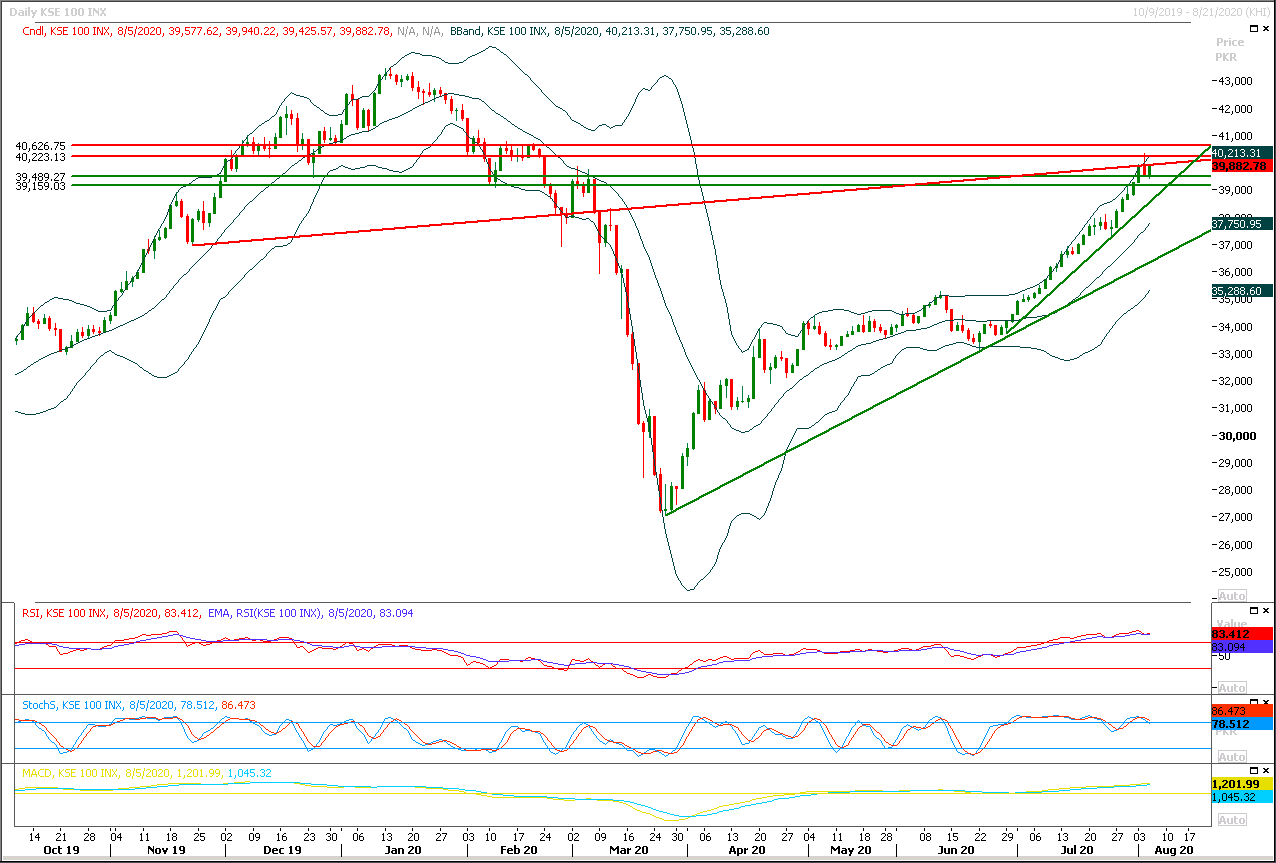

Technical Overview

The Benchmark KSE100 index have bounced back after getting support from a horizontal supportive region during last trading session and have formatted a bullish engulfing pattern on daily chart during last trading session which is indication of a further advance sentiment, but it's recommended to stay cautious until index succeeds in closing above its previous high of 40,330pts which falls on a strong resistant region because on hourly chart index still have recovered only 61.8% of its last bearish rally of this week. It's recommended to adopt swing trading with strict stop loss on both side because if index would not succeed in closing above 40,330pts then some kind of serious pressure would be witnessed while breakout above this region would call for 40,500pts and 40,700pts regions. Mean while on flip side index have supportive regions standing at 39,500pts and 39,200pts.

Regional Markets

Dollar wallows and stocks inch higher as stimulus eyed

The dollar languished and just about everything else rose on Thursday, as markets took patchy U.S. economic data as a harbinger of ever more stimulus and brinkmanship on Capitol Hill as a sign that a deal on a new U.S. stimulus package is close. Following Wall Street’s lead, MSCI’s broadest index of Asia-Pacific shares outside Japan extended the week’s rally by 0.3% to a fresh six-and-a-half-month high. Japan’s Nikkei index was steady and Asian currencies were on the march, with the Australian dollar gaining to around 72 U.S. cents, and the Korean won and Malaysian ringgit touching their strongest since March. S&P 500 futures firmed, oil rose and gold inched back toward a record high hit overnight.

Read More...

Business News

External account position remains stable in FY2020

Despite challenging global environment, the country’s external account position remained stable during the fiscal year 2020. The current account deficit continued to narrow, even though both exports and imports have fallen sharply since the coronavirus outbreak, official document revealed. During FY2020, current account deficit was reduced by 77.9 per cent to $ 2.9 billion (1.1 per cent of GDP) against $ 13.4 billion last year (4.8 per cent of GDP). The exports from the country declined by 7.2 per cent to $22.5 billion during FY2020 compared to exports of $ 24.3 billion last year, it said adding that the exports values were suppressed due to weak terms of trade, despite significantly higher quantum exports.

Read More...

UFG losses of SSGCL, SNGPL costing more than Rs50 billion to end consumers

Irked by the increased UFG losses, of up to 16 per cent, by the Sui companies the federal government has asked both Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Company limited (SNGPL) to link the promotions with the losses. The current unaccounted for gas (UFG) losses of both the SSGCL and SNGPL is causing a loss of more than Rs50 billion to the end consumers, it is learnt reliably here Wednesday. The unaccounted for gas (UFG) losses in SSGCL is roaming around 15.86 per cent while for the SNGPL it is around 10.20 per cent.

Read More...

Business Confidence Score in Pakistan stands at negative 50pc

Overall Business Confidence Score (BCS) in Pakistan stands at 50 percent negative, a further drop by 5 percent from the already 45 percent negative score in survey conducted in August 2019. Overseas Investors Chamber of Commerce and Industry (OICCI) shared the results of its Business Confidence Index (BCI) Survey – Wave 19. The latest BCI survey results reflect the continued pessimism across all sectors in general and particularly in the manufacturing and services sector. The business confidence of manufacturing sector, which represents about 42 percent of the respondents, declined by 5 percent over the past six months and was 48 percent negative compared to 43 percent negative in Wave 18.

Read More...

Former PM Abbasi indicted in PSO case

An accountability court on Wednesday indicted former prime minister Shahid Khaqan Abbasi, former petroleum secretary Arshad Mirza and two others in a reference about alleged illegal appointments to two key posts in the Pakistan State Oil (PSO). The National Accountability Bureau (NAB) had filed the reference in March against Mr Abbasi of the Pakistan Muslim League-Nawaz and Mr Mirza for allegedly misusing their authority in appointments of Sheikh Imranul Haq as managing director and Yaqoob Sattar as deputy managing director (finance) of the PSO in violation of rules and regulations for appointments of chief executive officers in public sector enterprises.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.