Technical Overview

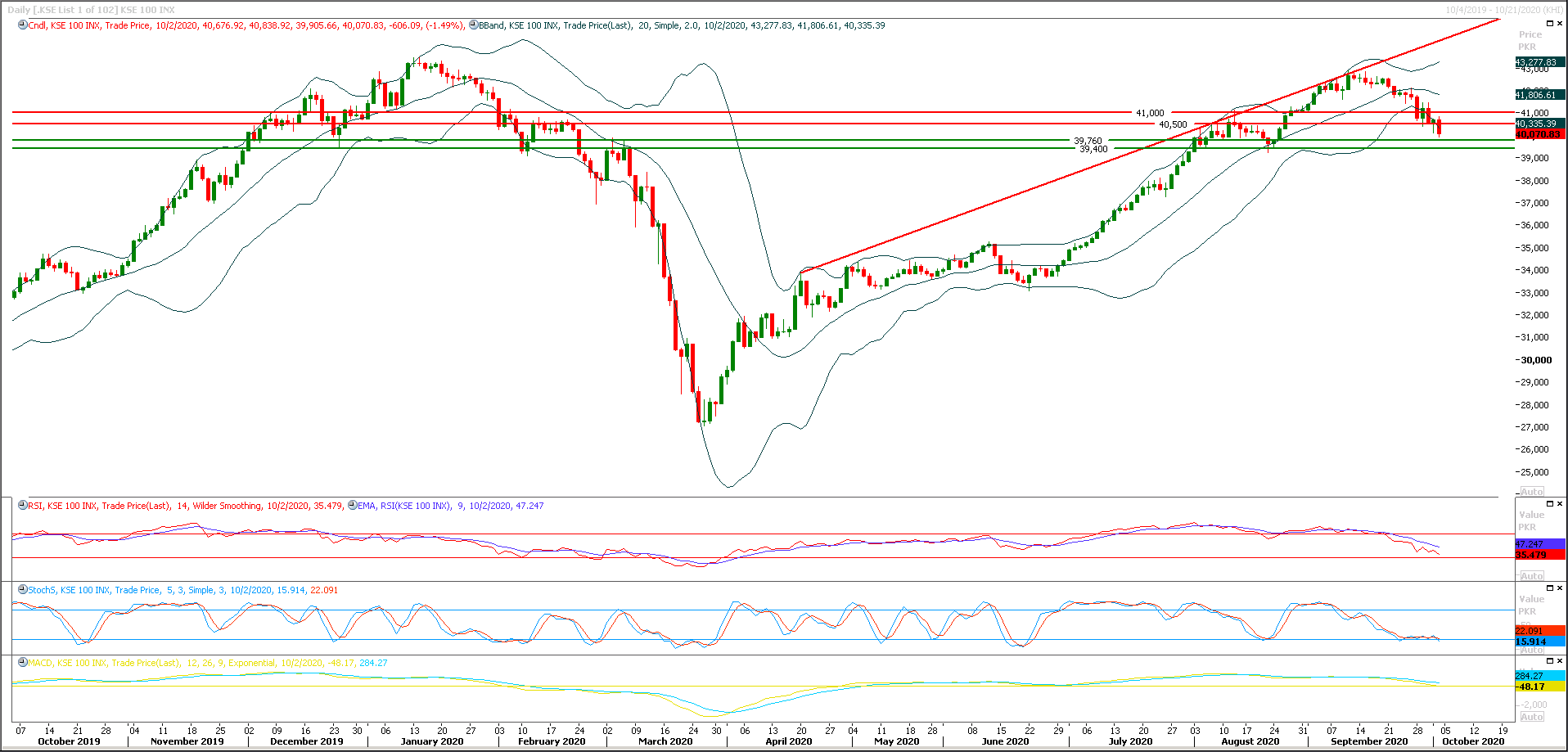

The Benchmark KSE100 index have continued its bearish rally below its major supportive region of 41,500pts during last week to continue evening shooting star of its last week. As of now it's expected that index would try to find ground between 39,700pts to 39,500pts where two consecutive supportive regions would try to push index back in bullish zone. For current trading session buying on dip with strict stop loss of 39,500pts could be beneficial but it's recommended to adopt cut and reverse strategy if index gave a breakout of 39,400pts on daily closing basis. While on flip side in case of bullish spike index would face initial resistance at 40,500pts which would be followed by 40,900pts and 41,000pts. Daily momentum indicators are strong bearish and these would try to push index beyond its supportive regions to complete its short term correction.

