia-Pacific shares outside Japan shed 0.6%. Investors had initially wagered that a possible Democratic sweep by Joe Biden could ease political risk while promising a huge boost to fiscal stimulus, hitting the safe-haven dollar and bonds. “Markets have taken a step back from the Democratic sweep scenario.”

Read More...

Business News

MPs ask to stop charging Neelum-Jhelum surcharge

The Senate Standing Committee on Planning, Development and Special Initiatives Tuesday recommended the power ministry to stop charging Neelum Jhelum Surcharge from electricity bills in the month of December. The committee which met here with Senator Agha Shahzaib Durrani in Chair directed the ministry to move a new summary for abolishing the surcharge from the bills. The Chairman maintained that the project was already achieved its commercial operation and was earning by producing the electricity, therefore WAPDA should immediately stop the surcharge.

Read More...

ADB, Pakistan sign $2 million grant agreement to combat COVID-19

The Asian Development Bank (ADB) will provide $2 million grant to strengthen Pakistan’s efforts to combat the coronavirus disease (COVID-19) pandemic. The Asian Development Bank (ADB) and the Government of Pakistan signed a $2 million grant agreement to strengthen Pakistan’s efforts to combat the coronavirus disease (COVID-19) pandemic. Agreement in this regard was signed here Tuesday by Secretary of the Economic Affairs Division, Noor Ahmed and ADB Country Director for Pakistan, Xiaohong Yang. The grant financed from the Asia Pacific Disaster Response Fund, will help provide life-saving medical supplies, diagnostic and laboratory facilities, and other critical equipment for communities affected by the pandemic.

Read More...

Economy back on growth path, no debt rise in past 4 months

Asserting that economy was steered back on growth path, Advisor to Prime Minister on Finance, Dr. Abdul Hafeez Shaikh said Tuesday that there was no increase in country’s debt during the past four months. “During the period from June 30 to November 1st, there was zero per cent increase in the country’s debt,” he said while accompanying Prime Minister, Imran Khan during a briefing on power relief package for industry. The advisor said that this all was done on the basis of country’s own income as the government had reduced expenditures while the revenues were on growth path.

Read More...

Pakistan’s exports to US decrease 0.57 per cent in Q1

Pakistan’s exports of goods and services to United States of America (USA) witnessed a decrease of 0.57 per cent during the first quarter (Q1) of current financial year (2020-21) as compared to the exports of corresponding period of last year, State Bank of Pakistan (SBP) reported. The overall exports to USA were recorded at $1047.748 million during July-September (2020-21) against exports of $1053.767 million during July-September (2019-20), showing nominal decline of 0.57 per cent, SBP data revealed. On year-to-year basis,

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.