Technical Overview

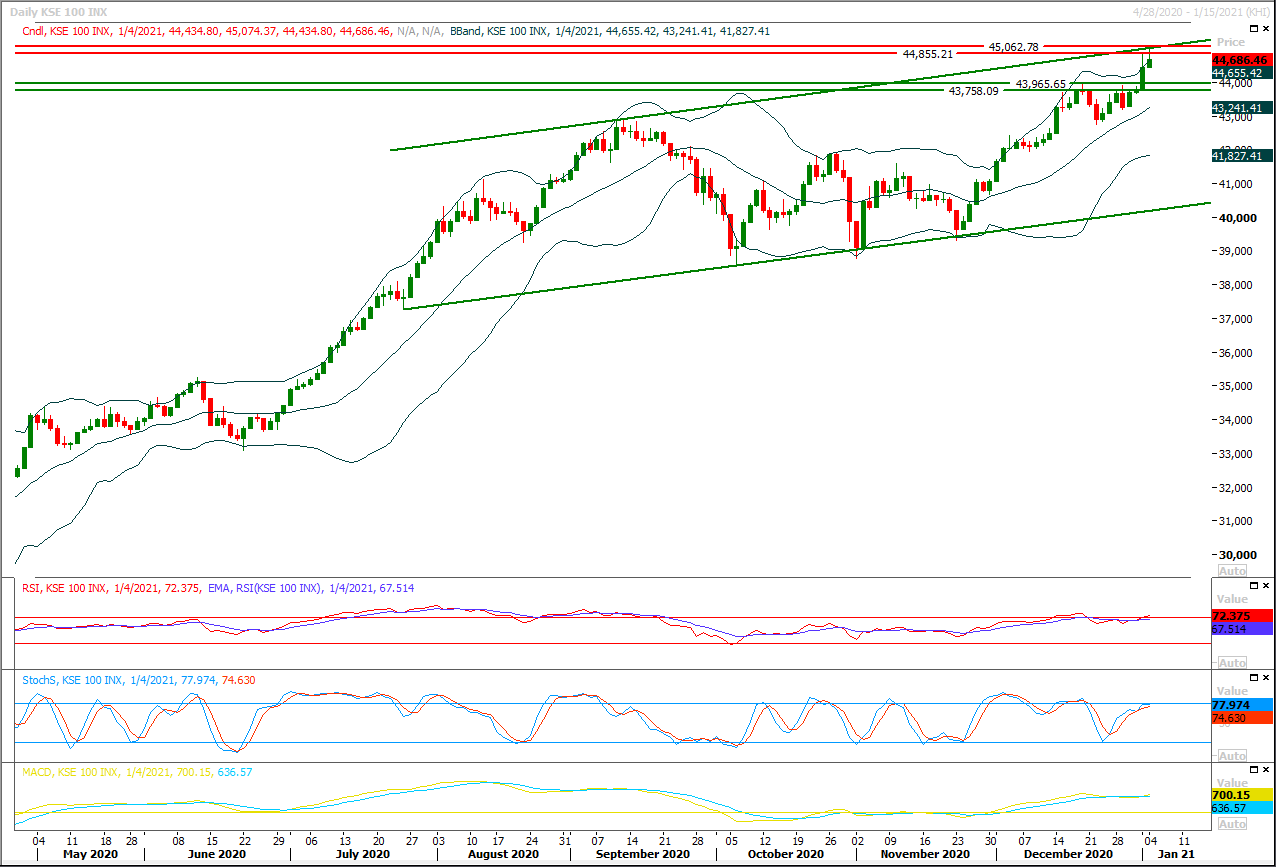

The Benchmark KSE100 index had faced rejection from resistant trend line of its bullish price channel during last two trading sessions therefore it's recommended to stay cautious and post trailing stop loss on existing long positions, while for day trading it's recommended to start selling on strength for current trading session. It's expected that index would face some serious pressure during current trading session and would start sliding downward. Initially it's expected that index would move downward towards 44,000pts-43,900pts where it would try to establish ground above a strong horizontal supportive region and breakout below that region would call for 43,550pts in coming days if index would succeed in closing below 43,950pts on daily chart. Meanwhile in case of bearish pressure doors would open for a daily evening shooting if index would succeed in sliding below 44,000pts during current trading session. While on flip side index would face strong resistance between 44,850pts-45,000pts where it's being capped by resistant trend line of its bullish price channel along with a strong horizontal resistant region. On short term basis index would be considered bullish until it would not succeed in closing below 42,500pts. Meanwhile hourly momentum indicators have entered into strongly bearish zone after MACD divergence therefore it's expected that selling on strength could be beneficial. International oil prices have face pressure during last trading session and it's expected that index would face pressure from its E&P sector participants.

