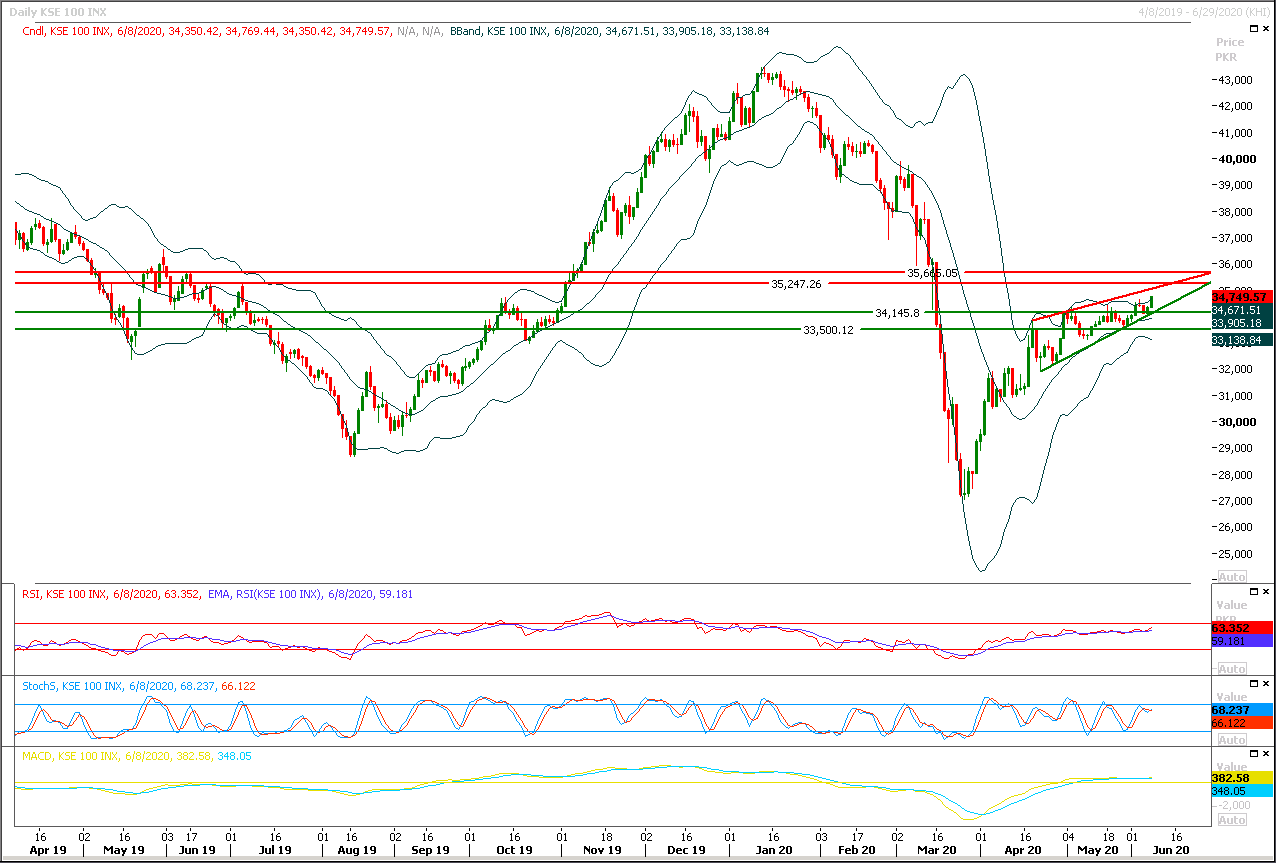

Technical Overview

The Benchmark KSE100 index have continued its bullish journey inside its rising wedge and succeed in closing above its major resistant region of 34,500pts during last trading session, meanwhile daily momentum indicators have changed their direction towards bullish side and these would try to push index towards 34,960pts and 35,200pts during current trading session. It's recommended to stay cautious and post trailing stop loss on existing long positions because index would face its initial resistance from resistant trend line of its rising wedge which may push index for intraday. In case of bearish reversal index would try to find ground at 34,500pts and sliding below that region would push index towards 34,000-33,900pts region.

Regional Markets

Asia stocks extend rally as economic recovery hopes boost confidence

Asian stocks rallied for their ninth straight day on Tuesday and oil prices jumped as the lifting of coronavirus lockdowns in many countries fed investor hopes of a relatively quick global economic recovery. MSCI’s broadest index of Asia-Pacific shares outside of Japan .MIAPJ0000PUS rose for a ninth straight session for its longest winning streak since early 2018. It was last up 0.76% at a three-month peak. Australia's S&P/ASX 200 jumped 2.5% while Chinese shares started on a firm footing with the blue-chip CSI300 index .CSI300 rising 0.4%. Hong Kong's Hang Seng index .HSI climbed 1.2%. Japan's Nikkei .N225 bucked the trend to be down 0.5%.

Read More...

Business News

Large gap between govt and IMF on revenues

The government plans to set revenue collection target between Rs4.5 trillion to Rs4.7tr in the budget for fiscal year 2020-21, documents seen by Dawn showed on Monday. The government also shared revenue targets with the International Monetary Fund (IMF) officials in the latest round of meetings, according to sources in the Finance Division. However, the IMF’s approval of the revenue plan has been delayed and the matter will be taken up during a meeting scheduled in the third week of June. Sources in the Finance Division told Dawn on Monday that the government has already shared its revenue collection proposals with fund officials to seek approval. “We had a detailed meeting with the IMF officials today [Monday] over the revenue collection plan”, the sources said, adding that these meetings will continue until the cabinet approves the budget.

Read More...

As petrol shortages persist, minister blames ‘mafias’

Without any let up in the acute petroleum shortage, the government on Monday blamed ‘mafias’ for creating another crisis and constituted a committee to probe “the element of hoarding and black marketing”. A senior official of the Petroleum Division told Dawn that total petrol stocks in the country had dropped below 200,000 tonnes and that of diesel to about 160,000 tonnes and were enough for six and four days, respectively. He said the major challenge was the transportation to overcome shortage and even out supplies. A couple of oil ships would beef up supplies over the next three to four days, he added. The authorities remained engaged on Monday with the refineries and oil marketing companies (OMCs) to address the crisis situation.

Read More...

Body formed to verify stock availability, identification of hoarding by OMCs

As the petrol shortage persists across the country, the government constituted a committee to monitor verify stock availability, and identification of black marketing, and hoarding by OMCs. The committee to be chaired by DG Oil, will consist the representatives of FIA, OGRA, PSO, HDIP, District Administration, said a notification issued by the government. The decision was taken in a video conference held here to address the issues arising out of scarcity of POL products in the country. The meeting was chaired by the Federal Minister for Energy Omar Ayub Khan. Special Assistant to Prime Minister on Petroleum, Nadeem Babar and Secretary Petroleum Mian Asad Hayaud Din also attended the meeting. Other stakeholders such as OGRA and OMCs also participated in the video conference to mitigate demand supply challenges.

Read More...

FBR to allow adjustment of payable taxes against refund claims

Islamabad Chamber of Commerce and Industry (ICCI) President on Monday Muhammad Ahmed Waheed has called upon the Federal Board of Revenue (FBR) to allow business community to adjust their payable taxes against their refunds claims. It would greatly facilitate them in overcoming liquidity issues and promoting business activities. He said billions of rupees of business community were held up with FBR in the form of refunds claims of sales tax, income tax and duty drawbacks and allowing adjustment of payable taxes including customs duties and sales tax against refunds claims would be a win-win arrangement, both for the government and for the business community.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.