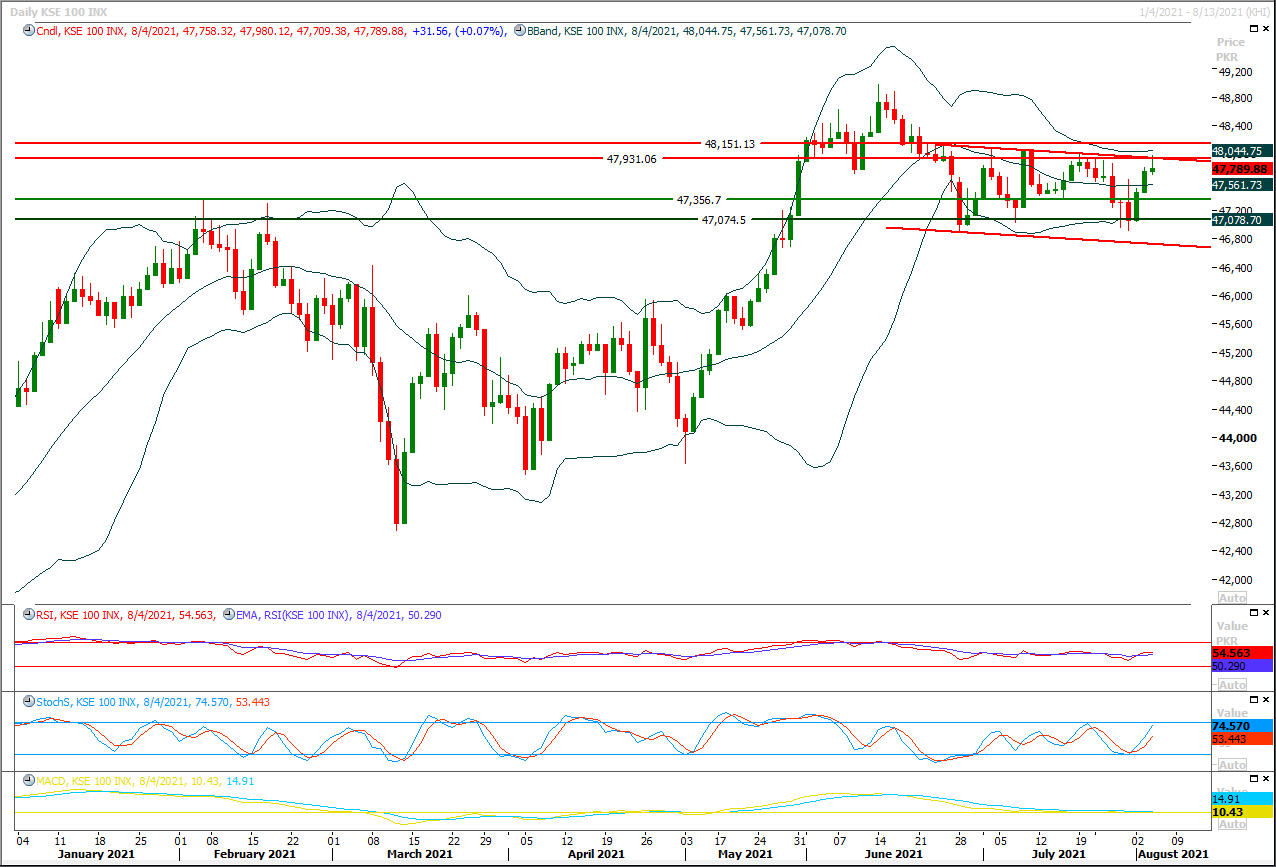

The Benchmark KSE100 had faced rejection from a horizontal resistant region along with resistant trend line of its bearish price channel on hourly chart during last trading session and a hammer formation was created on daily chart. As of now it's recommended to stay cautious because if index would not succeed in maintaining its bullish sentiment then there are chances of occurrence of an evening shooting star on daily chart. Currently hourly momentum indicators have changed their direction towards bearish side which indicates that index may face some serious selling pressure on intraday basis which may push index towards 47,500pts initially and breakout below this region would call for 47,380pts. While on flip side index would face initial resistance at 47,930pts where its being capped by two strong resistant objects and breakout above this region would call for 48,065pts and 48,150pts. For current trading session it's recommended to adopt selling on strength strategy.

Regional Markets

First Broadway play opens in NY since lengthy pandemic shutdown

The first Broadway play since the coronavirus pandemic shut down theaters in New York City in 2020 opened on Wednesday, with vaccinations and masks required for audiences."Pass Over," a modern twist on "Waiting for Godot," was sold out for its first preview at the August Wilson Theatre in Manhattan.The play, by Antoinette Chinonye Nwandu, is the tale of two young Black men who stand for hours at a street corner praying that a miracle will come their way.

Read More...

Business News

Adequate fuel stocks available: Ogra

Spokesman of the Oil and Gas Regulatory Authority (OGRA) said on Wednesday that the country had sufficient reserves of petroleum products to meet consumers’ day-to-day needs.“The current stocks in the country are adequate for our consumption and vessels carrying supplies have already reached Pakistan and are in the process of unloading,” spokesman Imran Ghaznavi said in a press statement.He made it clear that the fuel supply chain was fully intact and the consumers were getting petroleum products uninterruptedly.

Read More...

PM to launch Kamyab Pakistan Programme on 9th

The government is all set to announce Kamyab Pakistan Programme on August 9 for extending micro-loans to entrepreneurs, small businesses and farmers at 0% markup without collateral.Federal Minister for Finance and Revenue Shaukat Tarin on Wednesday chaired a consultative meeting on Kamyab Pakistan Programme. SAPM on Youth Affairs Usman Dar and senior officials of the ministry of finance also attended the meeting.It was decided in the meeting that Prime Minister Imran Khan would launch the programme on August 9. Finance Minister said that government has decided to accelerate the pace of projects of public welfare in the country.

Read More...

World Bank delegation meets Hammad Azhar

A World Bank delegation, led by Vice President for South Asia, Hartwig Schfer, called on Federal Minister for Energy, Muhammad Hammad Azhar here on Wednesday.Special Assistant to the Prime Minister on Power and Petroleum, Tabish Gauhar, secretaries of Power and Petroleum Divisions, Pakistan Executive Director at World Bank, Naveed Kamran Baloch, Country Director Pakistan, Najy Benhssine and other senior officials attended the meeting.During the meeting, the matters related to World Bank funded ongoing projects in the energy sector were discussed.

Read More...

Rs5000/40kg cotton intervention price to increase production, stabilise rates

The government has set cotton intervention price at Rs 5000 per 40kg for cotton crop 2021-22 claiming it would increase its production and stabilise the prices in the country.In its last meeting the federal cabinet had accorded approval for cotton intervention price and fixed seed cotton price at Rs5, 000 per 40 kg, Federal Minister for National Food Security and Research Syed Fakhar Imam said while addressing a press conference here.“If prices fall below Rs 5000/40kg of seed cotton then the intervention policy will be activated” Syed Fakhar Imam said. He said that the procurement price will be set as 90 per cent of the Import Parity Price (IPP).

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.