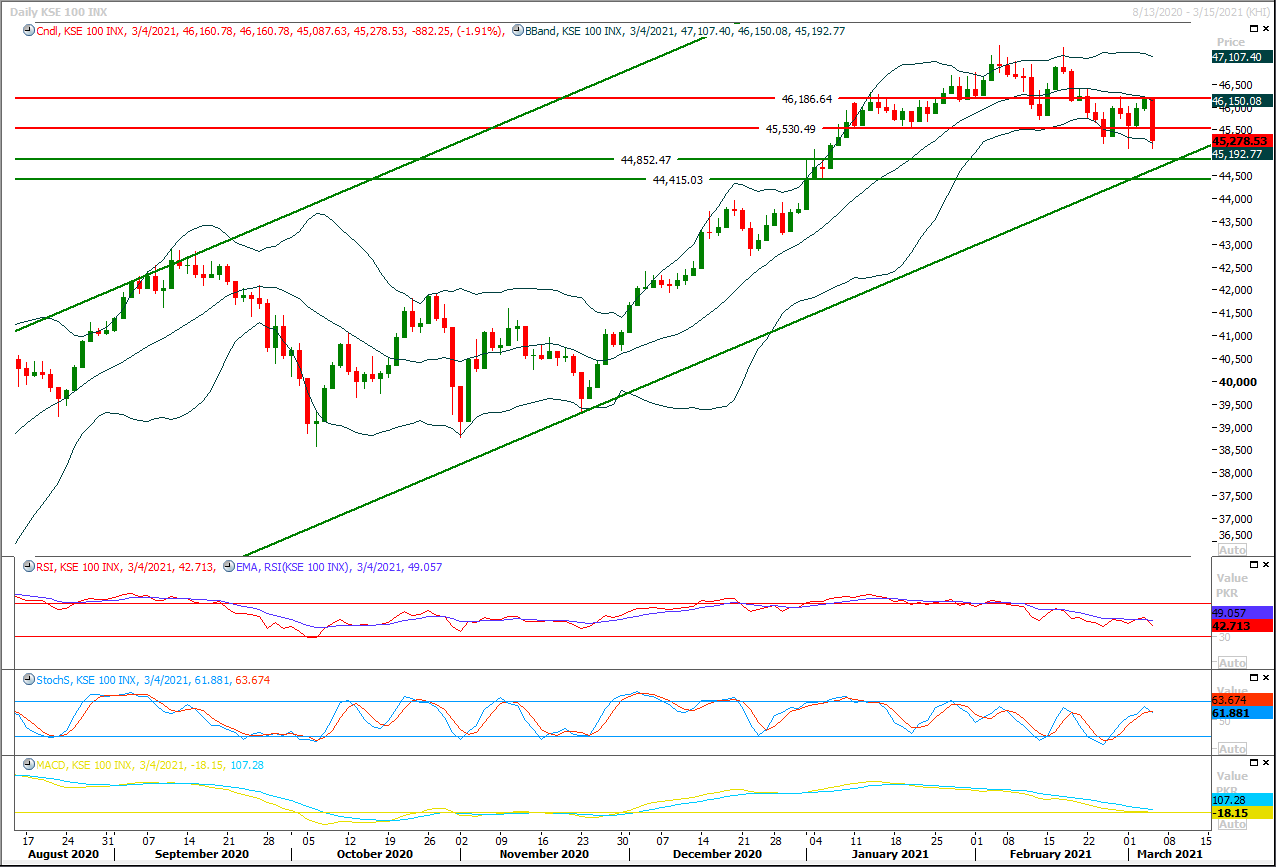

The Benchmark KSE100 index have moved downward aggressively during last trading session but most importantly it had completed its bearish correction on intraday basis which opened ways for more bearish move during current trading session because index is in expansion mode of its yesterday's 61.8% correction, meanwhile an evening shooting star have also been formatted on daily chart therefore it's expected that index would continue its bearish journey towards 44,800pts-44,700pts where it would try to establish ground above supportive trend line of its weekly bullish price channel but breakout of this region in downward direction would call for 44,500pts. Daily and hourly momentum indicators have entered in bearish zone and these would try to add pressure therefore it's recommended to stay on selling side. While on flip side in case of bullish pullback index would face initial resistance at 45,500pts which would be followed by 45,700pts and 45,900pts where index would face resistances from strong horizontal resistant regions. For short term investment its recommended to stay cautious because today's closing below 44,500pts could push index for a deeper correction towards 43,500pts and 42,500pts because closing below 44,500pts would gave a bearish breakout of its bullish price channel on daily and weekly charts.

