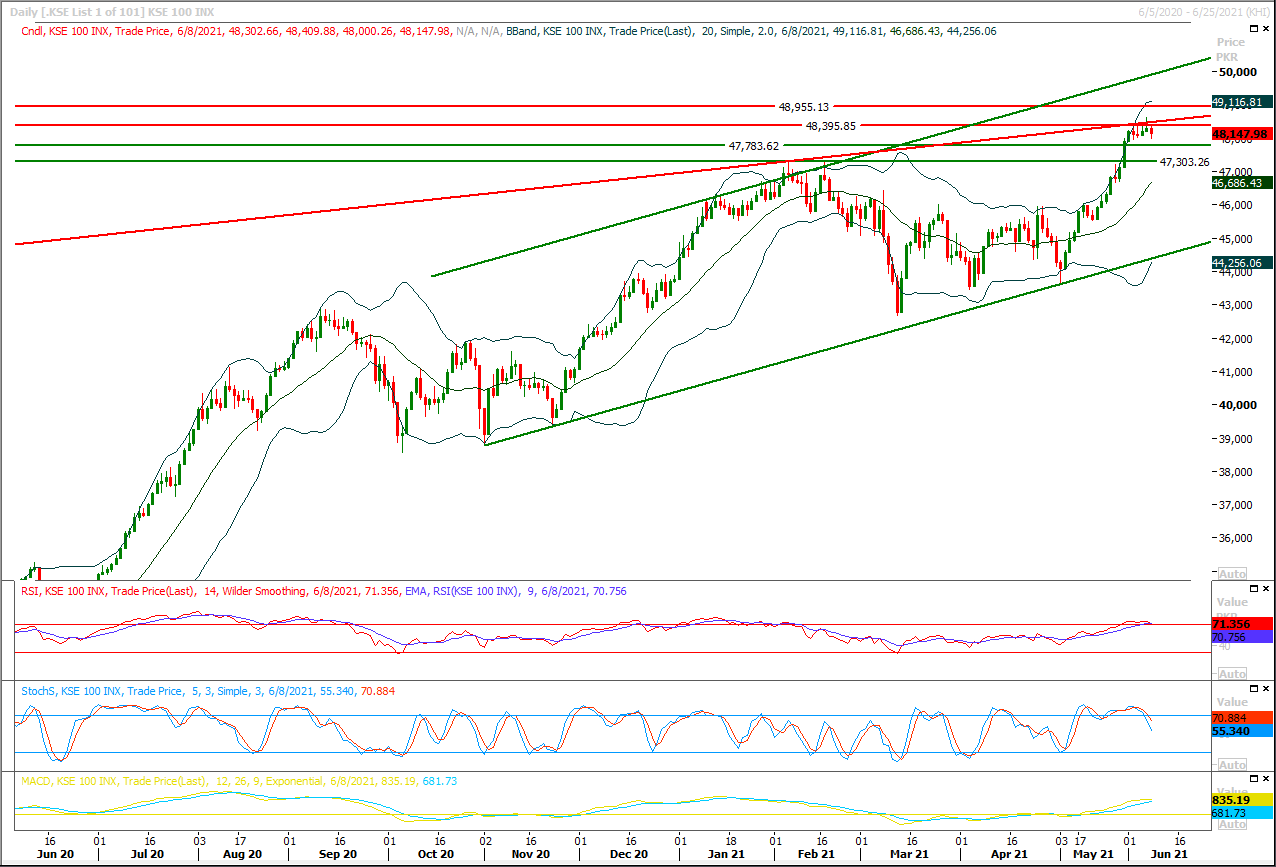

Technical Overview

The Benchmark KSE100 index had faced rejection from its resistant trend line on daily chart during last trading session again and now momentum have started gearing up, as hourly momentum indicators have changed their direction towards bullish side therefore it's expected that index may start a pull back during current trading session but it's recommended to stay cautious because its trading in caution zone and sliding below 48,000pts would push index towards 47,730pts for an intraday dip. Overall a volatile session could be witnessed as daily momentum is still week therefore it's recommended to wait for a breakout above 48,500pts to initiate new positions for short term trading but for day trading buying on dip could be beneficial. Overall sentiment would remain uncertain until index would not succeed in closing above 48,500pts. On flip side index would try to find support initially at 48,000pts and breakout below this region would call for 47,730pts but index would remain bullish as long as its trading above 47,500pts and 47,200pts. On intraday basis index would face initial resistance at 48,400pts which would be followed by 48,500pts and 48,760pts. It's recommended to start buying on dip with strict stop loss of 47,200pts.

