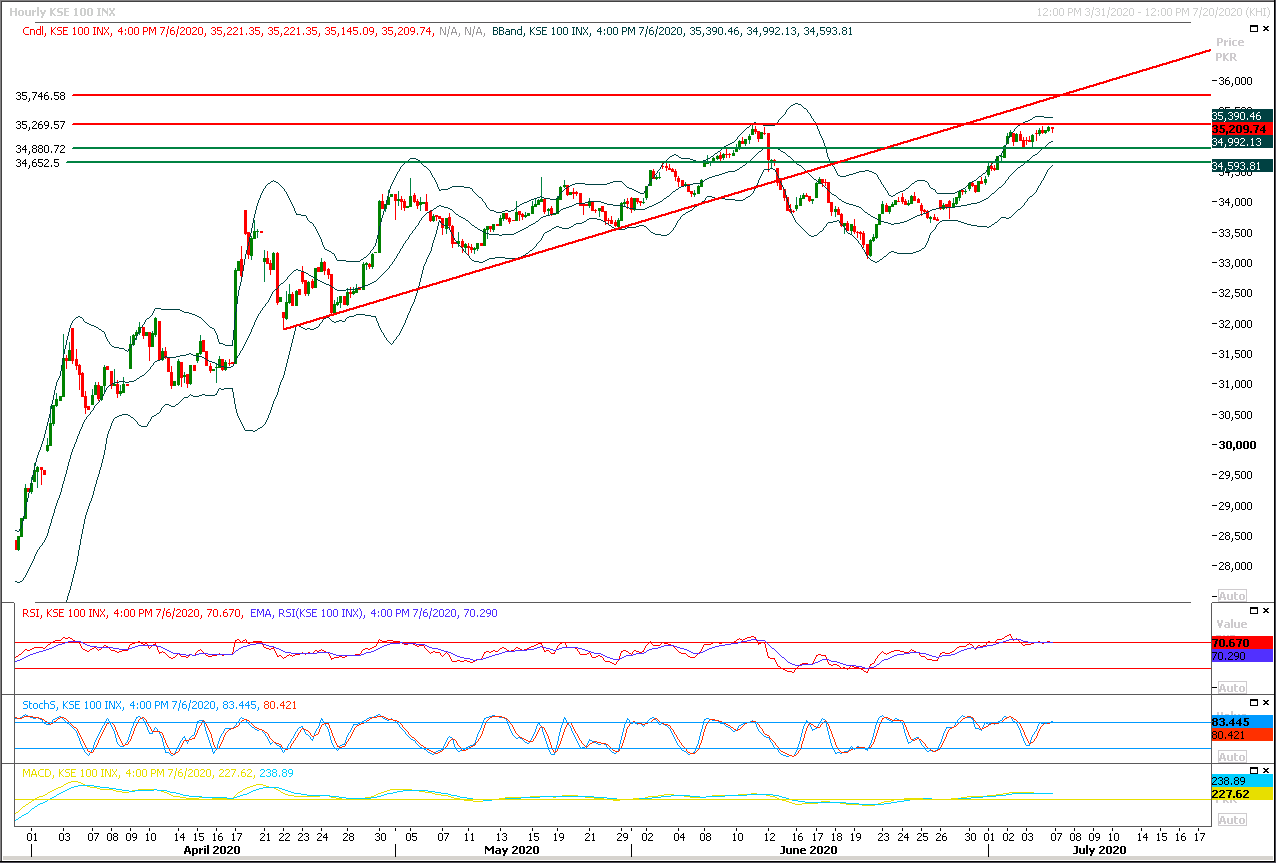

Technical Overview

The Benchmark KSE100 index have continued its bullish sentiment during last three trading sessions and have succeed in penetration above its initial two resistant regions of 34,500pts and 35,000pts during its bullish journey, as of now index have resistant region ahead between 35,200-35,300pts and if it would succeed in penetration above this region then a spike towards 35,860pts and 36,280pts would be witnessed. It's recommended to stay cautious and post trailing stop loss on existing long positions until index succeeds in closing above 35,300pts on even hourly closing basis. While in case of rejection from its resistant regions index would slide downward slightly towards 34,880pts or 34,650pts. But it would remain bullish until it would not close below 34,500pts on daily chart. For new long positions its recommended to wait for a breakout above 35,300pts.

