Technical Overview

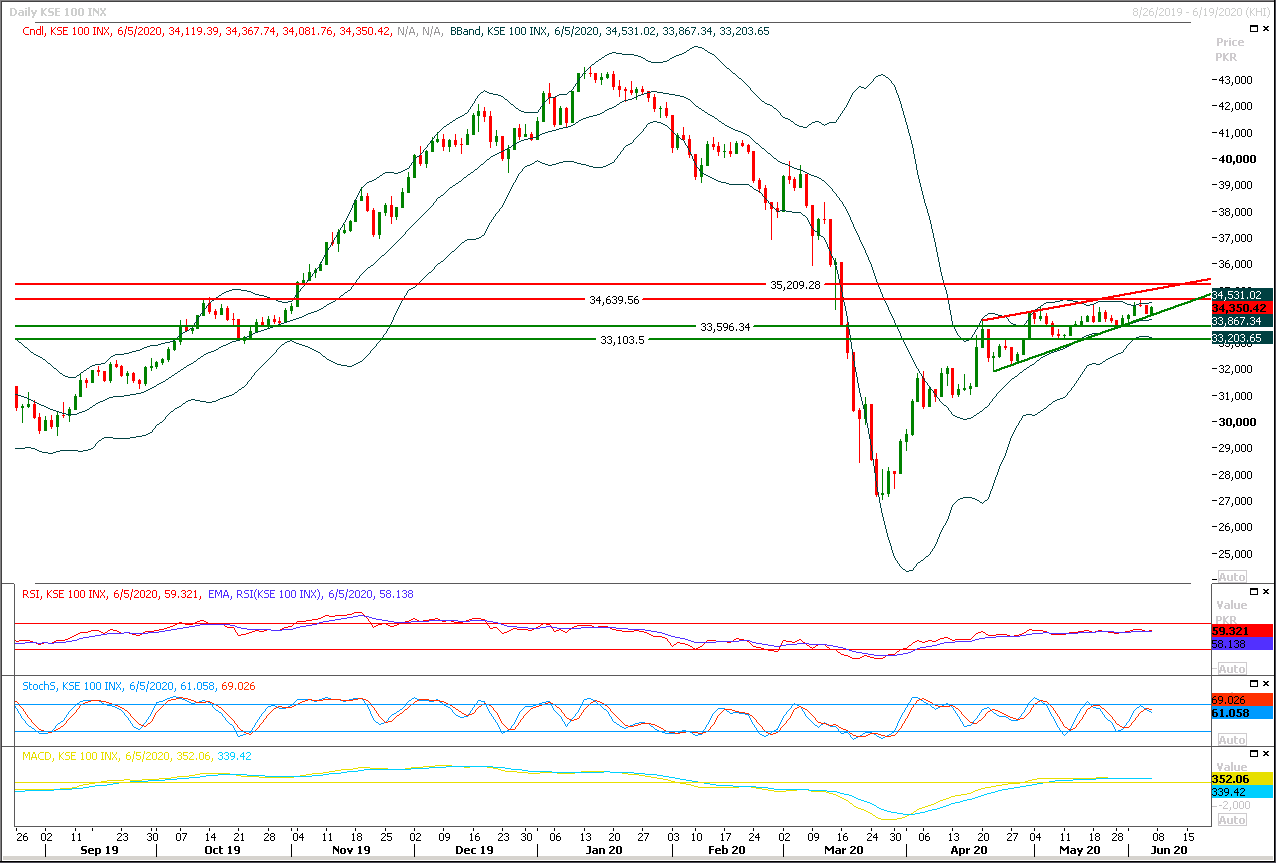

The Benchmark KSE100 index have generated a piercing line formation in response of daily evening shooting start to vanish bearish sentiment during last trading session after getting support from supportive trend line of its daily rising wedge. As of now it's expected that index would try to continue its bullish momentum towards 34,500pts and 34,640pts initially, while breakout above these regions would call for 35,000pts and 35,200pts. Staying on long side could be beneficial as long as index is trading above supportive trend line of its rising wedge, in case index would succeed in closing above 35,200pts in a day or two then a sharp spike towards 36,500pts or 37,000pts could be witnessed while in case of bearish breakout of said line its recommended to cut & reverse positions.

