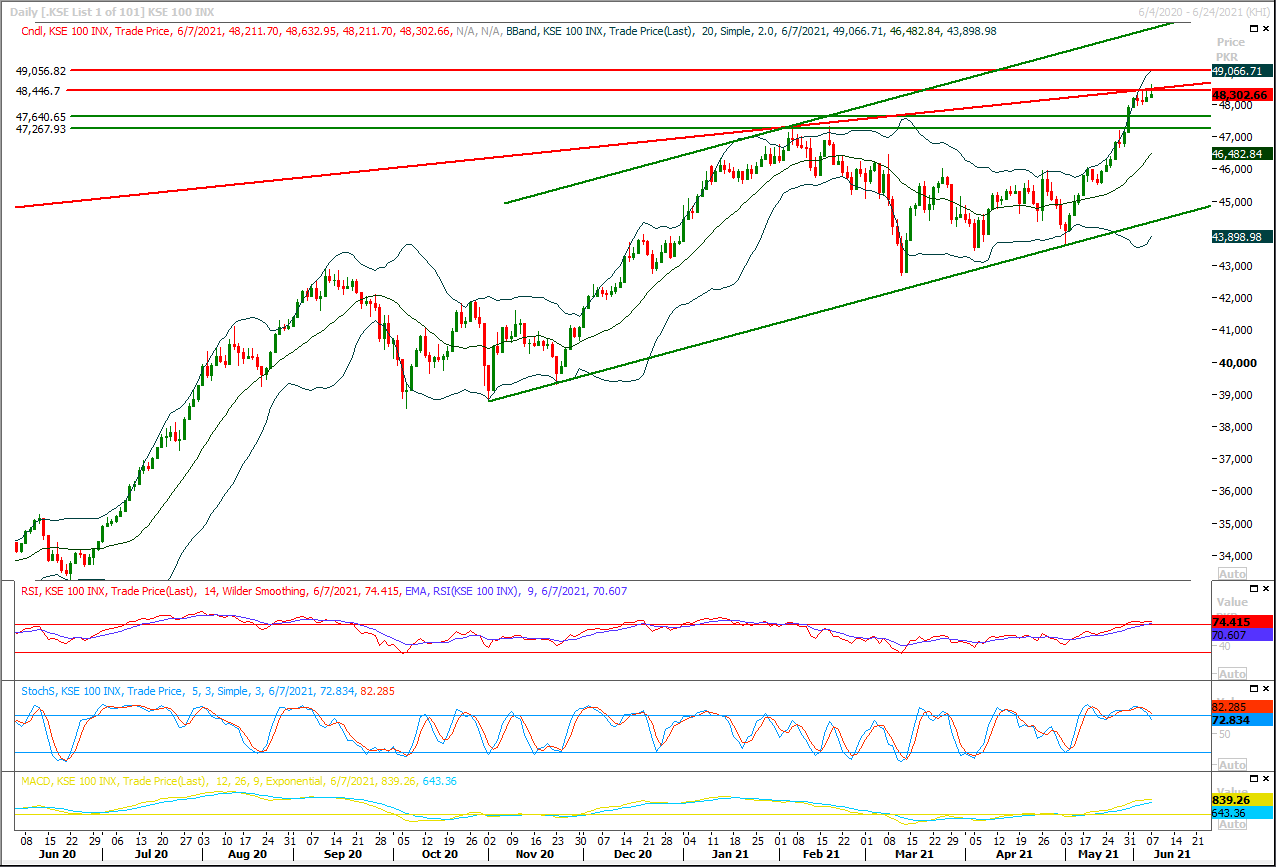

Technical Overview

The Benchmark KSE100 index is facing rejection from a strong resistant trend line since last week and could not succeed in closing this line during last trading session besides an intraday penetration. As of now it's expected that index would once again try to target this line initially at 46,450pts but in case of rejection from this region it would start sliding downward towards 48,060pts. An intraday gap already have been covered during last trading session there it can be expected that this time index would try it final effort to give a breakout above this region and if it would succeed in giving a breakout above 48,500pts then its next targets would be 48,760pts and 49,054pts. Overall sentiment would change toward positive direction from accumulative which may leads index towards 50,300pts. While on flip side in case of rejection index would got a push towards 48,060pts and 47,730pts. Daily and hourly momentum indicators are in bearish mode and closing below 48,000pts would start adding more pressure on index. Three consecutive hammers have taken place on daily chart and these would add uncertainty among investors if index would not succeed in closing above 48,500pts.

