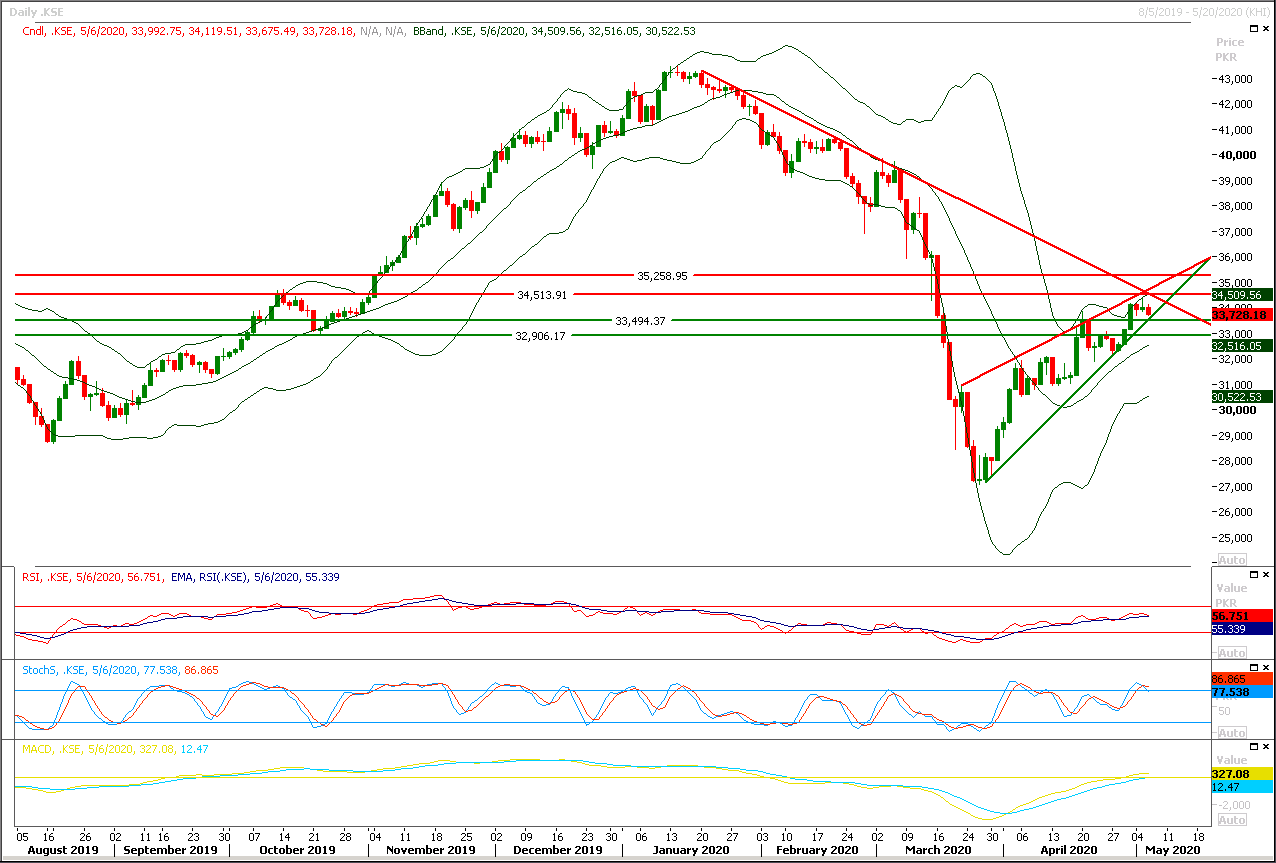

Technical Overview

The Daily rising wedge in which the Benchmark KSE100 index is caged is becoming narrowed with every passing day and today index would try to find support at rising trend line of that wedge along with a strong horizontal supportive region which falls at 33,500pts.It's recommended to stay cautious because daily momentum indicators are in bearish mode and these would try to push index downward but it's recommended to wait for closing below 33,500pts to initiate new short positions. Breakout below 33,500pts would call for 32,900-32,700pts region on immediate basis and then 32,300pts would become ultimate support for index. Meanwhile swing trading could be beneficial between 32,300pts till 35,200pts on mid-term basis until index succeed in giving a clear breakout of either side.

