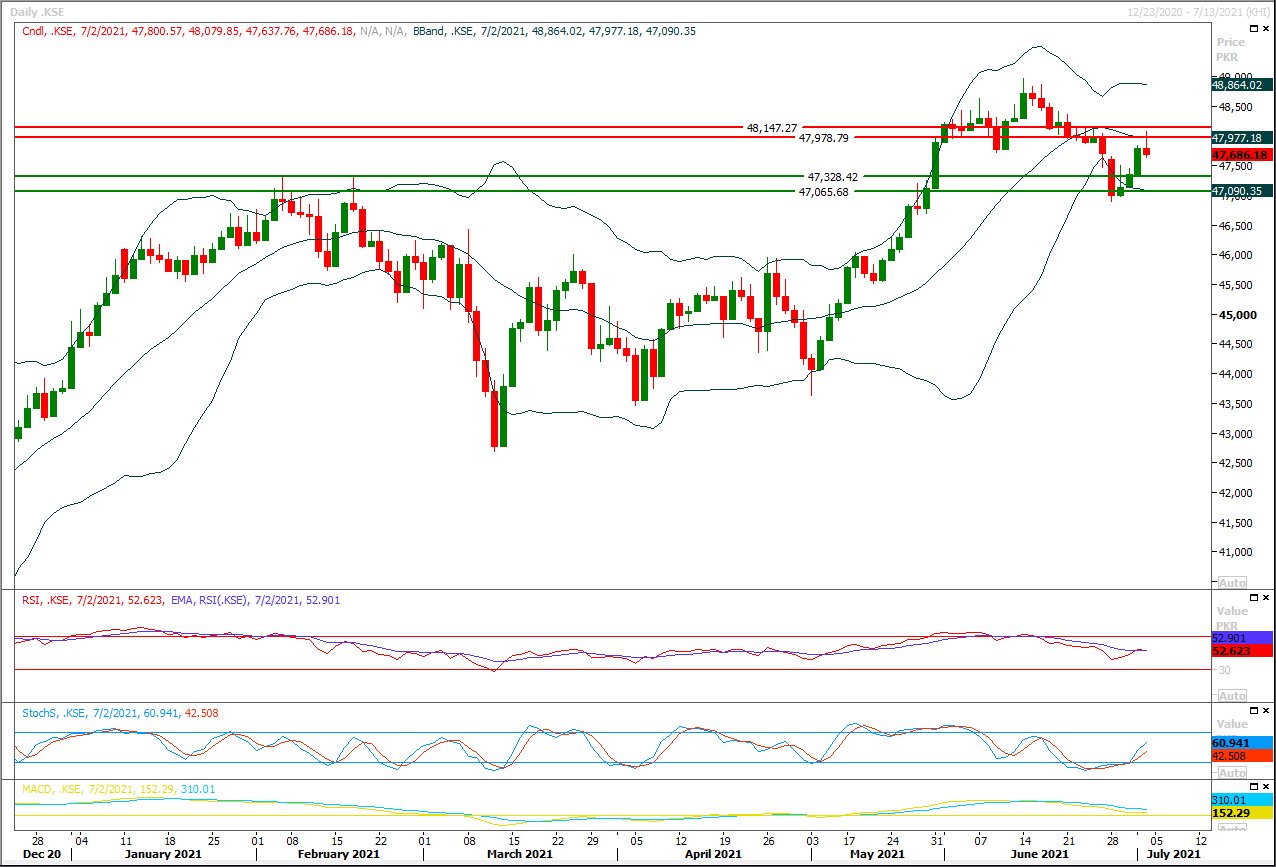

The Benchmark KSE100 index is in correction mode of its recent bullish rally after facing rejection from its major resistant region during last trading session and it can be said that index is taking correction of its correction on hourly chart. As of now it's expected that index initially would take a dip during current trading session and it would try to establish ground above 47,500ptsabove a strong horizontal supportive region and later on a pullback would be which may lead index towards its initial resistant region at 47,930pts. Overall a volatile session would be witnessed during current trading session because hourly momentum indicators are under pressure but daily momentum indicators are in further advance mode therefore it's recommended to stay cautious. A daily hammer formation have been formatted during last trading session and there are chances of an evening shooting star on daily chart if index would not succeed in maintaining above 47,500pts till day end today and this time sliding below 47,500pts would push index towards expansion of current pull back which may lead index towards 47,200pts and 46,900pts.

