Technical Overview

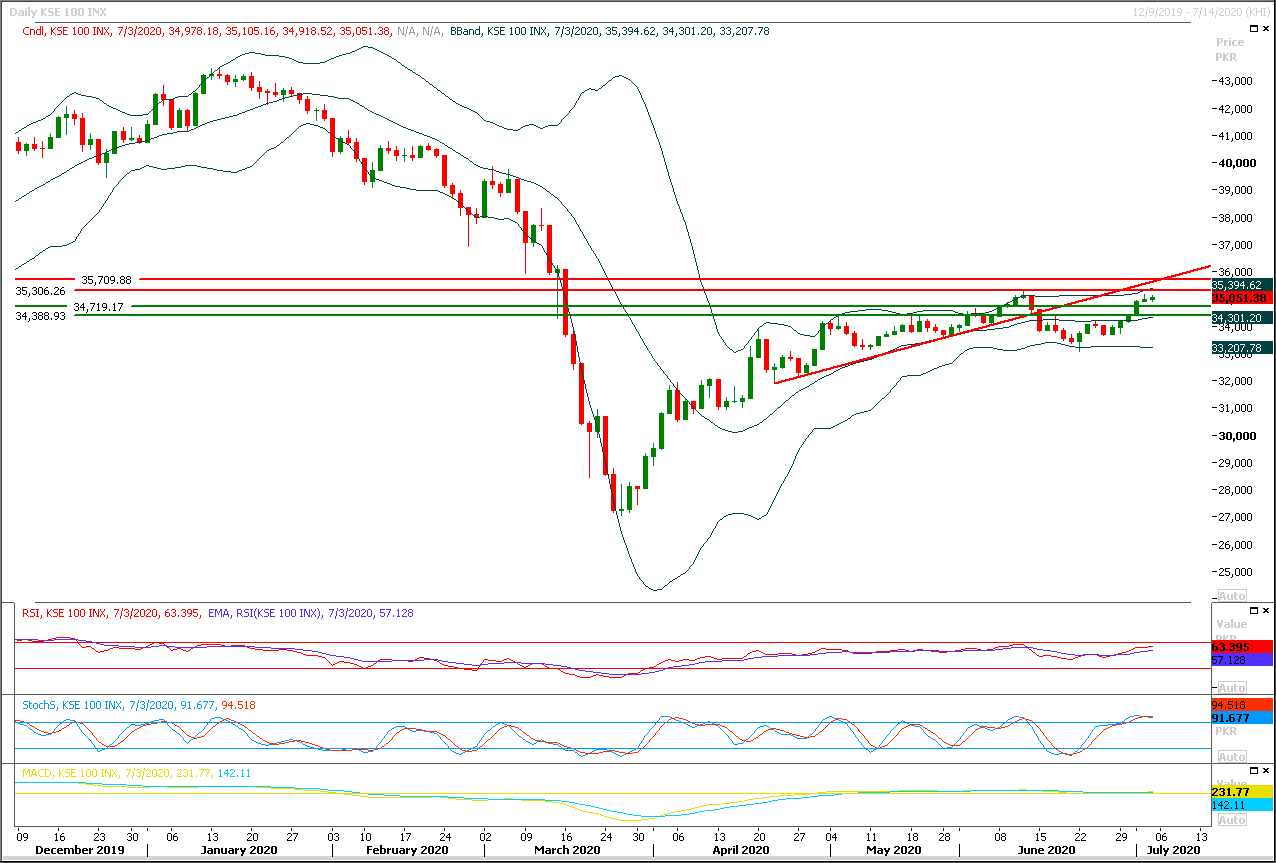

The Benchmark KSE100 index had succeeded in a closing above its pivotal value of 35,000pts during last trading session and a strong weekly bullish sentiment have been generated after last week's closing which would try to push index towards 35,760pts and 36,000pts initially if index would succeed in closing above 35,250pts on daily chart. For current trading session index have initial resistant regions ahead at 35,250 and 35,300pts and its recommended to stay cautious between these regions because if index would succeed in closing above these both regions then bullish spike for 500-1000 points could be witnessed in coming days. Meanwhile rejection from this region could push index downward again for a dip and in this case index would try to find some ground at 34,700pts and 34,500pts. Index would remain bullish until it would not succeed in closing below 34,500pts on daily chart while breakout above 35,300pts would boost this momentum While on flip side breakout below 34,500pts would plunge index towards 33,800 and 33,000pts again. it's recommended to stay cautious for next two trading session and trade with strict stop loss on either side.

