Technical Overview

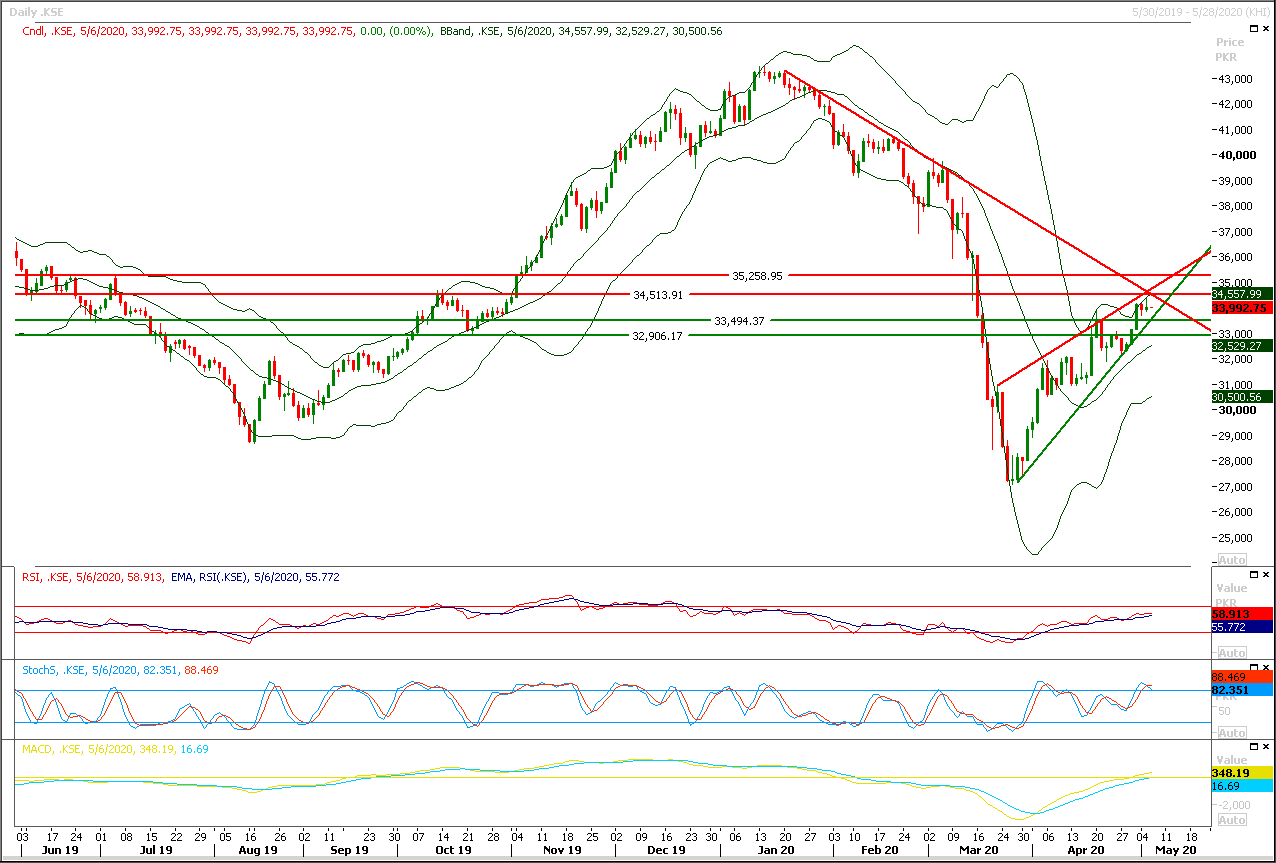

The Benchmark KSE100 index is caged in a rising wedge and still it's not being able to gave a clear breakout of either side of that wedge. As of now index is being capped by two strong resistant trend lines along with a horizontal resistant region at 34,540pts and this region would react as a strong resistant region. If index would not succeed in closing above this region in coming days then momentum would start changing towards bearish side and rejection from this region would push index towards 33,500pts where it would try to find ground at supportive trend line of its wedge. It can be said that index would remain range bound until it would not succeed in either closing above 34,700pts or below 33,500pts.Breakout of either side would push index for further 500-700pts in respective direction. It's recommended to stay cautious and post trailing stop loss on existing positions because breakout of either side would push index aggressively. While for new positions it's recommended to adopt swing trading.