Regional Markets

Global stocks rise as signs of Trump's improving health calm markets

Stock markets rose on Monday on hopes that President Donald Trump could be discharged from hospital later in the day, easing some of the political uncertainty that shook global bourses in the previous session.That helped U.S. S&P 500 e-mini futures rise 0.82% in Asian trading, while Nasdaq futures gained 1.11%. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.63%. Australian stocks jumped 2.37% for the biggest daily gain in almost two weeks. Japan’s Nikkei rose 1.39%. China’s financial markets are closed for a public holiday. “Equities and other risk-on traders should be well supported by easing concerns about Trump’s health,” said Junichi Ishikawa, senior currency strategist at IG Securities in Tokyo.

Read More...

Business News

FATF to decide about Pakistan status this month

A virtual meeting of the Financial Action Task Force (FATF) plenary scheduled for Oct 21-23 will decide if Pakistan should be excluded from its ‘grey list’, based on a review of Islamabad’s performance to meet global commitments and standards on fight against money laundering and terror financing (ML&TF). The FATF plenary was earlier scheduled in June but Islamabad got an unexpected breather after the global watchdog against financial crimes temporarily postponed all mutual evaluations and follow-up deadlines in the wake of grave health risk following Covid-19 pandemic. The Paris-based agency also put a general pause in the review process, thus giving additional four months to Pakistan to meet the requirements.

Read More...

Cement sales peak in September on rising demand

Cement sales — local and exports — during September reached to their highest monthly figure of 5.213 million tonnes as against despatches of 4.273m tonnes in September 2019, latest data showed on Saturday. The local uptake increased by 17.65 per cent to 4.089m tonnes from 3.475m tonnes in September 2019 while exports went up by 41pc to 1.124m tonnes from 0.797m tonnes in the same month last year. Domestic cement despatches in the north region surged by 16.30pc to 3.523m tonnes during September from 3.029m tonnes in September 2019. Exports increased by 9.27pc to 0.287m tonnes in September from 0.263m tonnes in September 2019.

Read More...

LPG cost escalates due to massive marketing, transportation margin

Marketing/distribution and transportation margin on Liquefied Petroleum Gas (LPG) is respectively 1247 per cent and 760 per cent higher as compared to other petroleum products which increases the prices of the fuel of the poor (LPG) for the end consumers, reveal official documents. The price of the LPG paid by the end consumers consists only 50 per cent of the LPG procurement cost while the remaining is Marketing/Distribution margin, Petroleum Levy and General Sales Tax, official documents reveal. In October the price of one Metric Tonne (MT) of indigenous LPG was Rs62,915.78 (including Excise duty of Rs85 per MT), Marketing/Distribution Margin of Rs35,000 per MT, Petroleum Levy Rs4,669 per MT and GST Rs17,439.41 per MT.

Read More...

Oil exploration up in air as prices dive

The coronavirus pandemic that has slammed oil demand and prices is forcing energy majors to tighten their belts on exploration, even if finding new deposits remain essential to their existence. While the sector is increasingly diversifying into greener energies such as electricity and wind power, its core business remains oil and gas. “Questions abound over whether it is still profitable to look for oil given subdued demand growth prospects and a low-price environment,” Stephen Brennock, analyst at oil brokers PVM, told. “The answer seems not, judging by the recent spate of massive hydrocarbon asset write-down.”Set against this backdrop, I don’t expect a rebound in drilling in the medium-term. “Instead, oil majors will be forced to beef up their green energy portfolios in order to survive,” Brennock said.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.