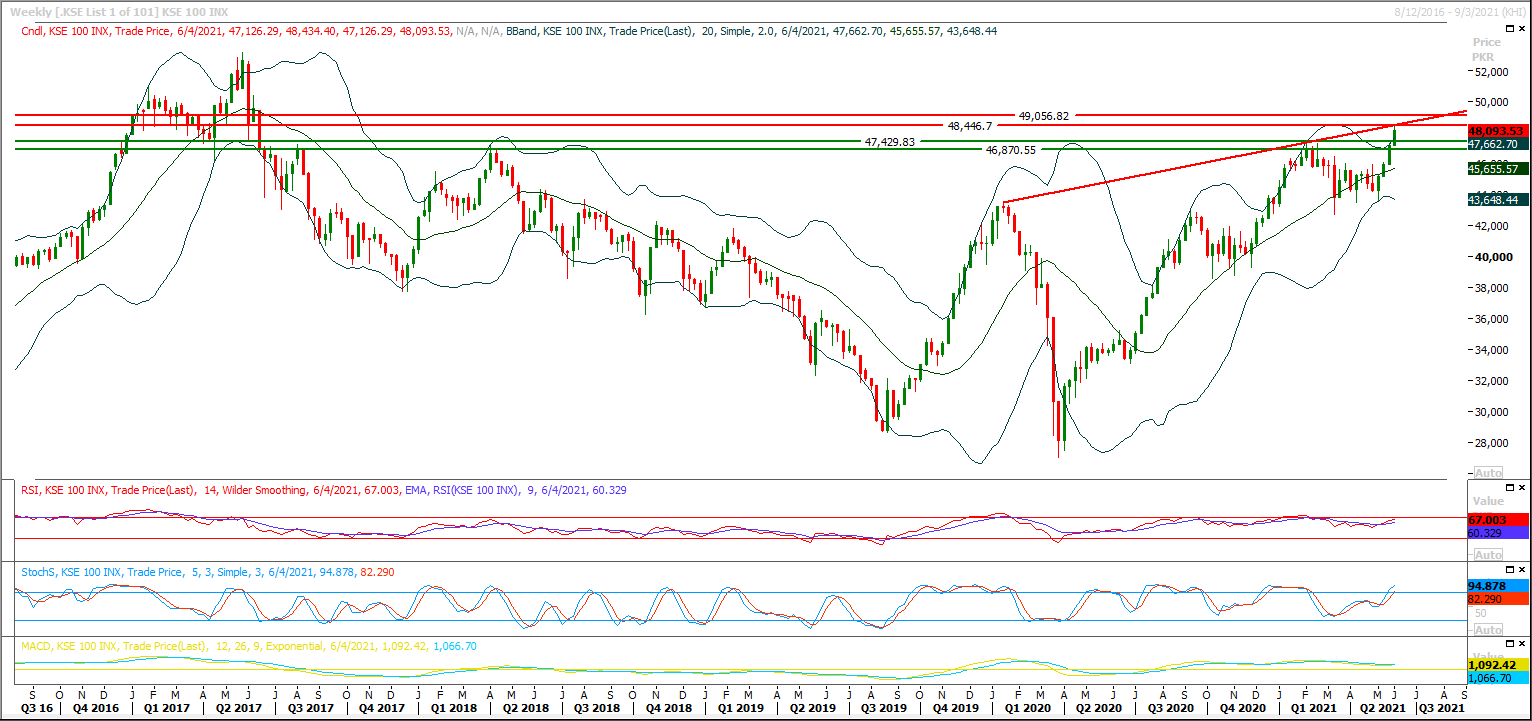

Technical Overview

The Benchmark KSE100 index had faced rejection from crossover of a resistant trend line and horizontal resistant region during last trading session. As of now it's expected that index would face major resistance again from same region and it would try to create a daily double top below this region. It's expected that index would try to retest its resistant region during current trading session as well. Meanwhile index have given bullish breakout of its ascending wedge on hourly chart therefore now it would try to establish ground above resistant trend line of that wedge and a bullish pull back would be witnessed after a dip if index would succeed in maintaining above this line. For current trading session it's recommended to cautious and post trailing stop loss on existing long positions as index seems to target 48,400pts for retesting purpose and if it would succeed in closing above this region then it would extend its gains in coming days towards 48,760pts. While on flip side in case of rejection from its resistant regions push index towards a slight correction but overall sentiment would remain bullish until index is trading above 47,200pts. Hourly momentum indicators have changed their direction towards bearish side and these would try to push index for an intraday correction but this correction could be an opportunity to initiate new positions for short term trading with strict stop loss of 47,400pts.