Regional Markets

U.S. Senate passes bill to raise fees on biggest mergers

The U.S. Senate passed a bill on Tuesday that would increase fees that companies planning the biggest mergers pay to government antitrust agencies and give those agencies bigger budgets.The bill - co-sponsored by Democrat Amy Klobuchar, the top antitrust senator, and Chuck Grassley, the top Republican on the Senate Judiciary Committee - would lower the fee for smaller mergers under $161.5 million to $30,000 from $45,000. But for deals worth $5 billion or more, the fee would rise to $2.25 million from $280,000."Now that my bill with Senator Grassley passed the Senate, the Federal Trade Commission and Department of Justice's Antitrust Division are one step closer to having additional resources to conduct rigorous reviews of large mergers," Klobuchar said in a statement.

Read More...

Business News

First home buyers receive Montenegrin passports

style="text-align: justify;">After the successful launch of its CBI Programme in Pakistan back in January 2021, Porto Montenegro proudly announced the delivery of first Montenegrin passports to homeowners at its newest residential neighbourhood Boka Place. March 2021 marked an exciting milestone for Porto Montenegro, with the first successful application approvals of Montenegro’s Citizenship by Investment programme (CBI) for homebuyers of hotel managed residences at the development’s newest neighbourhood. As qualifying applicants become Montenegrin citizens the race is on for investors to take advantage of this limited-time opportunity, with the close of the Montenegrin Citizenship by Investment programme scheduled for the end of 2021. BOKA Place promises to be an excellent investment opportunity for Pakistanis as well as a world class holiday destination for people travelling to Europe. The project falls under the limited time only, CBI (Citizenship by Investment programme) of the Montenegrin govt.Read More...

SECP revamps REITs’ regulatory structure to promote real estate sector

To promote investment in the real estate sector through Real Estate Investment Trusts (REITs), the Securities and Exchange Commission of Pakistan (SECP) has introduced a new Public Private Partnership (P3) model under REITs, besides completely revamping the regulatory framework for REITs.The amendments have shifted the regulatory structure from approval-based to disclosure-based issuance, reducing entry barriers for new REITs, making REITs competitive with the unorganised sector led real estate projects, cutting down regulatory approvals and attracting domestic and foreign investment into the formal real estate sector of the country. The regulations have been finalised after extensive consultations with all stakeholders, with a view to bring in amendments in conformity with domestic market conditions and in sync with globally recognized norms.

Read More...

Trade deficit widens by 30.56pc in 11 months

Pakistan’s trade deficit has swelled by 30.56 per cent in eleven months of the current fiscal year mainly due to massive increase in imports as compared to the exports.The trade deficit has recorded at $27.488 billion in July to May period of the year 2020-21 as against $21.054 billion in the corresponding period of the last year, according to the latest data of Pakistan Bureau of Statistics (PBS). The country’s imports have exceeded the pace of the exports, which resulted in massive increase in trade deficit of the country.Imports have recorded an increase of 22.52 per cent. The country has imported goods worth of $50.048 billion in July-May period of the year 2020-21 as compared to $40.849 billion. On the other hand, exports have enhanced by 13.97 per cent to $22.560 billion in July to May period of the current fiscal year from $19.795 billion of the last year.

Read More...

Govt allocates $1bn for vaccine procurement

Giving approval to allocation of $1 billion for vaccine procurement on Tuesday, Planning Minister Asad Umar said the National Economic Council (NEC) of the cabinet had decided to frequently hold its meetings every year for evaluation of not only the federal Public Sector Development Programme (PSDP) but also the provincial Annual Development Plans (ADPs) to ensure effective utilisation of public funds.Pakistan was initially depending on Covax, an international alliance which had pledged to provide free of cost Covid-19 vaccine for 20 per cent population of the country. However, supply was delayed as India, which had to provide vaccine to Pakistan, decided to divert all supplies for local use.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.