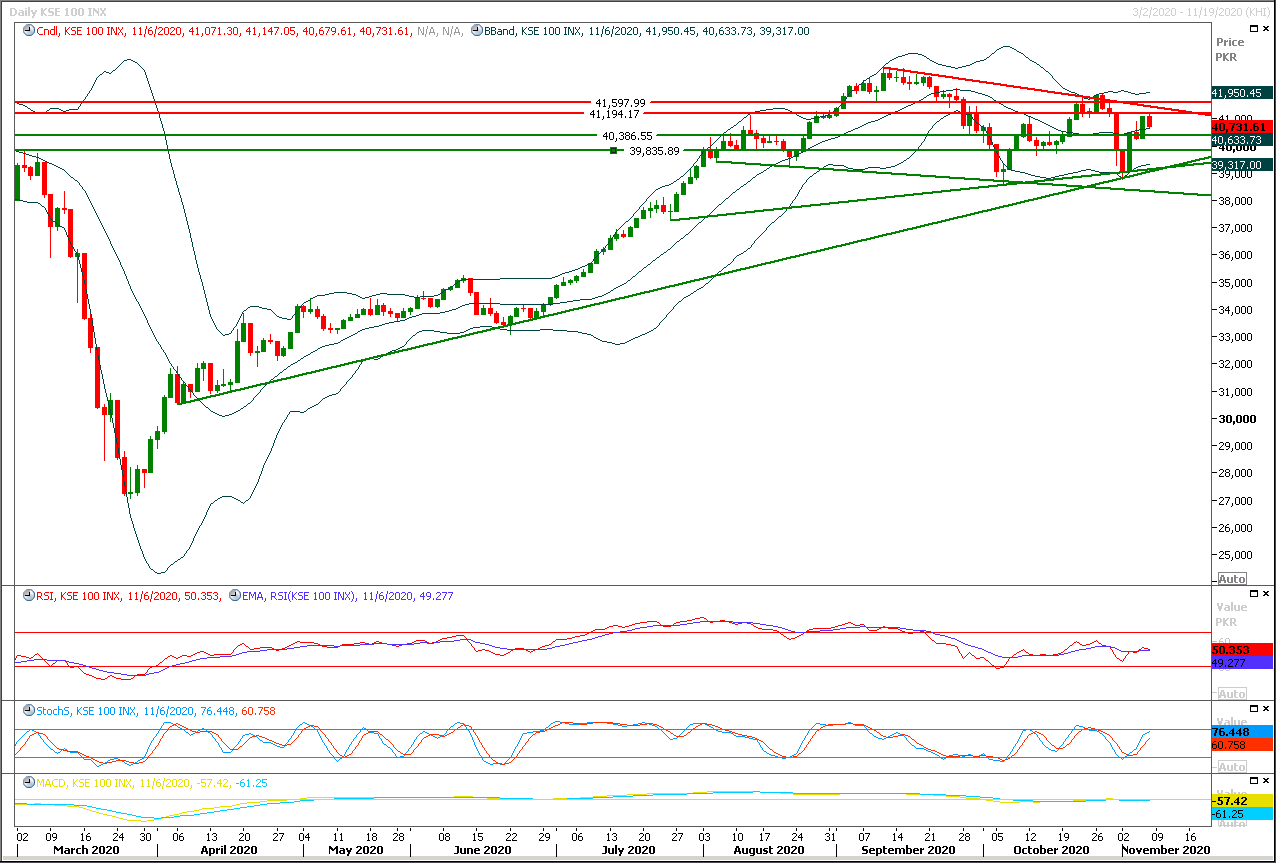

Technical Overview

The Benchmark KSE100 index had faced rejection from 74.6% correction of its last bearish rally and have escaped bullish engulfing on weekly chart by a narrow range during last trading session. As of now it's being capped by resistant trend line of descending wedge along with a strong horizontal resistant region at 41,400pts but on its way towards that region index would face initial resistance between 41,000pts-41,100pts. It's recommended to start buying on dip with strict stop loss of 40,200pts because it's expected that index would try to start the day with a positive spike but later on a dip could be witnessed which would be recovered before day end. While breakout above 41,200pts would call for 41,500pts and daily or weekly closing above this region would change market sentiment completely. But In case of rejection from its resistant regions index would start sliding downward which may lead index towards completion of its daily head & shoulder formation therefore it's recommended to post strict stop loss on long position, In this scenario index would try to find ground initially at 40,200pts while breakout below that region would call for 40,000pts and 39,760pts.