Regional Markets

Asia tracks Wall St lower as U.S. inflation bets perk up

Asian stocks followed Wall Street lower on Friday as signs of a strengthening U.S. recovery boosted bets for higher inflation and an earlier tapering of Federal Reserve stimulus.U.S. Treasury yields jumped, lifting the dollar and hurting tech shares, after better-than-expected employment data overnight raised expectations for a strong reading for nonfarm payrolls on Friday, while a measure of service sector activity climbed to a record high.Japan's Nikkei fell 0.8% early in the Asian session, while MSCI's broadest index of Asia-Pacific shares outside Japan was off 0.3%.Chinese blue chips slipped about 0.1% at the open.

Read More...

Business News

Shell Energy Pakistan receives gas marketing licence

style="text-align: justify;">The Oil & Gas Regulatory Authority has awarded a ‘gas-marketing licence’ to Shell Energy Pakistan Limited. Shell Energy Pakistan Limited has been incorporated with the aim of carrying out downstream gas marketing activities in Pakistan. It aims to aggregate demand from customers and secure competitive international supply to meet such demand. After evaluating its credentials, Ogra has granted rights to Shell Energy Pakistan to market gas to interested customers. Third-party access to gas import and distribution infrastructure is necessary for creating a competitive and developed gas market.For Shell Energy Pakistan to bring competitive and reliable LNG into the country and re-gasify to help meet growing demand in Pakistan, it needs support of the Government and other industry stakeholders in particular Port Qasim Authority, Sui Northern Gas Pipelines Limited and Sui Southern Gas Company for access to infrastructure.Read More...

KE requests Nepra to allow transfer of Rs7.174b’s burden to power consumers

K-Electric has requested Nepra to allow transfer of the burden of Rs 7.174 billion to power consumers under monthly fuel charges adjustments and Re 0.36 per unit increase under the 3rd quarter adjustments.However, for the month of April the KE has requested Nepra to allow it to return Rs 1.606 billion or Re 0.869 per unit to the power consumers of Karachi under monthly FCA for April.In its petition filed by the KE regarding monthly FCA adjustment for period of January 2021 to April 2021 and quarterly adjustment for the quarter ending in March 2021 under Multi Year Tariff (MYT) 2017-2023.KE petition for monthly Fuel Charges Adjustments of its own generation and Power Purchases for the period from January to April 2021.

Read More...

No FBR notices after July 1, Tarin assures businesses

Finance and Revenue Minister Shaukat Tarin has assured businessmen that no notices will be issued by the Federal Board of Revenue (FBR) from July 1 as the taxpayers will be able to carry out self-assessment whereas only 4 to 5 per cent of the cases will be sent for audit which will not be done by FBR but by the third party.“I want to remove harassment by FBR. Although there are good people at FBR but there are also some troublemakers. Hence, we have agreed upon Universal Tax Self-Assessment and the audits by third party only,” he added while speaking at an online meeting with BMG leadership and office-bearers of the Karachi Chamber of Commerce and Industry (KCCI) on Thursday.

Read More...

Economic recovery more visible: SBP

The economic recovery is becoming more visible exceeding the previous forecast to reach 3 per cent GDP growth rate with 7-9pc inflation and better prospects for wheat output, State Bank’s Second Quarterly Report said on Thursday.The report covers the first half of the ongoing fiscal year (FY21) and does not touch upon the latest development on the economic growth rate — now estimated at 3.94pc — with the SBP fully backing the figure announced by the National Accounts Committee on May 22.“This revision (about economic growth rate) mainly incorporates the continuation of recent trends in economic activities, including manufacturing.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.