Technical Overview

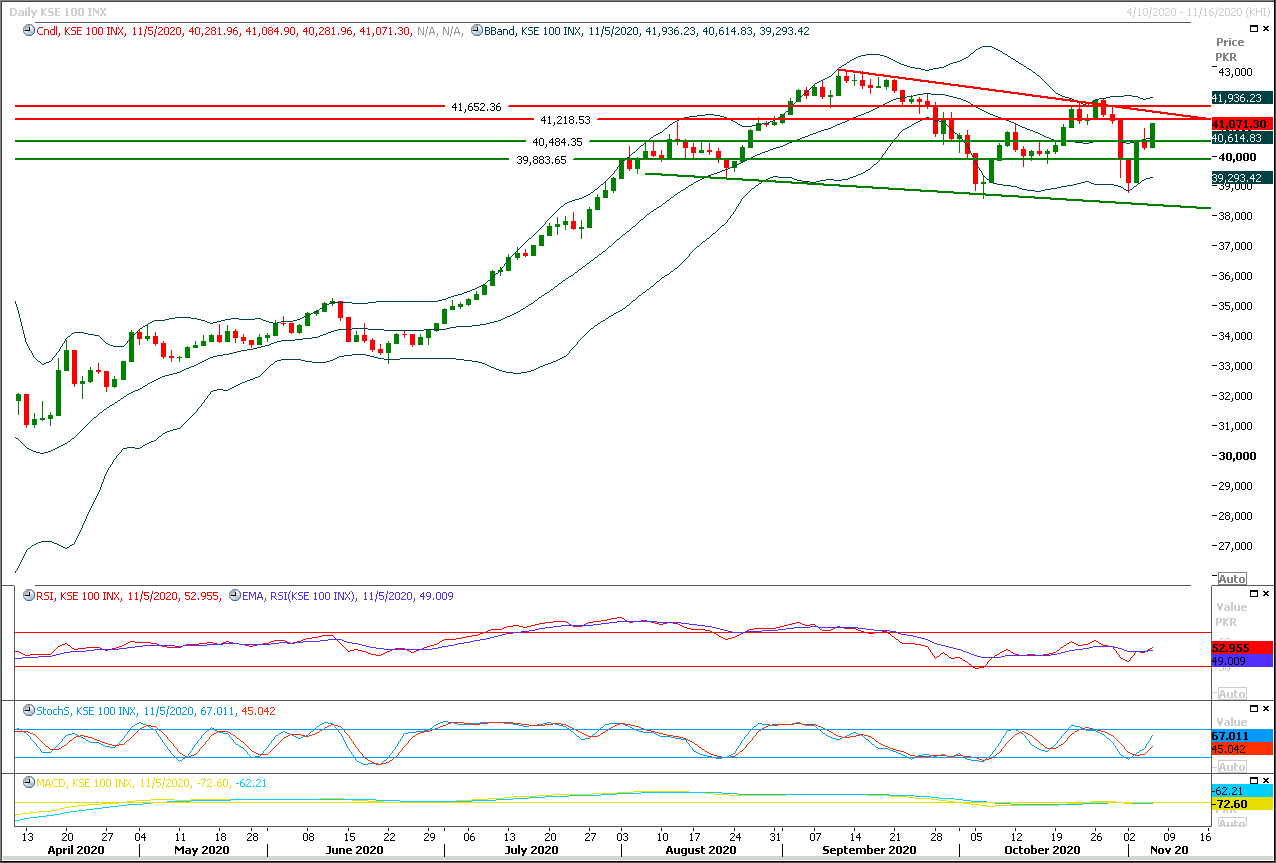

The Benchmark KSE100 index have reach 74.6% correction of its last week's bearish rally and its gaining momentum which indicates that index would try to target 41,500pts if it would succeed in giving a bullish breakout above 41,200pts. While daily closing above 41,200pts would complete weekly bullish engulfing pattern which would neutralize impact of previous weekly bearish engulfing. For current trading session it's recommended to initiate buying on dip with trailing stop loss. It's recommended to stay cautious between 41,200pts-41,500pts because index have major resistant region ahead at 41,500pts where a strong horizontal resistant region along with a descending trend line would try to cap current bullish momentum. While on flip side in case of rejection from resistant regions index would try to find initial support at 40,500pts and breakout below that region would call for 40,250pts and 40,000pts. Daily momentum indicators are still bullish but it's recommended to keep in mind that index have given two consecutive hammers in this region on monthly chart and these could create panic among investors as long as index is trading below 41,500pts.

Regional Markets

Asian shares at near three-year peak; dollar, U.S. yields head south

A gauge of Asian shares rallied to a near three-year peak while the dollar stayed sluggish and U.S. bond yields slipped on Friday in anticipation that a divided U.S. legislature would limit major policy changes and keep the status quo on economic policies. Japan’s Nikkei average rose 0.7% to almost its best level in 30 years while MSCI’s broadest gauge of Asian Pacific shares outside Japan rose 0.3%. U.S. S&P futures dropped 0.3% in early Asian trade, a day after the underlying stock index rose 1.95%. U.S. Treasury yields drifted lower again as investors bet that a divided U.S. government will cap debt-funded government spending and limit bond supply.

Read More...

Business News

Budget deficit reaches Rs484.3b in Q1

Pakistan’s budget deficit was recorded at Rs484.3 billion (1.1 percent of the GDP) during first quarter of the current fiscal year. The country’s expenditures stood at Rs1.963 trillion as against the revenues of Rs1.479 trillion during July-September period of FY2021. The budget deficit, gap between government’s expenditures and revenues, was recorded at Rs484.3 billion (1.1 percent of the GDP). Primary balance was recorded at Rs257 billion or 0.6 percent of the GDP. The government has met budget deficit financing through Rs161 billion external and Rs322 billion domestic resources, including Rs230 billion bank borrowing and Rs92 billion non-bank borrowing.

Read More...

Nepra to conduct public hearing on Wapda’s petition next week

National Electric Power Regulatory Authority(NEPRA) will conduct public hearing next week on the Water and Power Development Authority’s petition for increase of Rs1.65 per unit in electricity tariff from the WAPDA hydel power stations to meet its revenue requirement of Rs177.518 billion for the fiscal year 2020-21. In its petition for tariff revision submitted in August 2020, Water and Power Development Authority had requested NEPRA for the increase of Rs 1.65 per unit in power tariff and now NEPRA has set November 12 date for hearing.

Read More...

SBP reserves up by $61m

The foreign exchange reserve held by the State Bank of Pakistan increased by $61 million to $12,182.6 million during the week ending on October 29, 2020, State Bank of Pakistan (SBP) reported Thursday. The total liquid foreign reserves held by the country stood at $19,353.6 million. According the break-up figures, the foreign reserves held by the State Bank of Pakistan stood at $12,182.6 million whereas the net foreign reserves held by commercial banks stood at $7,171.0 million.

Read More...

Pakistani pharma exports increased in current FY

Adviser to Prime Minister on Commerce and Investment, Adbul Razak Dawood, has said that exports of medicines from Pakistan have increased this year. In his message on the social networking website, Twitter, the Federal Commerce and Investment Adviser said that the exports of the pharmaceutical products from Pakistan had increased by 22.6 per cent in the first quarter of the current financial year 2020-21. Dawood wrote on the social networking website that the pharmaceutical exports in the first quarter of the current financial year had increased to 68.1 million dollars as compared to 55.6 million exports in the corresponding period of the last financial year 2019-20.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.