It's recommended to stay cautious because weekly momentum is still in bearish mode and if index would succeed in sliding below supportive trend line of its rising wedge by any mean then some serious pressure would be witnessed which may push index towards 33,500pts initially. On short term basis it's expected that would remain bullish until unless it would not succeed in closing below 34,000pts on daily chart and breakout below that region would call for 33,500pts and 32,500pts.

Regional Markets

World shares advance on surprise U.S. job recovery

U.S. stock futures and Asian shares advanced on Monday after a surprise recovery in U.S. employment gave further confidence of a quick economic recovery after many weeks of lockdowns aimed at controlling the coronavirus pandemic. U.S. S&P500 futures rose 0.5% to stand near their highest levels since late February while Japan’s Nikkei opened more than 1% higher. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3% in early trade, with South Korea’s Kospi rising 1.4%. The Australian share market was closed for a holiday. U.S. nonfarm payrolls rose by 2.509 million jobs last month - in contrast with consensus estimates of a fall in 8 million jobs after a record plunge of 20.687 million in April.

Read More...

Business News

Petrol pricing likely to be deregulated

Amid continuously aggravating petroleum shortage across the country, the government has decided in principle to “completely deregulate” petrol pricing and marketing and do away with uniform pricing mechanism. The decision comes at a time when oil marketing companies (OMCs) are under criticism for their cartelisation-like behaviour in the case of high octane blending component (HOBC), another deregulated product whose price has not seen a reduction in line with a massive decline in international oil prices. Amid the media criticism, the Oil and Gas Regulatory Authority (Ogra) on Friday warned some of the leading OMCs over the exorbitant retail price of HOBC and hinted at referring the matter to the Competition Commission of Pakistan (CCP) for anti-competitive and collusive practices.

Read More...

Economy eclipsed by Covid-19

THE government expects economic growth to re-enter the positive zone in the next fiscal year with different stakeholders estimating GDP expansion of 1.8-2.3 per cent as opposed to negative 0.4pc in 2019-20. Prime Minister Imran Khan and his adviser on finance and revenue, Dr Abdul Hafeez Shaikh, have been putting the entire blame for the worst economic performance in 68 years on the coronavirus. The Planning Commission has, however, come up with a relatively independent assessment of the fiscal year. It found that the downhill journey had begun before the pandemic arrived. In its Review of Annual Plan 2019-20, it noted that “prospects for economic growth even before the emergence of the Covid-19 phenomenon were eclipsed by higher inflation and interest rates, negative large-scale manufacturing growth, weaker exports, sluggish resource mobilisation, uncertainty surrounding hot money inflows and, above all, tough International Monetary Fund (IMF) programme–related conditions”.

Read More...

‘Sugar cartel’ to face full brunt of law

Prime Minister Imran Khan on Sunday approved massive investigations through various accountability organisations for taking action against the ‘sugar cartel’ allegedly involved in a multibillion rupee scam for the past 25 years. At a joint press conference with Information Minister Shibli Faraz, Special Assistant to the Prime Minister on Accountability Shahzad Akbar said: “The government will take on all the mafias in the country one by one. Everyone will be held accountable, no matter how rich or politically powerful. No exceptions can be made.” However, in a veiled reference to the ruling party’s stalwart Jahangir Tareen, the main opposition Pakistan Muslim League-Nawaz blamed the Pakistan Tehreek-i-Insaf government for helping the ‘ATM’ flee the country and questioned his ‘quiet’ departure despite being a prime suspect in the sugar scam.

Read More...

OPEC, allies agree to extend deep output cuts through July

OPEC members, led by Saudi Arabia, and other key oil producers agreed Saturday to extend historic output cuts through July, as oil prices tentatively recover and coronavirus lockdowns ease. The 13-member cartel and its allies, notably Russia, decided to extend by a month deep May and June cuts agreed in April to boost prices, the Organisation of the Petroleum Exporting Countries said in a statement. But Mexico, which had already made clear ahead of the talks that it “could not adjust... production further”, announced that it would not be complying. Oil prices have plummeted as a result of falling demand as countries around the world impose strict lockdowns to stop the spread of the new coronavirus. “All participating countries... agreed the option of extending the first phase of the production adjustments pertaining in May and June by one further month,” the OPEC statement said.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.