Regional Markets

Asia shares climb as China blue chips hit five-year peak

Asian shares scaled four-month peaks on Monday as investors counted on super-cheap liquidity and fiscal stimulus to sustain the global economic recovery, even as surging coronavirus cases delayed re-openings across the United States.MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 1% to its highest since February. Eyes were on Chinese blue chips, which jumped 3%, on top of a 7% gain last week, to their loftiest level in five years. Even Japan’s Nikkei, which has lagged with a soft domestic economy, managed a rise of 1.3%. “We think there is a case for raising tactical allocation on Asian equities in the context of global equity portfolios,” wrote analysts at Nomura in a note. “We see a number of catalysts that could drive Asia ex-Japan (AeJ) equities’ outperformance over U.S. equities in the near term,” they added. “Better COVID-19 trends and mobility data in economies/markets that dominate the AeJ index should translate into faster economic recovery vs the U.S.” E-Mini futures for the S&P 500 also firmed 0.8%, while EUROSTOXX 50 futures added 1.8% and FTSE futures 1.5%.

Read More...

Business News

Govt launching pilot project for developing bio-compost using locusts

The Federal government is launching pilot project for using locusts for developing bio-compost with an expected return of around Rs2.80 billion in two years. Ministry of National Food Security and Research (NFS&R) is piloting a project to use locusts for developing bio-compost through community mobilization, said a spokesman for the NFS&R. The project is at approval stage and the pilot testing will be launched in Cholistan and Thar. If 10 per cent population of both pilot areas becomes active then 222,000 force available to combat against locust. The project will result in protection of biodiversity and fully mobilisation of local community to develop well informed system to protect 23.6 mha of cropped area, the spokesman said. There will be reduction in environmental pollution, the spokesman added. And there will be Introduction of low cost (60-70 per cent lower) compost and expected return will be around Rs2.80 billion in two year, said the spokesman. It will result in Improving soil organic matter (SOM), soil fertility and soil health. Through this project, Organic farming will be promoted in Pakistan. It will improve crop productivity by 10-15 per cent.

Read More...

OGDCL injects 4 new wells in production gathering system

The Oil and Gas Development Company Limited (OGDCL) has injected four new wells, producing 540 Barrels per Day (BPD) oil and 33.25 Million Cubic Feet per Day (MMCFD) gas, in the transmission network during a period of just five days, from June 26 to 30, 2020. On June 26, the company had successfully started commercial production of 10 MMCFD gas from Thar East Well-I, while on June 28 it started injecting 2.25 MMCFD gas from Bhimbra Well-I and 12 MMCFD gas and 300 BBL oil from Dhoke Hussain Field Well-I in the system, a senior official privy to petroleum sector developments told APP. On June 30, the OGDCL commenced commercial production of gas and condensate from its another Togh Well-I, located in Kohat district of Khyber Pakhtunkhwa, from where it was injecting 9 MMCFD gas and 240 BPD condensate in the production gathering system.

Read More...

EOBI pensioners to get Rs2.4b arrears in August with increased annuity

The Employees’ Old-Age Benefits Institution (EOBI) would pay three-month arrears amounting to Rs2.4 billion to around 400,000 registered pensioners with increased annuity in the next month, its Chairman Azhar Hameed said on Sunday. “Each retired employee registered with the EOBI will get increased pension of Rs8,500 coupled with Rs6,000 arrears of three months (April, May and June). In total, Rs14,500 will be transferred in bank account of each pensioner by the current month-end,” he told APP here in an exclusive interview. He said the recent raise of Rs2,000 was announced by the EOBI in the start of this year which was approved by the Federal Cabinet due to active persuasion of Special Assistant to the Prime Minister on Overseas Pakistanis and Human Resource Development Sayed Zulfikar Abbas Bukhari.

Read More...

27-year power generation plan ignores local energy resources

All the four provinces, Azad Kashmir as well as key public and private sector stakeholders have pointed out deficiencies in the proposed 27-year Integrated Generation Capacity Expansion Plan (IGCEP 2020-2047), saying it is overambitious, undermines indigenous energy resources and makes faulty assumptions in comparing various generation technologies to the advantage of thermal plants. This is the crux of about two dozen interventions submitted by public and private sector stakeholders to the National Electric Power Regulatory Authority (Nepra) against the IGCEP, proposed by the National Transmission & Despatch Company — a corporate entity of the Energy Ministry’s power division. Documents seen by Dawn suggest that a majority of the interveners have protested over major hydropower projects allegedly being pushed back, e.g. Diamer-Bhasha energy to 2043 instead of 2028-29.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.