Regional Markets

Asian stocks set to follow U.S. higher on China hopes, upbeat data

Asian markets looked set to rise on Tuesday as investors weighed growing expectations of an economic rebound in China and a resurgent U.S. services industry, brushing off worries about a spike in U.S. coronavirus cases.Australian S&P/ASX 200 futures climbed 0.52%, while Japan’s Nikkei 225 futures rose 0.07%, and Hong Kong’s Hang Seng index futures were up 0.68%. E-mini futures for the S&P 500 rose 0.08% following a rally in global stocks on Monday. Bullish sentiment toward the Chinese economy propelled the yuan on Monday to its best day against the dollar since December, while an index of blue-chip Chinese shares soared to its highest in five years. Jawboning by the Chinese government through a state-sponsored journal on the importance of “fostering a healthy bull market” helped spur the move, said Ray Attrill, head of FX strategy at NAB, in a research note.

Read More...

Business News

Agreement for $1.5bn hydropower project signed

Prime Minister Imran Khan has said that China-Pakistan Economic Corridor (CPEC) will be a ‘game changer’ for the motherland, bringing unprecedented prosperity and progress to the country. “It (CPEC) is a project that will take Pakistan to new heights [of prosperity],” the prime minister said after witnessing the signing of agreement with China Gezhouba for Azad Pattan hydropower project at a ceremony held at PM Office on Monday. “Pakistan can learn with the progress made by emerging economic power, China, during the last 30 years,” Mr Khan said. He said he was glad that the hydropower project was being commissioned under the CPEC.

Read More...

Road projects worth Rs300bn to be completed under public-private partnership

The government on Monday selected two road projects worth Rs300 billion for development through Public-Private Partnership (PPP). The expected completion date for the design and feasibility studies of both projects by March 31, 2021. The decision was taken at a meeting on road infrastructure projects under the PPP mode presided over by Minister for Planning, Development & Special Initiatives Asad Umar. The meeting was attended by National Highway Authority (NHA) Chairman Sikkandar Qayyum, PPP-Authority (PPPA) Chief Executive Officer Malik Ahmed Khan and other senior officials. The meeting was briefed on various projects currently under consideration for implementation under the PPP mode

Read More...

une sees 19pc jump in domestic cement sales

After posting decrease for three consecutive months, cement despatches swelled by 30pc to 4.623 million tonnes in June, from 3.557m in same month last year. According to the data released by All Pakistan Cement Manufacturers Association (APCMA), domestic cement uptake increased by 19.63pc to 3.835m tonnes in June, from 3.206m tonnes in the same period of last year. Meanwhile, exports soared by 124pc to 0.787m tonnes, from 0.351m tonnes. The domestic consumption in the North was 3.384m tonnes in June, as against 2.750m tonnes while exports declined to 46,025 tonnes compared with 0.145m tonnes. The scenario was opposite in the South where domestic consumption fell to 0.451m tonnes in June, from 0.455m in, but exports increased from 0.206m tonnes to 0.742m.

Read More...

Car sale falls by 53.78 per cent, production by 54.54 per cent in 11 months

The sale and production of cars decreased by 53.78 per cent and 54.54 per cent respectively during the eleven months of financial year 2019-20 compared to corresponding period of last year. During the period under review, as many as 89,130 cars were sold against the sale of 192,863 units while the production of cars decreased from 196,415 units to 89,284 units, showing negative growth of 53.78 and 54.54 per cent respectively, according to Pakistan automobile Manufacturing Association (PAMA). Among cars, the sale of Honda cars went down by 66.96 per cent from 37,083 units in last year to 12,252 units during current year while Suzuki Swift sale also dipped by 63.77 per cent from 4,488 units to 1,626 units during this year. The sale of Toyota Corolla went down from 52,314 units to 21,285 units, showing decreased of 59.31 per cent, the data revealed.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.