Technical Overview

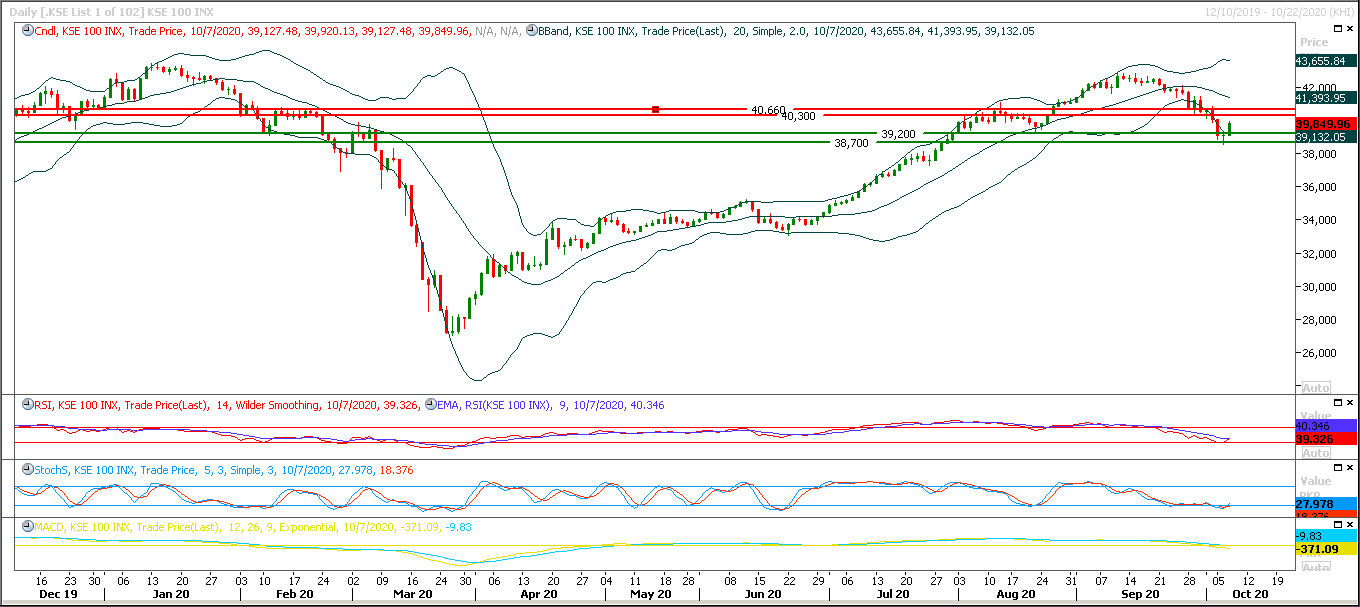

The Benchmark KSE100 index have formatted a morning shooting star on daily chart during last trading session and now it's widely expected that it would try to continue current bullish pullback during current trading session. But it needs to be very cautious until index could not succeed in closing above 40,500pts because if it would not succeed in closing above 40,500pts then this morning shooting star would be considered as a cheat pattern. Daily stochastic and MAORSI are trying to start a reversal sign but MACD is still bearish which is a negative sign for the market therefore it's recommended to post trailing stop loss on existing long positions. Current index would face initial resistance at 40,200pts which would be followed by 40,500pts and 40,760pts. While on flip side in case of rejection from its resistant regions index would try to find ground at 39,500pts and 39,000pts. For new long positions it's recommended to wait for closing above 40,200pts minimum.

Regional Markets

Asian shares at one-month highs on renewed U.S. stimulus hopes

A gauge of Asian shares climbed to a one-month high on Thursday, as renewed hopes for more U.S. stimulus helped restore investor confidence with markets now pricing in a Democratic victory during elections in November.MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3% for its fourth straight session of gains to a level not seen since early September. Australia’s benchmark index jumped 1.1% to a one-month high helped by a larger-than-expected fiscal stimulus announced in federal budget on Tuesday night.New Zealand shares rallied on expectations of further monetary policy easing after the country’s central bank said it was “actively considering” negative interest rates and a funding-for-lending programme. Japan’s Nikkei added 0.5%.

Read More...

Business News

ECC authorises Ogra to issue licenses for RLNG-based CNG stations

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday allowed Oil and Gas Regulatory Authority (OGRA) to issue new licenses to re-gasified liquefied natural gas (RLNG) based CNG stations with the provision that the licensee would neither receive indigenous gas or can claim for its conversion to indigenous gas. The ECC, which was chaired by Adviser to the Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh at the Cabinet Division, has considered the summary of petroleum division for grant of new CNG licences to absorb the imported RLNG.

Read More...

Ogra rebuffs AGP’s demand to examine regulator’s decisions

Rejecting the AGP’s (Auditor General of Pakistan) demand to audit regulatory decisions of Oil and Gas Regulatory Authority (OGRA), OGRA has said that, it contravenes the constitutional provisions as well as the Authority’s Ordinance and beyond the Auditor’s scope. “Oil & Gas Regulatory Authority (OGRA) reiterates its stance that, Auditor General of Pakistan (AGP) is mandated to conduct the audit of the accounts of the Authority, whereas the audit of the regulatory decisions/ determinations is not its mandate in accordance with the relevant constitutional provisions, as enshrined under Article 170(2) of Constitution of Islamic Republic of Pakistan” OGRA said in a letter to Cabinet division regarding the audit on the accounts of the authority for FY 2019-20.

Read More...

Pak-WB discuss cooperation on tariff rationalisation, E-commerce, EoDB

Pakistan and World Bank (WB) on Wednesday has discussed various matters for mutual cooperation particularly support for institutional strengthening of Ministry of Commerce, including tariff rationalisation, Ease of Doing Business (EoDB) reforms, and E-Commerce activities under the Ministry’s E-Commerce policy. The newly appointed Country Director of World Bank for Pakistan, Mr. Najy Benhassine called on Advisor to the Prime Minister on Commerce and Investment Mr. Abdul Razak Dawood at Ministry of Commerce. “A productive meeting was held with the newly appointed Country Director World Bank.

Read More...

Pakistan’s exports to USA decrease by 6 per cent

Pakistan’s exports of goods and services to United State of America (USA) witnessed a decrease of 6 per cent during the first two months of current fiscal year (2020-21) as compared to the exports of corresponding period of last year, State Bank of Pakistan (SBP) reported. The overall exports to USA were recorded at $671.752 million during July-August (2020-21) against exports of $714.632 million during July-August (2019-20), showing negative growth of 6 per cent, SBP data revealed. Overall Pakistan’s exports to other countries witnessed decline of 16.63 per cent in first two months, from $4.105 billion to $3.422 billion, the SBP data revealed.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.