Morning Market Brief 5th Oct. 2021

Technical Overview

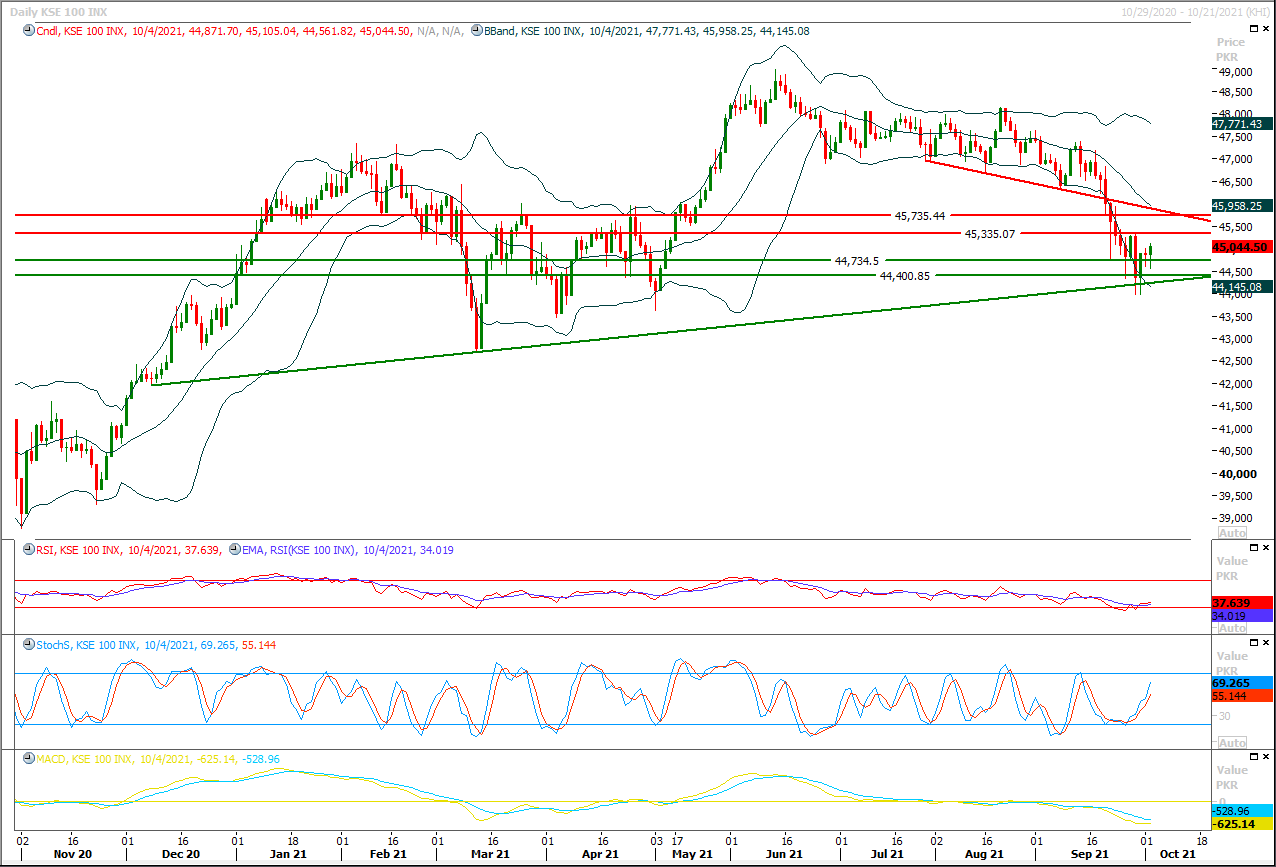

The Benchmark KSE100 index had continued its bullish journey during last trading session but a volatile session was witnessed and index moved in a zig zag way after breakout of its descending wedge in bullish direction. As of now it's expected that initially index would try to continue its bullish sentiment but later on it may face strong resistance between 45,200pts-45,350pts region therefore it's recommended to stay cautious and its recommended to post trailing stop loss on existing long positions, because if index would not succeed in closing above this region on hourly chart then it may face some session pressure which may lead it towards negative zone before day end. Hourly and daily momentum indicators are still in bullish mode and these would try to attract some fresh volumes from buying side but index have major resistant regions ahead therefore it needs some healthy volumes to close above 45,350pts. In case of rejection from its resistant regions index would start sliding downward and initially it would try to target 44,760pts where it would try to target establish ground above a horizontal supportive region but breakout below this region on intraday basis would change sentiment and bears would take control and they would lead index towards 44,500pts and 44,350pts in coming days. swing trading could be beneficial as long as index trading between 45,500pts and 44,350pts.

Regional Markets

Australia's trade surplus surprises with record high on commodity demand

Australia's trade surplus unexpectedly grew to a record in August as strength in liquefied natural gas and coal exports more than offset a pullback in iron ore prices, a windfall to mining profits and tax receipts.Figures from the Australian Bureau of Statistics out on Tuesday showed the surplus on international trade jumped to A$15.1 billion in August, from A$12.7 billion the month before. That was the highest on record and confounded analysts' forecasts of a drop to A$10.3 billion.

Read More...

Business News

Summit Bank to sell 51pc shares to UAE investor

The board of directors of Summit Bank has agreed to sell at least 51 per cent controlling interest to a UAE-based investor at Rs2.51 per share, a regulatory filing said on Monday.The smallest listed bank in terms of total assets will let Nasser Abdulla Hussain Lootah, who currently owns 0.51pc shares in the bank, subscribe to new ordinary shares by way of fresh equity injection.Post-subscription, the acquirer will purchase existing shares from minority shareholders through a public tender offer to bring its shareholding to at least 51pc and gain management control.

Read More...

SNGPL profit surges 55pc

Sui Northern Gas Pipelines Ltd (SNGPL) posted earnings of Rs8.9 billion in the first nine months of 2020-21, up 54.7 per cent from a year ago, according to a notice on the Pakistan Stock Exchange (PSX) on Monday.In addition to the simultaneous release of the financial results for October-December 2020 and January-March, the gas distribution company also announced an interim cash dividend of Rs2 per share. Its net profit was Rs2.7bn and Rs3bn for the two quarters, respectively.

Read More...

Cement sales dip almost 6pc in July-Sept

Overall cement sales — domestic and exports — fell 5.67pc to 12.825 million tonnes during the first quarter (July-September) of this fiscal year from 13.596m tonnes in the corresponding period last year.Amid booming construction activities, the domestic sales rose by four per cent to 11.279 million tonnes in 1QFY22 from 10.853m tonnes in the same period last fiscal year. However, exports posted a drop of 44pc to 1.546m tonnes from 2.743m tonnes.

Read More...

Trade gap widens by over 100pc in 1QFY22

The first quarter of the current fiscal year (1QFY22) posted a rise of more than 100 per cent in trade deficit driven largely by an almost triple increase in the country’s imports compared to exports, the Pakistan Bureau of Statistics (PBS) said on Monday.The merchandise trade deficit reached $11.664 billion in July-September 2021 from $5.814bn over the corresponding months of last year.The trade deficit poses a serious threat of causing pressure on the external side.

Read More...

Tags:

Mbrief

Mbrief Analysis

Mbrief Technical Analysis

Mbrief Price Forecast

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.