Technical Overview

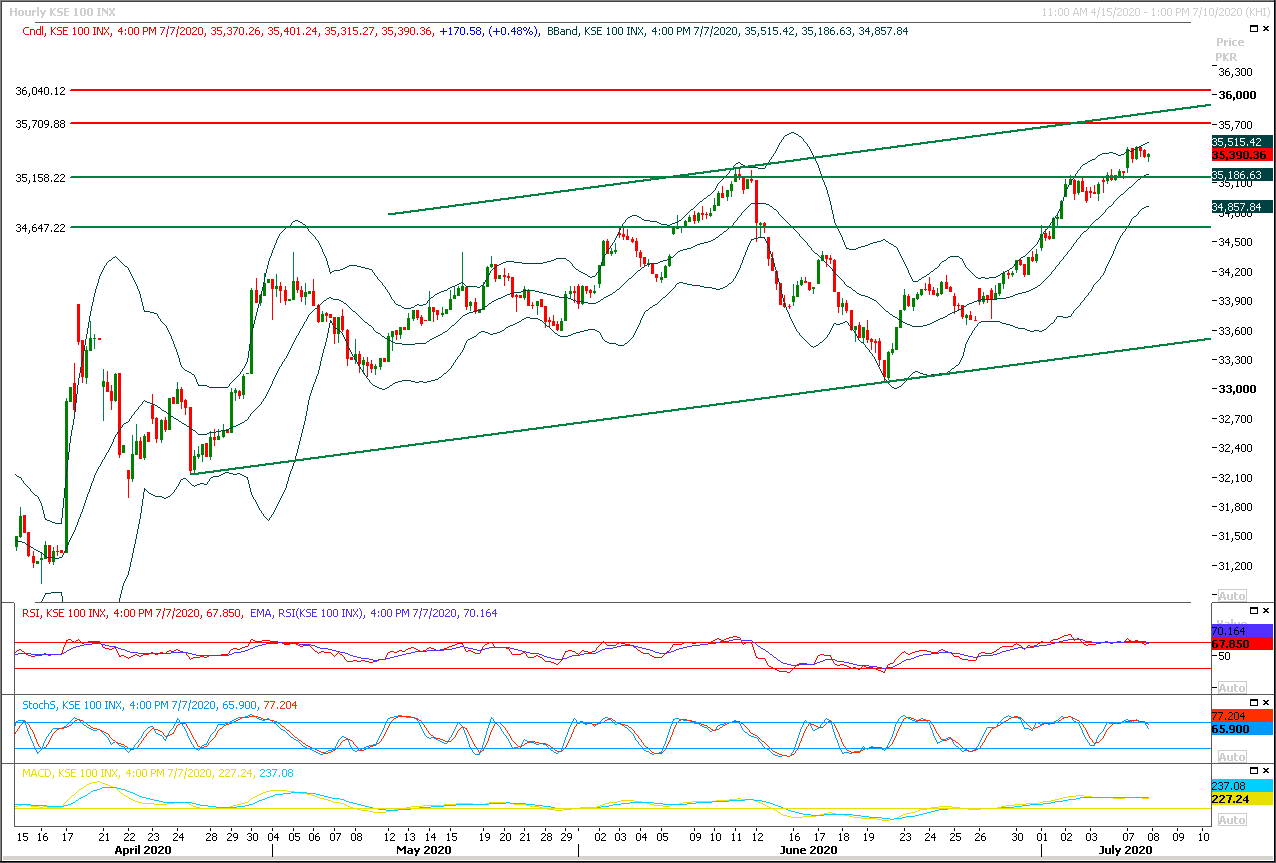

The Benchmark KSE100 index is moving in a rising trend line on hourly chart but now it's going to face resistance from resistant trend line of said channel along with a strong horizontal resistant region between 35,560-35,700pts. Meanwhile hourly momentum indicators are in bearish mode and a strong resistant trend line on daily chart would also try to cap current bullish sentiment below 35,700pts. Therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. If index would not succeed in closing above this region on daily chart then bears would try to take ride and they would try to push index towards 35,150pts initial while breakout below that region would call for 35,000pts and 34,880pts.