Regional Markets

Australia job advertisements rise 3% in June-ANZ

Australian job advertisements climbed for a 13th straight month in June to reach their highest since 2008 as the demand for labour remained strong despite a round of coronavirus lockdowns across the country.Monday's figures from Australia and New Zealand Banking Group showed total job ads climbed 3.0% in June from May, when they jumped 6.8%.At 211,854, ads were up 129% on a year earlier when the labour market was still recovering from a national pandemic lockdown which had shut many industries for a month.ANZ senior economist Catherine Birch said recent lockdowns in a range of states were a drag but any impact would likely be temporary.

Read More...

Business News

Govt to spent Rs14 billion on artificial insemination of livestock

Special Assistant to Prime Minister (SAPM) on Food Security Jamshed Iqbal Cheema has said that government would spent Rs14 billion on artificial insemination of livestock in order to replace the local animals’ breeds with high productivity supper breeds for enhancing domestic output of milk and meat. The initiative is being taken under Agriculture Transformation Plan for the uplift and development of livestock sector in the country to enhance local output of milk and meat for ensuring availability of pure, nutrient filled hygienic milk and meat to rural as well as urban population. Talking to APP, he said that livestock as an important sub-sector of local agriculture sector was contributing significantly in national GDP growth, besides it was a source of livelihood of a large bulge of rural population and source to fulfill their daily dietary requirements.

Read More...

SSGCL to allocate its own land for two new LNG terminals

he Sui Southern Gas Company Limited (SSGCL) has decided to allocate its own land for tie-in points of two new LNG terminals as Pakistan Steel Mills (PSM) was asking the lease rate which was 23 times higher than the Sindh government rate, it is reliably learnt here.Sui Southern Gas Pipeline Limited will provide its own land for the construction of two new LNG terminals as PSM is asking for Rs 35 million per acre for the lease of land, which is 23 times higher than the Sindh government lease rate of Rs 1.5 million per acre for 99 years, official sources told The Nation.To further expand the country’s LNG market Ogra had granted Licences to Tabeer and Energas to undertake regulated activity related to the sale of re-gasified liquefied natural gas (RLNG). However.

Read More...

Petroleum Div to execute six new projects of Rs1775.85m in FY 2021-22

The Petroleum Division (PD) would execute six new projects at a cost of Rs1,775.857 million during the current fiscal year to achieve self-sufficiency in the energy sector. The government has allocated Rs40 million in the Public Sector Development Programmes (PSDP 2021-22) for a new project, under which development of Strategic Underground Gas Storage (SUGS), hiring of consultancy services for bankable feasibility study and transaction advisory services (PC-II) would be carried out, according to an official document. Similarly, funds amounting to Rs30 million have been specified for Legal Consultancy Services for drafting of Model Mineral Agreement and updating of Regulatory Framework (Federal and Provincial Minerals/Coal Departments) prepared by Mineral Wing.

Read More...

NAB cell to counter terror financing, money laundering

The National Accountability Bureau (NAB) has established the Anti-Money Laundering and Combating the Financing of Terrorism (AML&CFT) cell to check financial crimes and illegal transfer of resources.However, the main responsibility to investigate terror financing cases will still lie with the Federal Investigation Agency (FIA).A senior official of the anti-graft watchdog told Dawn that the AML&CFT cell would coordinate with the Financial Action Task Force (FATF) Secretariat and stakeholders concerned to curb money laundering and terror financing.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.