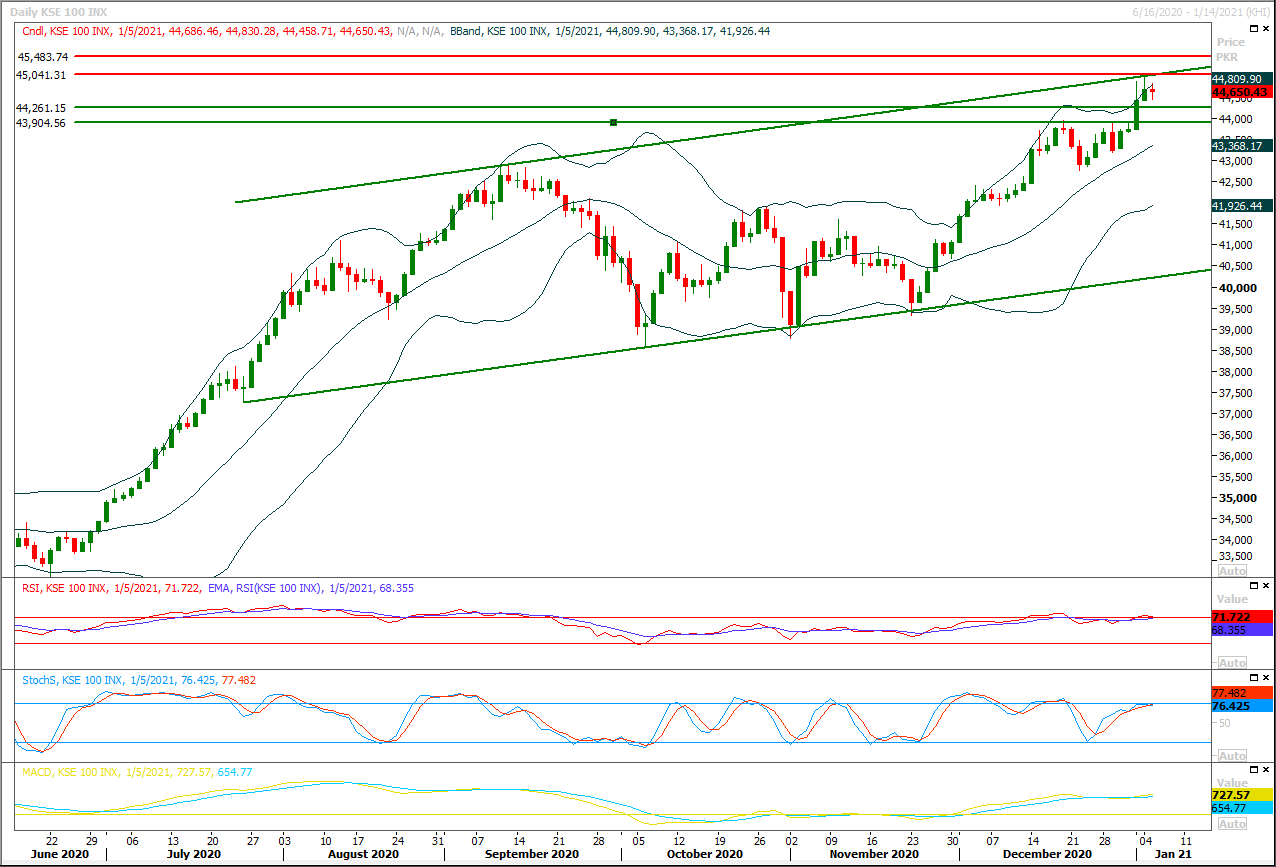

Technical Overview

The Benchmark KSE100 index is moving in a bullish price channel since last week and it's trying to establish ground above a rising trend line inside this channel which was previously reacting as a major resistant region. Meanwhile after facing rejection from resistant trend line of its rising channel chances of an evening shooting star are increasing on daily chart therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. Even today's closing below 44,100pts would confirm an evening shooting star therefore it's recommended to stay cautious. For current trading session index have initial resistant region ahead at 44,900pts which is being followed by 45,034pts where it's being capped by a strong horizontal resistant region while breakout above this region would call for 45,200ptsand 45,450pts regions. Meanwhile hourly and daily momentum indicators are still moving in uncertain region therefore it's expected that index could take a dip any time if it would face rejection from its resistant regions. Initial index would try to find support 44,320pts if it would succeed in closing below 44,550pts on hourly chart, while breakout below 44,320pts would push index further downward which may lead towards 44,000pts-43,900pts. Index would face some serious pressure once it would succeed in closing below 44,000pts therefore it can be said that swing trading with strict stop loss of either 45,200pts on short positions or 43,900pts on long positions could be beneficial until index could not succeed in giving a breakout of either side.

Regional Markets

Stocks fall, bond yields rise as investors brace for possible Democrat triumph in Georgia

Global stock prices slipped and U.S. bond yields rose on Wednesday as investors braced for the prospect that Democrats could win both races in a U.S. Senate run-off election in Georgia, handing them control of the crucial chamber.Japan’s Nikkei fell 0.4% while MSCI’s index of Asian-Pacific excluding Japan erased earlier gains to stand almost flat. The 10-year U.S. Treasuries yield rose to as high as 0.987%, the highest level since March, on expectations of larger government borrowing. “A market pullback seems both reasonable and healthy. But stocks won’t plunge to zero because there is a countervailing positive here,” said Phil Orlando, Chief Equity Market Strategist, Federated Hermes of a potential Democratic sweep.

Read More...

Business News

‘Riyadh offers extra output cut as part of Opec+ deal’

