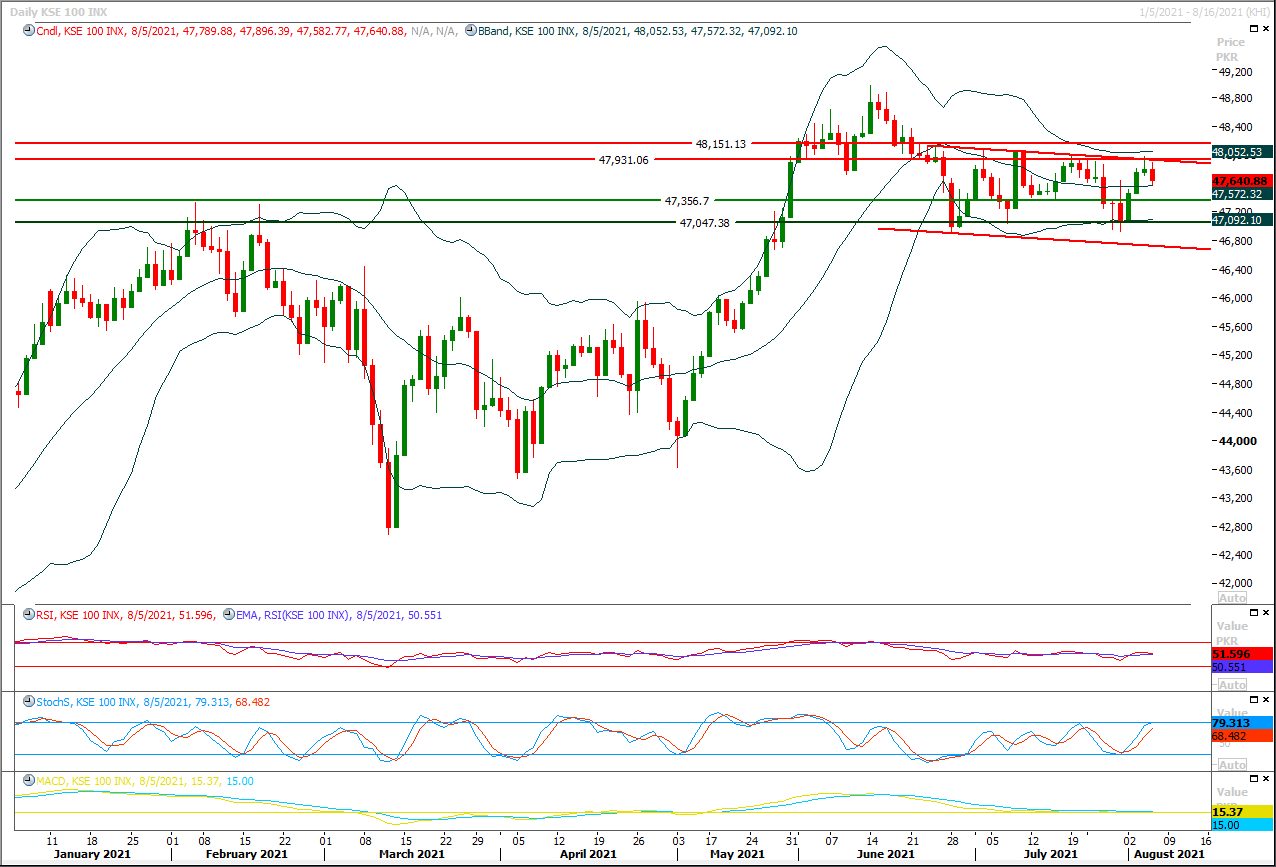

The Benchmark KSE100 index had faced rejection once again from resistant trend line of its bearish price channel during last trading session but it succeeded in avoiding an evening shooting star on daily chart. As of now it's recommended to stay cautious because index is still being capped by same resistant regions at 47,930pts and 48,065pts, meanwhile chance of a weekly bullish engulfing pattern are still open and if index would succeed in closing above 47,800pts then a weekly bullish engulfing pattern would take place but a two strong resistant regions around 48,000pts would try to ruin impact of this engulfing pattern. While daily and hourly indicators are ready for a bearish run and if index would not succeed in maintaining above 47,500pts till day end today then some serious selling pressure would be witnessed. For day trading it's recommended either to adopt swing trading or buying on dip with strict stop loss. Index would initially try to establish ground above 47,450pts-47,500pts regions but breakout below this region would push index towards 47,380pts and 47,200pts.

Regional Markets

S&P downgrades China Evergrande again to 'CCC'

S&P Global has downgraded the ratings of heavily indebted developer China Evergrande Group and its subsidiaries, citing an escalating risk of non-payment of debt, its second downgrade in less than two weeks.S&P downgraded Evergrande and subsidiaries Hengda Real Estate Group Co Ltd and Tianji Holding Ltd by two notches to "CCC" from "B-", and lowered the long-term issue rating on U.S. dollar notes issued by Evergrande and guaranteed by Tianji to "CCC-" from "CCC+", the agency said in a statement on Thursday evening.The move followed its two-notch downgrades last Monday.

Read More...

Business News

Bank AL Habib declares Rs9.04b profit after tax

The Board of Directors of Bank AL Habib Limited has announced the bank’s financial results for the half year ended 30 June 2021. The bank posted profit after taxation of Rs. 9.04 billion i.e. an increase of 25.10 percent compared to corresponding period last year. The bank’s profit before tax was recorded at Rs.14.34 billion, highlighting a growth of 18.51 percent as compared to corresponding period last year, driven by markup income as well as fees and commission incomevtranslating into an EPS of Rs. 8.13 per share as against Rs. 6.50 per share for the corresponding period last year. Net markup income increased to Rs. 27.40 billion, reflecting the bank’s success in maintaining sustainable growth.

Read More...

KE shares plans for Karachi’s future including Rs440b investment plan

Highlighting the need for investment in Karachi’s power sector for the continued growth of the city, K-Electric (KE) shared that the utility had submitted a revised investment plan of around Rs 440 billion for the tariff control period of 2017- 2023.Per the Multi Year Tariff 2017 – 2023 (notified in May 2019) determined by Nepra for KE, the utility was allowed an investment plan of Rs 299 billion. Subject to regulatory approvals, KE has submitted plans to make additional investments to the tune of around Rs 140 billion beyond the Nepra allowed.The revised investment plan was developed keeping in mind the dynamic and challenging environment we operate in.

Read More...

Tarin asks FBR to continue efforts for boosting tax collection

Federal Minister for Finance and Revenue Shaukat Tarin has directed Federal Board of Revenue (FBR) to continue its diligent efforts for enhancing the tax collection.He chaired the meeting of the APEX Committee on broadening the tax base and integration of retail businesses held at the Finance Division yesterday. SAPM on Finance and Revenue Dr. Waqar Masood, Chairman FBR and other senior officers participated in the meeting. In his opening remarks, the finance minister commended FBR over record revenue collection during the month of July, 2021 equal to Rs.413 billion which is 21% above the set target for the month.

Read More...

Roshan Digital Account inflow reaches $1.87bn

The inflow through Roshan Digital Account reached $1.87 billion at the end of July, with the first month of the current fiscal year witnessing the second highest inflow since the RDA was launched in September last year.Data released by the State Bank of Pakistan (SBP) on Thursday shows that the country received $307 million in July compared to $310m in June, reflecting a trend with inflow of over $300m per month.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.