Technical Overview

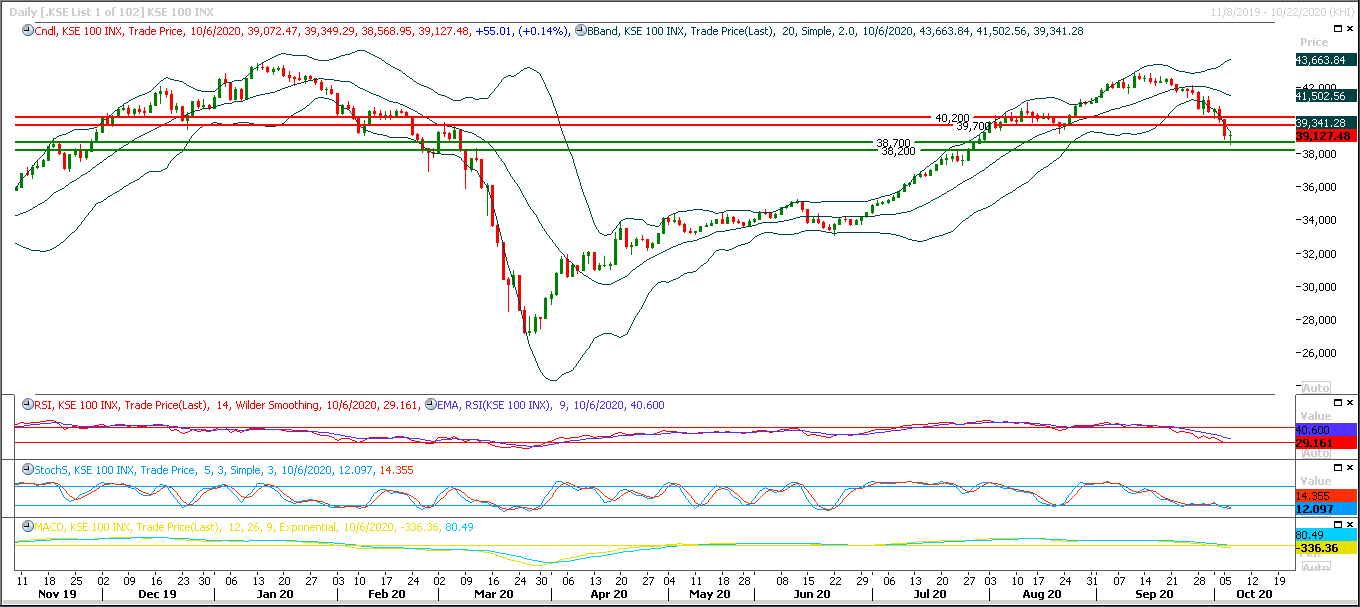

The Benchmark KSE100 index had bounced back after getting support from a strong horizontal supportive region at 38,500pts, as of now it's expected that index would try to continue its pullback during current trading session and a morning shooting star formation would try to take place on daily chart but index would remain under uncertainty until it would not succeed in closing above 39,700pts on daily chart because expected morning shooting star formation would turn into a cheat pattern if index would not succeed in closing above 39,700pts. While on longer run it would not be considered bullish until it would not succeed in closing above 40,500pts. While on flip side in case of rejection from its resistant regions index would try to find some ground at 38,760pts and 38,500pts while closing below 38,500pts would call for 38,000pts and 37,600pts in coming days.

Regional Markets

Asian stocks were set to open lower on Wednesday, weighed by a weaker Wall Street finish after U.S. President Donald Trump dashed hopes for a fourth stimulus package with a tweet.Futures for the S&P 500 EScv1 fell 0.58% in early trading, while Australia's S&P/ASX 200 futures YAPcm1 and Japan's Nikkei 225 futures NKc1 lost 0.29% and 0.17%, respectively.The Dow Jones Industrial Average .DJI fell 1.34%, the S&P 500 .SPX lost 1.40% and the Nasdaq Composite .IXIC dropped 1.57%. MSCI's gauge of stocks across the globe .MIWD00000PUS shed 0.64%.

Read More...

Business News

KP, Balochistan recommend federal govt to increase MSP of wheat

The provinces of Khyber Pakhtunkhwa and Balochistan have recommended the federal government to increase minimum support price (MSP) of wheat to Rs 1800 and Rs 1700 per 40kg respectively for the upcoming season, it was learnt reliably here Tuesday. In a meeting of the Wheat Review Committee (WRC), KP and Balochistan have given their recommendations regarding minimum support price (MSP) of wheat for the upcoming season, while Punjab and Sindh are likely to give their recommendations on the matter within next few days, official source told The Nation.

Read More...

Multi-pronged strategy being followed to meet country’s gas needs

The government is following a multi-pronged strategy to meet the country’s ever-increasing needs of the gas throughout the year especially during the peak winter season. “Increased import of LNG, development of strategic underground gas storages, trans-country gas pipeline projects, accelerating oil and gas exploration activities, reinforcement of transmission network and attracting private sector investment are some of the main features of the government strategy to achieve self-sufficiency in the energy sector,” a senior official privy to petroleum sector developments told APP.

Read More...

Govt hopes higher tax collection will reduce budget deficit

The government is expecting that budget deficit would improve after Federal Board of Revenue (FBR) has exceeded the tax collection target by Rs34 billion in the first quarter (July to September) of the current fiscal year. “Budget deficit figure of the first quarter will be finalised in next couple of weeks,” said an official of the ministry of finance. However, he hoped that government would control the deficit after massive increase in tax collection in July to September period of the ongoing financial year. He said that government is following financial discipline that is helping in controlling the deficit.

Read More...

Services trade deficit shrinks 50.41 percent

The country’s services trade deficit contracted by 50.41 percent during the first two months of the current financial year (2019-20) as compared to the corresponding period of last year. The services trade deficit during July-August (2020-21) was recorded at $462.07 million against the deficit of $931.77 million in July-August (2019-20), according to the latest data of Pakistan Bureau of Statistics. The services exports during the two months under review were recorded at $ 758.05 million against the exports of $884.14 million last year, showing decline of 14.26 percent.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.