Regional Markets

U.S. stock futures, Chinese shares slip amid Sino-U.S. tensions, oil falters

Shares struggled and the yen gained on Wednesday, with markets in China faltering on their return from a long holiday as investors fretted over Sino-U.S. tensions, while oil ended an extended winning streak on oversupply risks amid weak demand. Wall Street futures turned negative after starting higher, with E-minis for the S&P500 ESc1 off 0.3%. China, opening for the first time since Thursday, started on the backfoot with the blue-chip index .CSI300 down 0.6%. Australian shares skidded 0.8%. Elsewhere, Hong Kong's Hang Seng index .HSI added 0.7% while South Korea's KOSPI was also upbeat, rising 1%. Japanese markets were closed for a public holiday. That left MSCI’s broadest index of Asia Pacific shares outside of Japan .MIAPJ0000PUS up 0.3% in relatively light volumes.

Read More...

Business News

ECC takes up power sector debt restructuring today

The Economic Coordination Committee (ECC) of the Cabinet will meet on Wednesday (today) to consider a heavy agenda including more than Rs1.1 trillion worth of restructuring of the power sector debt. To be presided over by Finance Adviser Dr Abdul Hafeez Shaikh, the ECC is also expected to set an intervention price for cotton crop 2020-21, take stock of wheat procurement by the public sector and a couple of fresh funding allocations to the country’s premier intelligence agency in the aftermath of recent visit of Prime Minister Imran Khan to its headquarters. A total of 15 subjects are expected for discussion.

Read More...

Exports plummet 54pc in April as pandemic curtails global demand for goods

Exports during the month of April plunged by 54 per cent to $957 million from $2.08 billion a year ago following the order deferrals and cancellations due to the impact of coronavirus on the global economy. The data released by the Pakistan Bureau of Statistics (PBS) on Tuesday showed the impact of global economic slowdown mainly in the north American and European countries — top export destination for Pakistani goods — brought down the country’s total export proceeds during the month. Exports were expected to fall during the month of April as only a few buyers were honouring their import commitments with local manufacturers following the demand contraction in the wake of pandemic.

Read More...

Power division recommends forensic audit to determine authenticity of report

Raising questions to Mohammad Ali Committee report on power sector, the Power division has recommended forensic audit to objectively assess findings of the report, it is learnt reliably here. In response Mohammad Ali Committee Report’s options to deals with IPPs and their additional profitability, the power division has recommended two options to the Cabinet Committee on Energy for pursual, official source told The Nation. Cabinet Committee on Energy (CCE) had requested the Power Division to provide input on the report and present the way forward to the CCE in the near future. The Power Division has examined the report with focus on the sections discussing IPPs Profitability and the section dealing with Circular Debt.

Read More...

Govt releases Rs7.5b for finance division projects

The Federal government has so far authorized to release Rs 7595.950 million for various ongoing and new projects of Finance Division under its Public Sector Development Programme (PSDP) 2019-20, as against its total allocation of Rs 9930.749 million. Out of the total, all allocated amount of Rs 1000 million have been authorized to be released for Construction of Sibbi Rakhni Road, according to the latest data released by the Ministry of Planning, Development and Special Initiatives. Likewise, all the budgeted amount of Rs 1000 million have been authorized for release to carry out work on Gwadar Development Authority for which Rs1000 whereas an amount of Rs 800 have been authorized for release for necessary facilities of fresh water treatment, water supply and distribution Gwadar, for which Rs1000 million were earmarked.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.