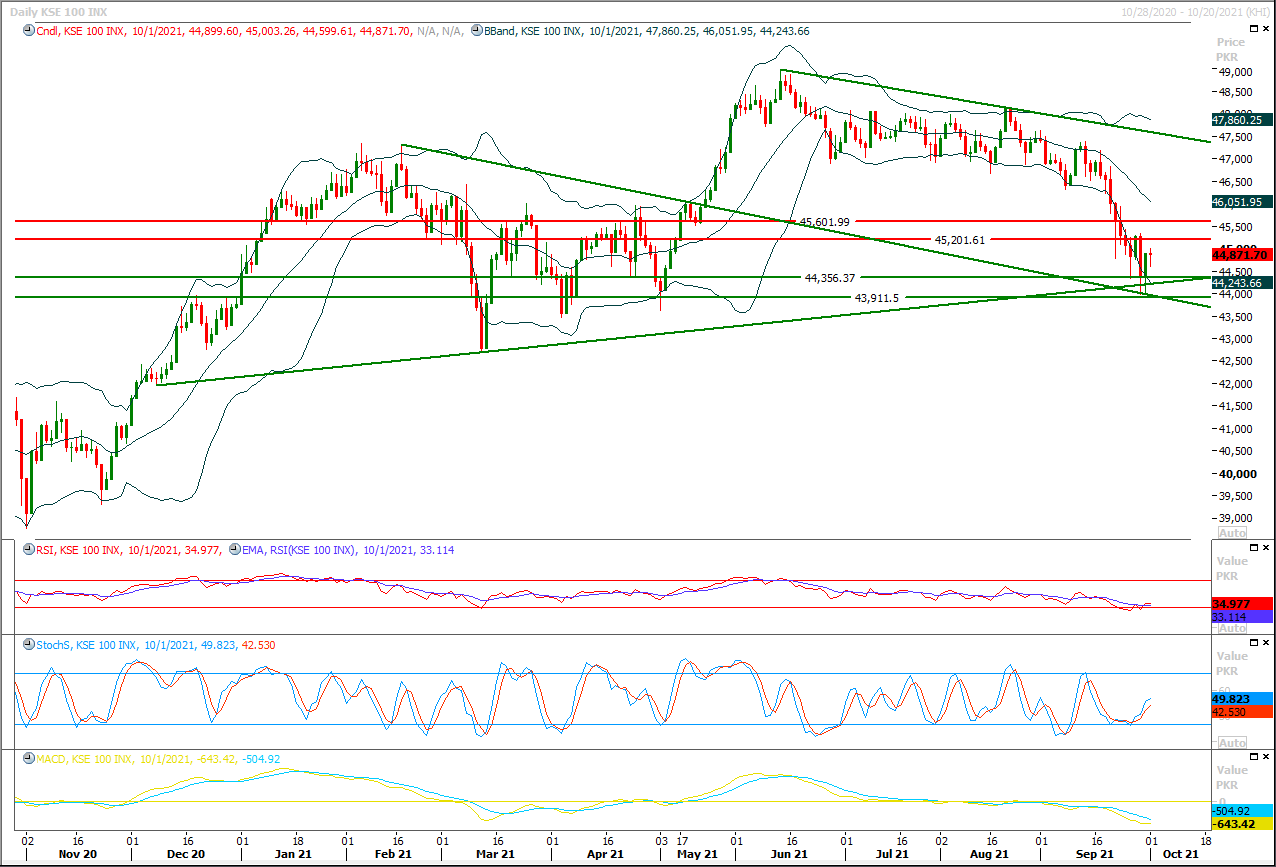

The Benchmark KSE100 index had started recovery after posting a double bottom on daily chart and now it's trying to penetrate above resistant trend line of its descending wedge on hourly chart. As of now it's expected that index would try to continue its pull back towards bullish direction after an intraday dip therefore buying on dip could be beneficial for day trading. Initially index seems to target 45,000pts and 45,200pts while breakout above this region would call for 45,350pts. Currently hourly momentum indicators are ready for a bearish crossover therefore it's expected that index may take a dip before continuing its bullish journey therefore it's recommended to adopt buying on dip strategy with strict stop loss. For current trading session index would try to establish ground between 44,650pts to 44,500pts where it's being supported by a strong horizontal supportive region, but breakout below this region would change sentiment and index would start facing some serious selling pressure therefore it's recommended to stay cautious in this region and post strict stop loss on long positions. On short term basis index may show some volatility during this week and chances for a weekly morning shooting star are open after occurrence of a hammer on weekly chart.

Regional Markets

Asian shares slip as Evergrande, inflation worries sap positive mood

Asian shares dipped on Monday as concerns about China's property sector and inflation worries offset upbeat U.S. data and positive news on new drugs to fight the coronavirus.Trading in shares of debt-laden China Evergrande (3333.HK) was suspended after it missed a key interest payment on its offshore debt obligation for the second time last week."The biggest problem is not a default by Evergrande but the environment that has led to its downfall. Authorities are regulating housing loans and lending to property firms. Markets are looking for a next Evergrande already," said Kazutaka Kubo, senior economist at Okasan Securities."There is rising risk Evergrande's woes will spread to the entire Chinese property sector."

Read More...

Business News

Oil prices buoyed by soaring gas rates ahead of OPEC+ meet

The sharp rise in wholesale gas prices is spilling over into the oil market, with looming demand for electricity generation and heating likely to further spur the sector this winter. The spike in demand and consumption could lead the OPEC+ alliance of oil exporters, which meets in Vienna on Monday, to scale up their production plans. “We could see an additional oil demand boost of nearly one million barrels per day (bpd) for December 2021, half of which we deem quite likely to materialise from incremental oil-for-power generation in Asia,” said Bjornar Tonhaugen, an analyst Rystad Energy. “The remaining half is more uncertain and hinges on a colder-than-normal start of winter in the Northern Hemisphere, which would drive oil for heating.”

Read More...

OGDCL injects 12 new wells in production gathering system

The Oil and Gas Development Company Limited (OGDCL) has injected 12 new wells, producing 584,808 barrels (BBL) crude oil and 12,092 million cubic feet (MMCF) gas, in its production gathering system during the last fiscal year.“The injected wells include Mela-7, Pasakhi-11, Pasakhi Deep-6, Pasakhi West Deep-2, Saand-1 & 2, TAY South West-1, Umair-1, Mangrio-1, Togh Bala-1, Nashpa-10 and Qadirpur-62 which cumulatively yielded gross crude oil and gas production of 584,808 barrels and 12,092 MMCF respectively,” the company said in its financial report for the year 2020-21.

Read More...

No let-up in dubious transactions in real estate sector

Even though improvements have been introduced in reporting requirements for real estate sector through the Designated Non-Financial Business and Professions (DNFBPs) initiative, a lot of transactions in the sector still take place in the grey area, which may pose serious challenges to the system.“There are many housing societies and market players who are trading open files worth Rs1 million to Rs10m through open certificates and affidavits in the open market and remain totally outside the regulated regime,” said a senior government official.

Read More...

FBR announces no extension in deadline for returns filing

The Federal Board of Revenue (FBR) on Sunday asked for no further extension in deadline for returns filing beyond October 15, 2021.Unlike in the past, Federal Board of Revenue uploaded forms for filing of Income Tax Returns for TY 2021 on July 01, 2021 and thus afforded taxpayers the statutory period of 90 days to file their tax returns by September 30, 2021, said a press release issued by FBR. On numerous occasions, FBR reiterated its principled stance that it would not extend this period beyond the given deadline i.e. September 30.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.