Regional Markets

Biden win pumps up risk assets, dollar nurses losses

Shares surged, oil prices jumped and the dollar stayed weak on Monday as expectations of fewer regulatory changes and more monetary stimulus under U.S. president-elect Joe Biden supported risk appetite. E-mini futures for the S&P 500 ESc1 jumped more than 1.5% on Monday while Nasdaq futures NQc1 rallied over 2%, signalling a positive start for U.S. markets. MSCI's broadest index of Asia Pacific shares outside of Japan .MIAPJ0000PUS jumped 1.3% to 613.95 points, the highest since January 2018. It had climbed 6.2% last week to clock its best weekly performance since early June. Chinese shares started higher with the blue-chip CSI300 index .CSI300 up 1% on hopes of better Sino-U.S. trade relations under Biden. Japan .N225 rose 2% while the main indexes of Australia .AXJO, Hong Kong .HSI and South Korea .KS11 gained 1.7% each.

Read More...

Business News

SPI-based weekly inflation falls 0.12pc

The Sensitive Price Indicator (SPI) based weekly inflation for the week ended on November 5, for the combined consumption group, witnessed decrease of 0.12 percent as compared to the previous week. The SPI for the week under review in the above mentioned group was recorded at 142.81 points against 142.98 points registered in the previous week, according to the latest data of PBS. As compared to the corresponding week of last year, the SPI for the combined consumption group in the week under review witnessed an increase of 8.93 percent.

Read More...

E&P companies make 90 discoveries

Exploration and Production (E&P) companies have made around 90 oil and gas discoveries in different parts of the country during the last six years. The companies found 12, 24, 17, 22, 12 and 3 hydrocarbon deposits in 2015, 2016, 2017, 2018, 2019 and 2020 respectively, out of which 10 were discovered in different parts of Punjab, 69 in Sindh, eight in Khyber Pakhtunkhwa and three in Balochistan, according to an official document available with APP. The E&P companies, during first two years of the Pakistan Tehreek-i-Insaf (PTI) government, made 26 finds and added 9,444 BPD (Barrels per Day) oil and 218 MMCFD (Million Cubic Feet per Day) gas in the national pool against the depletion of 9611 BPD oil and 279 MMCFD gas from the operational wells.

Read More...

Sports goods’ exports fall 11.84 per cent

The exports of sports goods from the country witnessed decrease of 11.84 per cent during the first quarter (Q1) of the ongoing financial year (2020-21) against the exports of corresponding period of last year. The country exported sports goods worth $66.681 million during July-September (2020-21) against the exports of $75.633 million during July-September (2019-20), showing negative growth of 11.84 per cent, Pakistan Bureau of Statistics (PBS) reported.

Read More...

CCI to consider payment of Rs150b windfall levy on Crude Oil

The Council of Common Interest (CCI) will consider the payment of around Rs150 billion Windfall Levy on Crude Oil, Condensate and Natural Gas this week, it is learnt reliably here. The 43th meeting of the Council of Common Interest (CCI) has been convened here Wednesday, which will consider 17 point agenda including recommendations of Attorney General of Pakistan (AGP) on IRSA act, Amendment in the OGRA Ordinance 2002, Handing over the control of Chasma Right Bank Canal (CRBC) to Punjab, Windfall levy, Royalty on LPG, import of LNG, implementation of Article 158 and 172(3) of the constitution of Pakistan and implementation of Kazi Committee Methodology for calculation of Net Hydle Power Profit, source told The Nation here Sunday.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.