A slight intraday correction would be healthy for market and it would remain bullish until it would not succeed in closing below 34,500pts and index would try to target 35,700pts to continue its bullish momentum and it's recommended to post strict stop loss at 35,100pts on long positions for day trading because closing below that region would push index into uncertainty zone and later on new positions could be initiated around 34,700pts with strict stop loss of 34,500pts.

Regional Markets

Asian shares waver with coronavirus, corporate earnings in focus

Asian stocks dithered on Wednesday as an increase in new coronavirus cases in some parts of the world cast doubts over the economic recovery while oil prices eased on oversupply fears. MSCI’s broadest index of Asia-Pacific shares outside Japan were a tad lower after hitting a 4-1/2 month high just on Tuesday. Chinese shares flickered between green and red. Australian shares were down 0.4% as were indexes for New Zealand and South Korea. Japan’s Nikkei was off 0.1% and Hong Kong’s Hang Seng index was slightly firmer. E-mini futures for the S&P 500 added 0.18%. Overnight, U.S. stocks fell, halting a five-day winning streak by the benchmark S&P 500 index, its longest this year and driven by better-than-expected economic data. Following the recent rally, the declines looked like a consolidation, with the markets largely in “wait and see mode” ahead of the upcoming earnings session, said NAB economist Tapas Strickland.

Read More...

Business News

Debt deferment facility extended till Sept 30

The State Bank of Pakistan (SBP) on Tuesday extended the deferment facility of principal amount for small and medium-enterprises (SME) till end of September FY21. “Considering the fact that Covid-19 pandemic is continuing to stress the cash flow of small and medium- sized businesses and households, SBP has decided to extend the Deferment of Principal Amount facility up till 30th September 2020,” the central bank said. This facility will be available for SME financing, consumer financing, housing finance, agriculture finance and micro financing only, it added. The facility is not being extended to corporate and commercial borrowers since a significant amount of their loans and advances has already been deferred.

Read More...

As interest rates rose in FY20, money poured into govt securities: SBP data

The deposits of banks increased by 12 per cent year-on-year basis while their total investments — mainly in government securities — jumped 40pc during the outgoing fiscal year, reported the State Bank of Pakistan on Tuesday. The total deposits of banks rose by 12.2pc to Rs16.229 trillion by June end, compared to Rs14.458tr in same period last — an increase of 1.771tr. Overall money supply of the country increased by almost 16pc in FY20, compared to 11.3pc last year. But private sector lending remained severely depressed throughout the year as advances grew at a meagre 1.2pc in the same period. Another report of the State Bank showed that the investment in the government papers reached record high as it crossed the mark of Rs11tr.

Read More...

FBR to meet massive tax collection target of Rs960b in 1st quarter of current FY

Senior officials of FBR had informed the parliamentary committee in last month that it was estimated that the FBR would be able to collect Rs850 billion in first quarter of the current fiscal year. However, more efforts would be required to move from Rs850 billion to Rs960 billion by the end of first quarter of 2020-21. The government had set ambitious annual tax collection target of Rs4.963 trillion for the current financial year, which had termed unrealistic by the economic experts without additional revenue generation measures. The FBR had missed the budgetary target by whopping Rs1.561 trillion in last fiscal year. The FBR had collected Rs3989 billion as against the initial target of Rs5.55 trillion. The federal government had downward the tax collection target several times in previous fiscal year.

Read More...

Planning Commission assents around 92pc of PSDP during FY 2019-20

The Planning Commission has issued authorisation for around 92 percent of the PSDP during fiscal 2019-20, official documents reveals. Out of the total allocations of Rs701 billion in fiscal 2019-20 the planning commission has released Rs644.702 billion, said authorisation summary released by the Planning Commission. According the documents out of Rs147.987 billion allocations for blocks managed by Finance Division authorisation for 104.011 billion has been issued. As per the details, out of Rs48 billion allocated for Merged Areas 10 Years Development Plan authorisation for Rs 23 billion or less than 50 percent has been issued. For the Merged Districts of Khyber Pakhtunkhwa out of total allocation of Rs 24 billion authorisation of Rs 15.403 billion has been issued. For Gas Infrastructure Development Cess authorisation for less than 50 percent of allocations has been issued.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.