Saudi Arabia has offered to make voluntary cuts in its oil output in February in a bid to persuade fellow Opec+ producers to hold steady amid concerns that new coronavirus lockdowns will hit demand. Two Opec sources said Saudi Arabia made the offer on Tuesday at a meeting of Opec+, which combines Opec producers and others including Russia, after failed talks on Monday. It was not clear how much Saudi Arabia offered to cut on its own. Opec+ sources told Reuters that Russia and Kazakhstan were pushing for the group to raise production by 500,000 barrels per day (bpd) while Iraq, Nigeria and the United Arab Emirates suggested holding output steady.

Read More...

PSM land valuation discussed

Matters relating to the Pakistan Steel Mills (PSM) including valuation of its land to be leased out to a strategic partner were discussed by Minister for Privatisation Muhammad mian Soomro and Minister for Industries and Production Hammad Azhar on Tuesday. They discussed follow-up to the decision made by the Cabinet Committee on Privatisation which approved the transaction structure for PSM. The committee had approved the transfer of identified core operating assets into a wholly-owned subsidiary of PSM. Majority of the shares of the mills would be transferred to the strategic private sector partner without transferring full ownership.

Read More...

IPPs not impressed by govt plan for dues settlement

Independent power producers (IPPs) have cast off a payment plan offered by the government for partial settlement of their dues and demanded at least 50 per cent upfront cash payments before signing formal agreements for tariff discounts. An implementation committee led by Finance Minister Dr Abdul Hafeez Shaikh had last week offered payment of about Rs450 billion to the IPPs in three equal (one-third of total) installments through a combination of cash and tradeable bonds next month, June and December 2021. Each installment was to comprise one-third (about Rs50bn) in cash and two-thirds (about Rs100bn) in bonds.

Read More...

Value-added, non-traditional products push up exports

An increasing trend has been witnessed in the export of value-added and non-traditional products that helped in increasing Pakistan’s exports last month. Exports of value-added and non-traditional products have increased including Tobacco & Cigarettes (212.2 per cent), Ethyl Alcohol (128.6 per cent), Stockings & Socks (49.8 per cent), Home Textiles (38.1 per cent), Women’s Garments (37.8 per cent), Jerseys & Cardigans (37.3 per cent), Gloves (25.5 per cent), T-shirts (16.9 per cent), Rice (15.5 per cent) and Fruits & Vegetables (13.4 per cent) as compared to December 2019. According to the data of Ministry of Commerce, Pakistan’s exports in December 2020 have increased by 18.3 per cent to $2,357 million as compared to $1,993 million in December 2019, showing an increase of $364 million. This is the highest export ever in December.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.