While on flipside if index would succeed in finding some ground at its supportive regions then it would try to target 34,000pts and 34,300pts where its being capped by a descending trend line. Index would remain bearish until unless it would not succeed in closing above 34,500pts on daily closing basis.

Regional Markets

Asia stocks relieved by China export surprise, U.S. bonds face debt flood

Asian shares pared early losses on Thursday after Chinese exports proved far stronger than even bulls had imagined, while U.S. bond investors were still daunted by the staggering amount of new debt set to be sold in coming weeks. Beijing reported exports rose 3.5% in April on a year earlier, completely confounding expectations of a 15.1% fall and outweighing a 14.2% drop in imports. The surprise stoked speculation the Asian giant could recover from its coronavirus lockdown quicker than first thought and support global growth in the process. The news helped regional market steady after a shaky start and MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was back to near flat. Japan's Nikkei .N225 was off a slim 0.2% while South Korea .KS11 added 0.2%. Chinese blue chips .CSI300 were just a fraction lower, while E-Mini futures for the S&P 500 ESc1 bounced 0.5%.

Read More...

Business News

Govt moves to take over Rs800bn power sector circular debt

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday expressed concerns over slow procurement of wheat by the public sector and set in motion shifting of over Rs800 billion power sector circular debt to public debt to honour commitments with the international lending agencies. The meeting, presided by Adviser to PM on Finance and Revenue Dr Abdul Hafeez Shaikh also approved a total of five supplementary grants worth Rs2.492bn. Major part of these grants pertained to Rs2.1bn funding to Inter Services Intelligence including Rs1.665bn for upgradation of Special Telecom Monitoring Project and a Rs500 million for construction of a Special Education School at the Defence Complex Islamabad.

Read More...

Govt promises to bear 40pc first loss to banks on SME loans

The government has said that it will bear 40 per cent of the first loss to banks on loans given to the small and medium enterprises (SMEs). In a statement, the ministry of finance announced on Wednesday the risk-sharing mechanism to support bank lending to SMEs and small businesses availing Refinance Facility of the State Bank of Pakistan (SBP) to support employment. The ministry said it had taken cognizance of the SMEs facing difficulties in arranging adequate collateral and banks’ risk averseness in taking exposures for such lending under the SBP’s Refinance Scheme to Support Employment.

Read More...

Amendments to restrict forex outflow from insurance sector

The Securities and Exchange Commission of Pakistan (SECP) on Wednesday proposed amendments to the Credit & Suretyship (Conduct of Business) Rules, 2018 for the insurance sector to restrict the outflow of money for reinsurance. The draft amendments have been placed on the SECP’s website for public opinion. The amendments aim to delink reinsurance requirement of collateral to save foreign exchange. The measure aims to facilitate the insurance industry in increasing local retention of insurance risks.

Read More...

Govt controls budget deficit at 3.8pc of GDP in nine months

The government successfully controlled the budget deficit at 3.8 percent of the gross domestic product (GDP) in first nine months (July to March) of the current fiscal year (FY20) due to increase in non-tax collection and provincial surplus budget. The country’s expenditures were recorded at Rs6.376 trillion as against the revenues of Rs4.689 billion in nine months of the ongoing financial year. Budget deficit was recorded at Rs1.686 trillion (3.8 percent of the GDP) in July-March period of FY20. The government had controlled the deficit due to budget surplus of provinces and increase in non-tax collection, which offset the massive shortfall in tax collection in period under review. Earlier, Pakistan had agreed with the International Monetary Fund (IMF) to reduce the budget deficit to 7.2 percent of the GDP (Rs3.15 trillion) in the current fiscal year. However, the deficit is expected to widen due to the outbreak of coronoavirus.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.