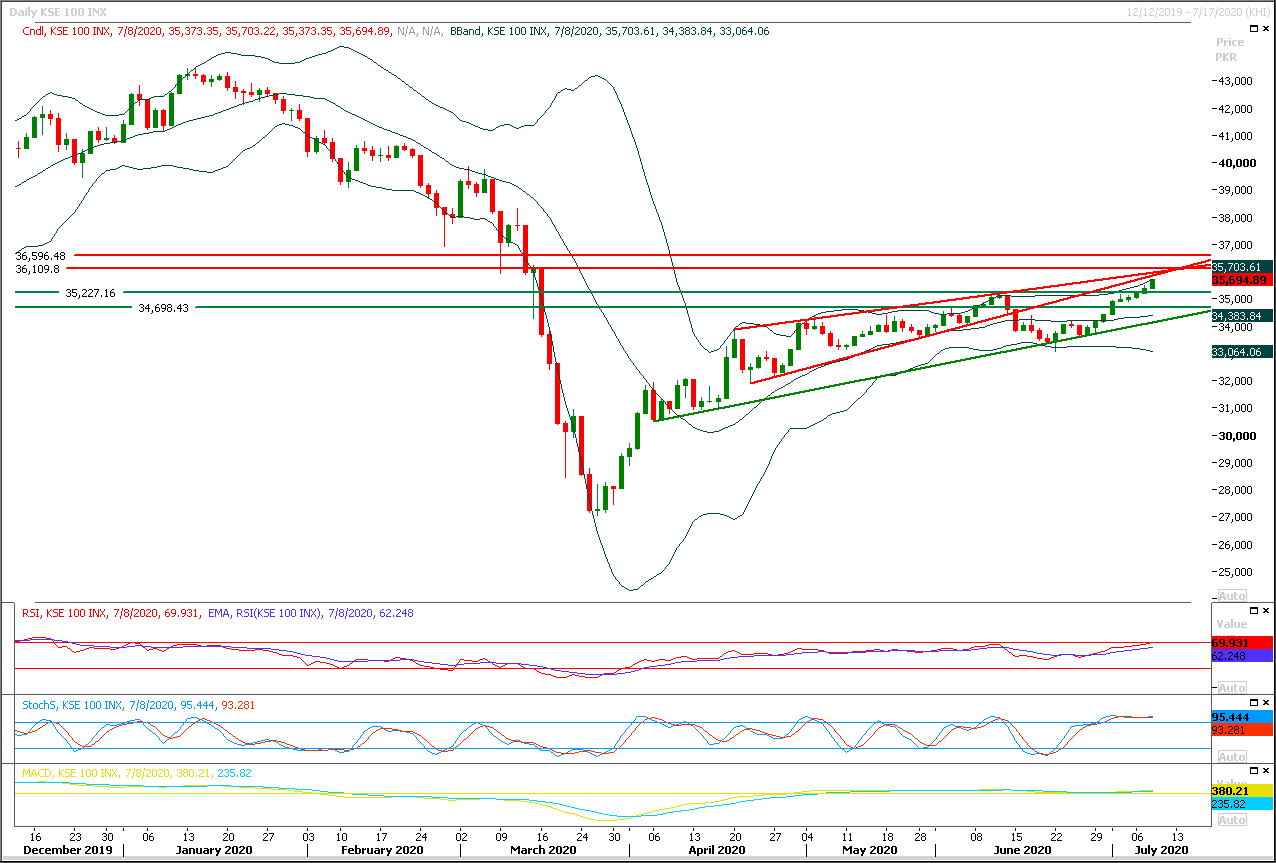

Technical Overview

The Benchmark KSE100 index is approaching its weekly correction by moving inside a rising wedge on daily chart. But now index is being capped by resistant trend line of that wedge at 35,950pts along with a strong horizontal resistant region. Now it needs to be very cautious while trading because its widely expected that rising wedges are mean to gave a bearish breakout therefore small to medium traders would start selling on strength but this logic is not a thumb rule for rising wedge because if this rising wedge would gave a bullish breakout then a sharp spike of 800-1000pts would be witnessed with huge volumes in coming days and this breakout would push index towards 37,100pts where its weekly 61.8% correction would be completed. It's expected that some volatile moves would be witnessed during current trading session and index would face strong resistances at 35,950pts and 36,100pts and incase it would not succeed in getting required volume at this level then it would start sliding downward therefore it's recommended to post trailing stop loss on existing long positions. In case of rejection from its resistant regions index would slide towards 35,500pts and 35,200pts. Sentiment would remain bullish until index would not succeed in closing below 35,200pts or 34,500pts on daily chart.