Regional Markets

Asian stocks fall amid concern about Georgia Senate vote

Asian shares fell on Tuesday amid uncertainty about Senate runoffs in Georgia, which could have a big impact on incoming U.S. President Joe Biden’s economic policies.MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.34%, pulling back from a record high hit in the previous session. Australian stocks fell 0.44%. Chinese shares erased early losses and rose 0.26%. Japanese shares lost 0.25% after a media report that the government will curb business hours in Tokyo and surrounding cities from Thursday. U.S. S&P 500 stock futures edged up 0.24%. Oil futures rose slightly in cautious trade as investors awaited a meeting later on Tuesday where major crude producers are set to assess output levels for February.

Read More...

Business News

Coca-Cola to establish 17 drinking water filtration plants

Coca-Cola Pakistan is partnering with Cantonment Board Clifton, Rotary International and 2 other organizations to establish 17 water filtration plants to provide clean drinking water for disadvantaged communities in various parts of Karachi. This project under the CSR leg of Coca-Cola’s recent Karachi is Love campaign has a budget of Rs. 26.78 million. All the plants together will provide safe drinking water to over 383,000 people of low-income communities living in areas like Akhtar Colony, Hazara Colony, Machhar Colony, Lassi Goth, Khadim Solangi Goth and Aatma Colony. One filtration plant will also be established at the Karwan e Hayyat Psychiatric Care and Rehabilitation Center to provide 4000 gallons per day water for the Center’s 100 beds hospital for in-house psychiatric patients.

Read More...

Minister asks opposition parties for proof of their foreign funding

Minister for Information and Broadcasting Shibli Faraz has said that opposition parties instead of holding a sit-in in front of the Election Commission of Pakistan should better submit documentary proof of their foreign funding in order to avoid cancellation of their registration. Talking to reporters on Monday, he said the Pakistan Muslim-League-Nawaz (PML-N), Pakistan Peoples Party (PPP) and Jamiat Ulema-i-Islam-Fazl (JUI-F) did not heed to repeated directives of the ECP scrutiny committee to submit documentary proof in the foreign funding cases filed by the Pakistan Tehreek-i-Insaf, which might result in forfeiture of the funds received from abroad, besides cancellation of their election symbols.

Read More...

Inflation decelerates for third consecutive month in December

The National Price Monitoring Committee (NPMC) on Monday has expressed satisfaction over the decline in the inflation rate, which has dropped to 8 per cent in December. Federal Minister for Finance & Revenue, Dr Abdul Hafeez Sheikh, chaired the meeting of the NPMC. Inflation has eased to 8 per cent in December on the back of a slight decline in the price of perishable products. The deceleration in inflation was noticed for the third consecutive month in December. The National Price Monitoring Committee (NPMC) reviewed the price trend of essential commodities especially wheat, sugar and edible oil. Finance Secretary briefed about the decline in per cent the Consumer Price Index recorded at 8 per cent in December 2020 as compared to 12.6 per cent in December 2019 as a positive outcome of vigilant monitoring under NPMC on regular basis.

Read More...

Cement dispatches grow by 15.66pc in first half of current FY

-Cement sector posted a growth of 11.18 per cent in December 2020 as compared to December 2019. Total cement dispatches during December 2020 were 4.788 million tonnes against 4.306 million tonnes despatched during the same month of last fiscal year. According to the data released by All Pakistan Cement Manufacturers Association (APCMA), local cement despatches in December increased to 4.154 million tonnes compared to 3.536 million tonnes in December 2019, depicting an increase of 17.47 per cent. However, the second consecutive drop was witnessed in cement exports. The exports dropped from 769,986 tonnes in December 2019 to 633,431 tonnes in December 2020.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.