Regional Markets

U.S. Republicans vow to oppose Yellen’s G7 tax deal, casting doubt on its future

Several top U.S. Senate Republicans on Monday rejected Treasury Secretary Janet Yellen’s G7 deal to impose a global minimum corporate tax and allow more countries to tax big multinational firms, raising questions about the U.S. ability to implement a broader global agreement.The opposition from Republicans may push President Joe Biden to attempt to use budget procedures to pass the initiatives with only Democratic votes.It left lawyers and tax experts in Washington wondering whether it could get done without crafting a new international treaty, which requires approval by a two-thirds majority in the evenly split 100-member Senate."It's wrong for the United States," Republican Senator John Barrasso said of the tax deal struck on Saturday by finance ministers from the G7 wealthy democracies.

Read More...

Business News

Experts warn govt of overburdening tax payers in upcoming budget

style="text-align: justify;">Government lacks a robust strategy for expanding the tax base, which could make the attainment of tax collection target for next year challenging, experts noted on Monday as they warned against overburdening the existing tax payers.“The government does not appear to be having any out of the box ideas for expanding tax base,” analyst Hussain Haider said at a pre-budget discussion hosted by Islamabad Policy Institute (IPI).After collecting over Rs 4 trillion in taxes in the outgoing financial year, government is reportedly planning to set a tax collection target of Rs 5.8 trillion for the next year. Finance Minister Shaukat Fayyaz Ahmed Tarin has repeatedly said that the government would not further burden the existing tax payers. However, experts were skeptical about the claim.Read More...

Govt considering new tax regime according to changing economic environment: Tarin

Federal Minister for Finance and Revenue, Shaukat Fayyaz Ahmed Tarin, chaired a meeting here at the Finance Division with Managing Director / CEO Pakistan Stock Exchange Farrukh H Khan to review proposals for Federal Budget 2021-22.Pakistan Stock Exchange (PSX) MD gave a detailed presentation on the huge impact of stock markets on wealth creation and mobilization of capital. He said that a broad-based capital market helps to achieve important economic and social objectives like increasing the number of tax payers, optimising savings and investment rates, and reducing wealth inequalities. Tax measures are an important policy tool to increase investments and savings in the economy and to stay competitive with other markets.He submitted proposals to align rates of capital gain tax on disposal of securities in line with regional practices, rationalisation of tax rates for companies listed on the stock exchange, enhanced tax credit for listed small and medium enterprises, unlocking the potential of private funds and many other suggestions that will help broadening the tax base/ revenue collection.

Read More...

Collateral free loans up to Rs10m to businesses soon: Reza Baqir

State Bank of Pakistan Governor Dr Reza Baqir has said that financing of cottage industry up to Rs10 million without collateral would start soon.Talking to Lahore Chamber of Commerce and Industry (LCCI) President Mian Tariq Misbah and Vice President Tahir Manzoor Chaudhry, he said that the government will invite Expression of Interest from banks for inclusion in this scheme. SBP Governor said the government will give guarantee to banks against losses. He said that the end user rate for the small businesses and cottage industry in this scheme would be 9 per cent which otherwise get loans at 24 per cent. He said that to facilitate the growth of IT sector, particularly the startups, foreign exchange laws have been relaxed and made more business friendly. The foreign funding in IT sector will be facilitated by relaxation in laws. Banks have been fully delegated to handle the payment issues of IT companies.

Read More...

NEC approves 40pc hike in development spending for FY22

Amid dissent by Sindh Chief Minister Murad Ali Shah, the National Economic Council (NEC) on Monday set next year’s economic growth rate target at 4.8 per cent to be supported by Rs2.135 trillion consolidated development outlay — about 40pc higher than current year’s revised budget of Rs1.527tr.The meeting of the NEC — the highest economic decision-making body in the country — was presided over by Prime Minister Imran Khan. Chief ministers of all the provinces and other members of the NEC participated in the meeting.The Prime Minister Office said the meeting also approved Macroeconomic Framework for Annual Plan 2021-22 envisaging growth target of 4.8pc, with sectoral growth targets of 3.5pc for agriculture, 6.5pc for industrial sector, and 4.7pc for services sector.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.