Regional Markets

Asian stocks set to rise as focus swings to recovery prospects

Asian stocks were expected to rise on Thursday, as hopes of a robust economic recovery offset concerns over flare-ups in the coronavirus pandemic, and as investors looked ahead to earnings season.Australian S&P/ASX 200 futures were up 0.85%, Japan’s Nikkei 225 futures added 0.16%, and Hong Kong’s Hang Seng index futures rose 0.82%. E-mini futures for the S&P 500 edged up 0.08%. “Risk sentiment remains resilient ahead of next week’s key earnings reports,” said NAB economist Tapas Strickland. He singled out earnings from JPMorgan, Citigroup, and Wells Fargo on Tuesday, as well as tech heavyweights of Microsoft and Netflix on Thursday. Demand for technology stocks lifted U.S. shares and helped the Nasdaq add 1.44% to 10,492.50, its fourth record closing high in five days. The Dow Jones Industrial Average rose 0.68% and the S&P 500 gained 0.78%. MSCI’s broadest index of Asia-Pacific shares outside Japan closed 1.29% higher, helped by Chinese stocks, which have rallied for seven-straight days. Emerging market stocks rose 1.67%.

Read More...

Business News

Govt orders all petrol, diesel imports be Euro-V compliant as oil companies protest move

Amid protest and resistance by the oil industry, the government has ordered ban on import of petrol and diesel of less than Euro-V standard with effect from Aug 1, 2020 and Jan 1, 2021 respectively. This has put the oil industry and the authorities in yet another conflict when the two sides were already poles apart on petroleum pricing mechanism and maintenance of 20-day stocks, leading to serious supply disruptions in the recent months. The oil industry has expressed inability to abide by the fresh instructions, particularly because of such a short notice and has warned of Rs7-8 per litre price hike and $200 million annual foreign exchange loss. It said the country’s motor vehicle fleet was also not ready for such a steep switchover. On Wednesday, the Directorate General of Oil of the Petroleum Division notified specifications of Euro-V petrol of all three grades (RON 92, 95 & 97) and asked the Oil & Gas Regulatory Authority (Ogra), Hydrocarbon Development Institute of Pakistan (HDIP) and oil industry to implement these specifications.

Read More...

NA body seeks details of tax refund payments

The National Assembly Standing Committee on Finance on Wednesday showed displeasure over the payment of refunds to taxpayers while directing the Federal Board of Revenue (FBR) to share details on Thursday. The meeting, chaired by MNA Faiz Ullah, gave a one-day deadline to Member FBR Inland Revenue Operation Dr. Ashfaq Ahmed to present details of refund payments and the pending amounts so far. Dr. Ahmed told the committee that the FBR has released an amount of Rs174.8 billion refunds during the outgoing fiscal year (2019-20). The board has also paid Rs100bn additional refunds under the prime minister package, he added. On the payment claims, MNA Naveed Qamar intervened and asked Dr. Ahmed to share the actual volume of total refunds. He said the committee should also be briefed over the stuck amount and the payment procedures.

Read More...

Gulpur power project starts generating electricity

Gulpur Hydropower Project has achieved certified commercial operation and has been producing cheap electrity for the national grid, said Dr Tahir Masood, Managing Director NESPAK in a statement on Wednesday. NESPAK in a joint venture with M/S MWH Inc. USA has provided consultancy services as Owner’s Engineer to M/s Mira Power Limited, a subsidiary of KOSEP, South Korea, for the 102 MW Gulpur Hydropower Project. NESPAK provided technical support to Mira Power Limited in getting approvals from different government agencies as well as supporting the EPC Contractor in resolving complex issues arised during construction. NESPAK was also involved as Owner’s Engineer in development and completion of 84MW New Bong Escape Hydropower Project, which is the first hydro IPP of Pakistan, thus becoming a leading consultancy firm in development of private hydropower project in Pakistan.

Read More...

OGRA forfeits 3 companies involved in LPG bowser accident

Oil and Gas Regularity Authority (OGRA) has imposed fine on the companies involved in LPG bowser accident and also directed the companies to pay compensation to the effected people. Oil and Gas Regularity Authority (OGRA) has imposed fine on the companies involved in LPG bowser accident at Shahdara Morr, Lahore as well as directed the companies to pay compensation to the people who lost their lives, acquired injuries as well to compensate the loss of property and vehicles during the unfortunate incident, said spokesman Ogra here. The Authority in its Regulatory Meeting No. 10 of 2020, considered the fact finding report submitted by LPG department and directed three Companies/Licensees namely M/s Rana and Company, M/s Engro Vopk Terminal Ltd (EVTL) and M/s Havelet Gas Ltd., to pay the compensation (on equal basis) to the affected parties under Rule 27(2) of LPG (Production and Distribution) Rules 2001. The Authority further approved to impose penalty of Rs0.5 Million on each of the above Company/Licensee under Rule 29 of the LPG Rules 2001 upon violation of their license conditions, LPG (Production and Distribution) Rules 2001 (Which is maximum penalty according to Rule 29 of LPG rules 2001).

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.