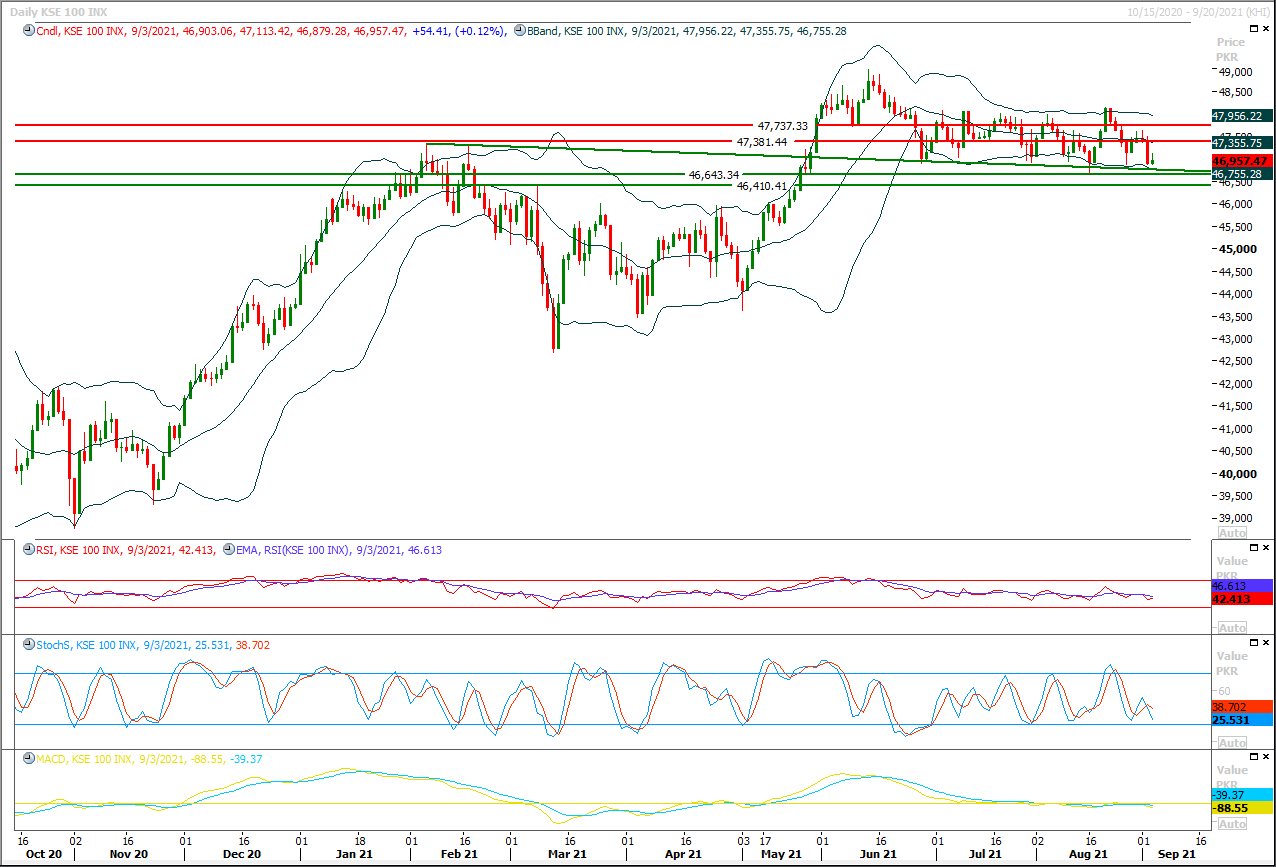

The Benchmark KSE100 index had tried to establish ground above supportive trend line and created a hammer on daily chart which opened doors for a morning shooting star for current trading session but momentum indicators are still in bearish mode and today's closing below 46,760pts would fuel bearish sentiment for short term basis. Meanwhile major supportive trend line which is trying to provide ground against bearish pressure since last two months is standing at 46,760pts for current trading session therefore it's expected that index may show some volatile behavior during current trading session in this region. Some fresh and healthy trading volumes are required for a pull back from this region but if index would not succeed in maintaining above this region till day end today than it would start sliding downward in coming days towards its next expansion levels which fall at 46,500pts and 46,200pts. Meanwhile index had continued its bearish journey during last trading session towards expansion of its last bearish correction on hourly chart, currently hourly momentum indicators are still bearish and these indicates that index would try to target its 61.8% expansion level which falls at 46,830pts. It's recommended to stay cautious because daily and hourly both momentum indicators are in bearish mode daily candle stick formation may try to format a morning star if index would succeed in closing above 47,180pts till day today. irrespective of last week' bearish pressure index is still standing above its major supportive regions therefore it can be said that index is trying to attract buyers but it's recommended to post strict stop loss at 46,760pts as this region would react as a pivotal value. On flip side in case of bullish pull back index would face initial resistance between 47,065pts-47,180pts which would be followed by 47,380pts and 47,600pts.

Regional Markets

Asia shares mixed, mull implications of U.S. jobs shock

Asian shares got off to a mixed start on Monday as a disappointing U.S. payrolls report promised to keep policy there super-loose for longer, but also clouded the outlook for global growth and inflation.A holiday in the United States made for thin conditions and kept MSCI's broadest index of Asia-Pacific shares outside Japan flat in early trade.Japan's Nikkei added 1.7%, but South Korea eased 0.1%. Nasdaq futures were barely changed, while S&P 500 futures dipped 0.1%.

Read More...

Business News

FBR holds meeting with real estate associations to discuss progress on FATF requirements

The Chairman Federal Board of Revenue (FBR) has stressed upon collective and continued efforts by FBR and Real Estate Agents to combat money laundering and financing of terrorism.The chairman FBR stated this in a meeting with real estate associations on the progress on FATF requirements.A meeting was held with the real estate associations from all over Pakistan at FBR, HQ. The meeting was presided over by Dr Muhammad Ashfaq Ahmed, Chairman FBR and attended by DG DNFBPs Mohammad Iqbal.

Read More...

Pakistan has only 8,200MW surplus installed generation capacity of electricity

Pakistan has only 8,200 MW surplus installed generation capacity of electricity against its peak demand which is lowest in the region, Germany, Brazil and the United States of America, official documents reveals.The summer peak demand this year reached to 25,300MW, while the installed generation capacity is 33,500MW, official documents available with The Nation reveals.Pakistan installed generation capacity and peak demand has been compared with India’s 2020, Bangladesh 2019, Germany 2018, USA 2018, Brazil 2016 and Malaysia 2016 installed capacity and demand.

Read More...

Amazon to remove content that violates rules from cloud service

Amazon.com Inc plans to take a more proactive approach to determine what types of content violate its cloud service policies, such as rules against promoting violence, and enforce its removal, according to two sources, a move likely to renew debate about how much power tech companies should have to restrict free speech.Over the coming months, Amazon will hire a small group of people in its Amazon Web Services (AWS) division to develop expertise and work.

Read More...

Explaining food inflation and food trade deficit

The Food and Agriculture Organisation’s Food Price Index (FFPI) is the most reliable indicator of movements in international commodity prices. Measured by this index, global food prices were up 33.9 per cent between July 2020 and June 2021, the length of Pakistan’s fiscal year 2019-20.This fact should not be ignored while looking at the effect of imported inflation on food inflation in a country.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.