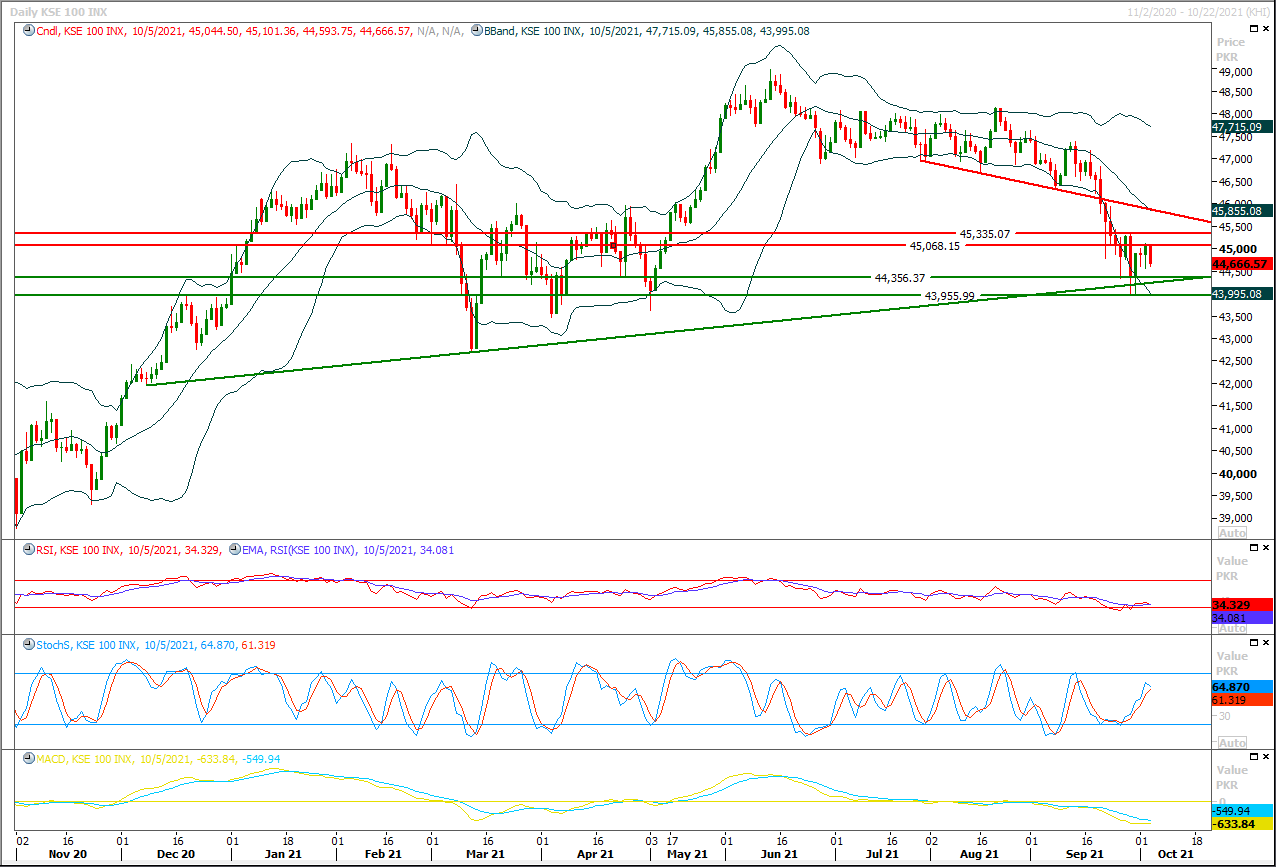

The Benchmark KSE100 had faced rejection from a resistant trend line on hourly chart during last trading session and it slide downward to retest resistant trend line of its previous descending wedge as supportive one. As of now it's expected that index would start an intraday recovery after a dip therefore it's recommended to start buying on dip for day trading with strict stop loss. Initially it's expected that index would try to establish ground above 44,500pts where correction of its last bullish pull back would also complete. Meanwhile hourly stochastic is ready for a bullish crossover which strengthen this view that index would start recovering after a dip. Meanwhile on daily chart index have strong supportive region ahead at 44,300pts therefore it's recommended to post stop loss between 44,300pts-44,250pts for new long positions, breakout below 44,250pts would change market sentiment for short term basis and it may start dragging index towards 43,950pts and further. On flip side index would face initially resistance at 44,900pts which would be followed by 45,065pts and 45,200pts. Index have key resistant region at 45,200pts therefore it's recommended to adopt swing trading between 44,250pts to -45,200pts with strict stop loss on both sides. Breakout of either side would call for a rally of further 500-1,000 points in respective direction.

Regional Markets

IMF board to interview Georgieva on data-rigging claims Wednesday -sources

The International Monetary Fund's executive board will interview Managing Director Kristalina Georgieva on Wednesday as it reviews claims she pressured World Bank staff to alter data to favor China in her previous role, sources familiar with the plans said.An IMF spokesperson declined to comment on the board's timeline.Board members were initially expected to meet with Georgieva on Tuesday, but spent their time working on other regular business matters, one of the sources said.

Read More...

Business News

Tarin encourages ZTBL to extend credit for agri projects on PPP basis

Federal Minister for Finance and Revenue Shaukat Tarin on Tuesday encouraged Zarai Taraqiati Bank Limited (ZTBL) to extend credit for building agri malls, commodity warehouses and cold storage facilities on public-private partnership basis to eliminate the role of middleman.He held a meeting with Board of Directors of ZTBL led by the President Muhammad Shahbaz Jameel at the Finance Division. The president ZTBL briefed about the overall steps taken to restructure organization. The key focus is to improve operations by streamlining the existing procedures of the Bank.

Read More...

Senate body to discuss Pandora leaks

Senate Standing Committee on Finance and Revenue on Tuesday decided to discuss the Pandora leaks, which included the name of more than 700 Pakistanis.The International Consortium of Investigative Journalists (ICIJ) has unveiled “Pandora Papers” which includes the names of more than 700 Pakistanis. The leaked documents revealed that key politicians including federal cabinet members, opposition party leaders, “have secretly owned an array of companies”. Senate Standing Committee on Finance and Revenue has also raised the issue in its meeting held yesterday. It has decided to discuss the issue in details in next meeting by taking input from the relevant stakeholders.

Read More...

CDC reduces base tariff

The Central Depository Company (CDC) of Pakistan has further reduced the base tariff for its major depository services to facilitate capital market participants.The company has slashed processing charges by 50 per cent for the induction of physical share certificates and to promote digitisation.It has also waived transaction fee on corporate action by 100pc and reduced certain tariff items for mutual funds to support leverage products.The CDC has abolished Rs67,500 annual fee for eligible security issued amount (face value)/annual fee on CDS eligibility of units of open-end mutual funds.

Read More...

Govt debt goes up by 11.5pc to Rs39.7tr

The central government’s total debt increased by 11.5 per cent in August this year from August 2020 while the external debt (in terms of rupees) increased by 8pc in the first two months of 2021-22.The State Bank of Pakistan’s latest report on government’s total debts showed the external debts also increased significantly by Rs1.3 trillion in a year’s time mainly on account of appreciation of US dollar against local currency.However, the domestic debt of the central government increased by Rs70 billion in July-August period. The domestic debts increased to Rs26.335tr in August compared to Rs26.265tr in June.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.