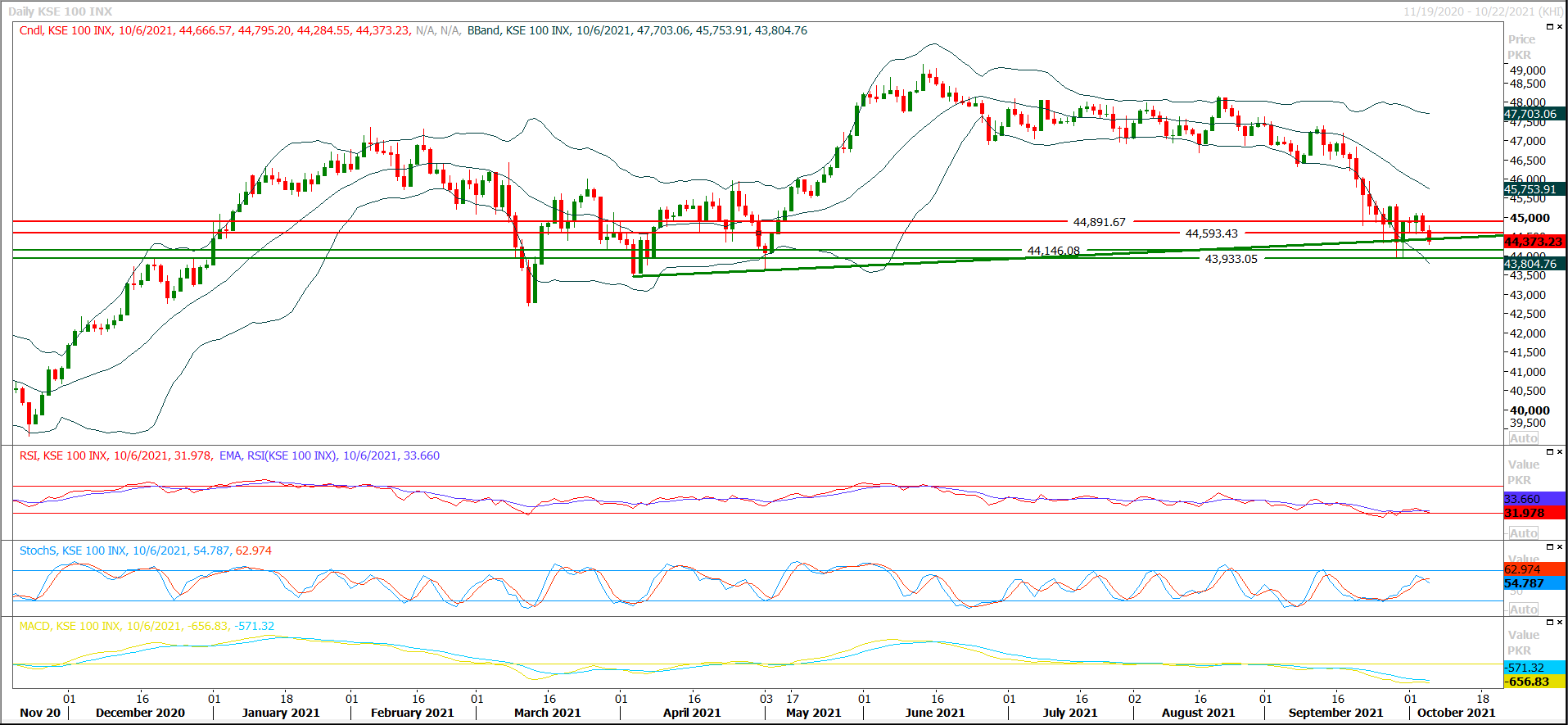

The Benchmark KSE100 had faced rejection from a resistant trend line on hourly chart during last trading session and it slide downward to retest resistant trend line of its previous descending wedge as supportive one. As of now it's expected that index would start an intraday recovery after a dip therefore it's recommended to start buying on dip for day trading with strict stop loss. Initially it's expected that index would try to establish ground above 44,125pts where a horizontal supportive region would try to support index against current bearish pressure. Meanwhile hourly stochastic is ready for a bullish crossover which strengthen this view that index would start recovering after a dip. Meanwhile on daily chart index have strong supportive region ahead at 44,200pts therefore it's recommended to post stop loss between 44,300pts-44,250pts for new long positions, breakout below 44,250pts would change market sentiment for short term basis and it may start dragging index towards 43,950pts and further. On flip side index would face initially resistance at 44,600pts which would be followed by 45,065pts and 45,200pts. Index have key resistant region at 45,200pts therefore it's recommended to adopt swing trading between 44,250pts to -45,200pts with strict stop loss on both sides. Breakout of either side would call for a rally of further 500-1,000 points in respective direction.

Regional Markets

Asian shares rise on stronger global risk appitite as oil prices ease

Asian shares rallied on Thursday, taking heart from a late recovery on Wall Street after U.S. politicans appeared near to a temporary deal to avert a federal debt default and as Russia reassured Europe on gas supplies, calming volatile markets.Oil prices also dropped back from multi-year highs hit a day earlier, having been a major contributor to this week's equities sell off, while U.S. benchmark Treasury yields and major currencies steadied amid the calmer mood.MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 1.25% in early trade, regaining ground lost in recent days to be little changed on the week.

Read More...

Business News

Stocks lose another 293 points on foreign selling

Selling pressure from foreign investors continued on the Pakistan Stock Exchange (PSX) on Wednesday as its benchmark index closed at 44,373 points, down 293 points, or 0.7 per cent, from a day ago.High commodity prices, especially of coal, have had their bearing on cement and steel stocks with ripple effects on oil and gas marketing companies as well as the energy exploration and production sector, according to Arif Habib Ltd.A key conditionality from the International Monetary Fund (IMF) for the resumption of the loan programme has been the upward revision in the electricity tariff besides an end to subsidies and increase in tax revenues.

Read More...

Tarin asks Balochistan, Sindh to bring down flour prices

\Finance Minister Shaukat Tarin on Wednesday took strict notice of high prices of wheat flour prevailing in Sindh and Balochistan and urged the chief secretaries to start daily release of wheat for stabilising its prices.The federal government is constantly criticising the provincial governments, especially Sindh, for not matching the price fixed by Punjab, which is releasing wheat to flour mills at Rs1,950 per 40 kg. As a result, wheat flour is costlier in Sindh and Balochistan compared to other provinces.In response to this pressure from the federal government, the provincial cabinet on Tuesday decided to match Punjab price to be effective from Oct 16.

Read More...

Record cotton rate sends buyers into frenzy

An all-time high rate of white lint in the Karachi cotton market traumatised the buyers, particularly textile spinners, on Wednesday when prices of the commodity crossed the Rs15,000 per maund mark.The price hike was forced by reports that cotton futures were traded at US 113.92 cents per pound in the New York market, which was perhaps the highest rate since 2011-12 when the lint had been sold at $2.26 per pound, brokers said.

Read More...

Biometric proof must for buying $500 or above: SBP

The State Bank of Pakistan (SBP) has imposed another restriction on buying of dollars from open market as it made biometric verification compulsory for all those who would buy $500 or above from open market. On the other hand, the dollar set a new record as the price rose to Rs171 on Wednesday.“The exchange companies will be required to conduct biometric verification for all foreign currency sale transactions equivalent to $500 and above and outward remittances,” said the SBP on Wednesday.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.