Regional Markets

Surging bond yields push Asian shares to one-month lows

Asian stocks skidded to one-month lows on Friday as rising U.S. Treasury yields again rattled equity investors while hoisting the dollar to a three-month high, which in turn dragged the Japanese yen. Energy markets were not spared the volatility either, with oil prices adding to big gains overnight after the Organization of Petroleum Exporting Countries (OPEC) and its allies agreed to mostly maintain their supply cuts in April as they await a more solid recovery in demand from the coronavirus pandemic. Australian stocks shed more than 1%, Japan’s Nikkei share average dropped 1.6% and shares in Seoul fell 1.4%. Chinese shares were in the red with the bluechip CSI300 index off 1.5%. That sent MSCI’s broadest index of Asia-Pacific shares outside of Japan to 684.52, the lowest since Feb. 1. E-Mini S&P futures were 0.5% lower.

Read More...

Business News

Ministry of Industries prepares ‘Ramazan Package’ for Utility Stores

Ministry of Industries and Production has prepared ‘Ramazan Package’ for Utility Stores Corporation (USC) for providing basic food commodities at subsidised rates during the holy month. The ministry has estimated Rs6.37 billion for the Ramazan Package, which would be effective at USC outlets from the start of April after getting approval from the Economic Coordination Committee (ECC) of the Cabinet. Officials have informed The Nation that the government would provide subsidy of 10 to 50 per cent on 19 food items in the month of Ramazan. The government has decided to provide subsidy worth of Rs40 per kg on sugar at USC. The commodity price would remain at Rs68 per kg in the month of Ramazan. Meanwhile, it would also provide subsidy on wheat flour by keeping its price at Rs800 per bag. The government would keep ghee price at Rs200 per kg at USC by providing subsidy of Rs43 per kg.

Read More...

MPs strongly oppose imposition of additional surcharges on power consumers

Taking a tough stance on the government plan to impose additional surcharges on power consumers, the parliamentarians have clearly stated that the surcharges should not surpass 10pc of base tariff and should be utilised only for funding of the projects of strategic importance and not for paying off the future circular debt. Despite the request from secretaries Finance and Petroleum division to pass the bill, the NA committee on power once again deferred “The regulation of Generation, Transmission and Distribution of Electric Power (Amendment) Bill, 2020”. The committee was informed that circular debt mitigation plan will be presented to the federal cabinet within next two weeks.

Read More...

Pakistan tops in providing low-priced petroleum products among regional countries

Despite financial constraints and substantial increase in the prices of petroleum products at the international market, the Pakistan Tehreek-i-Insaf (PTI) government has not passed on its impact to the common man by maintaining the rates at lowest level as compared to regional countries. Pakistan is standing atop in providing the low-priced petroleum products for the welfare of its masses among regional countries, and on the 18th position in a list of 167 countries of the world, according to an official document available with APP. The present petroleum rates in Pakistan are lowest in comparison to the regional countries including Sri Lanka, Nepal, Bangladesh and India where per liter price of petrol varies from $0.83 to $1.26, while the commodity in Pakistan is available at $0.70 per liter.

Read More...

FBR, PITB take step to promote ease of doing business, facilitate taxpayers

Federal Board of Revenue (FBR) and the Punjab Information Technology Board (PITB) have taken a significant step to promote ease of doing business and facilitate taxpayers by launching a one-window facility for registration of Sole Proprietor (Individual)/Association of Persons (AOP) in the government of Punjab’s Business Portal and FBR. This facility enables applicants to be registered with Punjab Business Portal and FBR in one go without visiting FBR’s field offices or its website. As a first step applicants will apply for registration on PITB’s Business Registration Portal (BRP) (https://business.punjab.gov.pk/). As soon as an applicant is registered in BRP, the system will cross-verify registration profile in FBR’s database. If applicant is not registered with FBR, the system shall automatically register the applicant and send confirmation email and SMS to the applicant.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.